Table of Contents

Introduction: Why Cash Flow Matters in Canada

Cash flow is the financial heartbeat of any Canadian business. While profits matter, a company that cannot manage its cash inflows and outflows risks running into trouble. From paying accounts payable on time to ensuring enough cash receipts from clients, tracking your cash balance is key to survival.

For small and medium enterprises (SMEs) in Canada, where credit conditions and seasonal cycles play a role, having the right cash flow forecast template helps owners make informed decisions. It’s not just about compliance—it’s about survival and growth.

Are you currently managing your bookkeeping in-house?

Understanding Cash Flow Basics

Cash flow tracks the money moving in (inflows) and out (outflows) of your company. Unlike net income, which can include non-cash items, cash transactions reflect real liquidity.

Think of it this way:

A healthy free cash flow means you can fund growth without relying on external financing.

Statement of Cash Flows Explained

The statement of cash flows template is a standard financial report alongside the balance sheet and income statement. It breaks movements into three sections:

- Operating activities – day-to-day business operations.

- Investing activities – buying equipment or long-term assets.

- Financing activities – loans, shareholder equity, or debt repayments.

The Role of Cash Inflows and Outflows

Canadian businesses often face mismatched timing—clients delay payments (accounts receivable), but vendors want their money now (accounts payable). This creates cash strain.

| Cash Inflows | Cash Outflows |

|---|---|

| Customer payments | Supplier invoices |

| Loan proceeds | Payroll expenses |

| Government grants (e.g., SR&ED credits) | Rent & utilities |

| Investor capital | Tax obligations |

This breakdown makes it easier to see where pressure points emerge.

Using Cash Flow Templates in Canada

A cash flow template helps track and project liquidity without starting from scratch. It ensures:

- Consistent formatting.

- Quick updates on a monthly basis.

- Visibility for lenders or investors.

Many free and paid options exist online, including cash forecast templates and example cash flow spreadsheets you can customize.

Cash Flow Projection Template vs. Cash Flow Forecast Template

While often used interchangeably, they serve different purposes:

- Cash flow projection template: Short-term (often 13 weeks), tactical planning. Helps spot if you’ll run short.

- Cash flow forecast template: Medium to long-term. Helps plan for growth, expansion, or debt repayment.

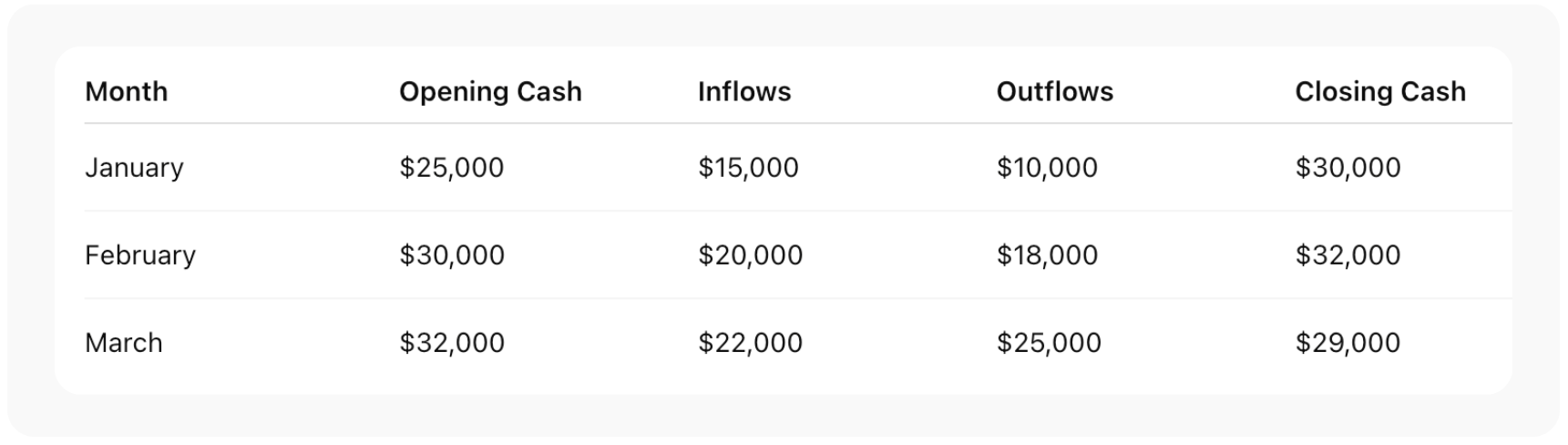

Example Cash Flow Spreadsheet: What It Looks Like

An example cash flow spreadsheet typically includes:

- Opening balance.

- Cash inflows (receipts, sales).

- Cash outflows (expenses, obligations).

- Closing balance.

Monthly vs. Long-Term Cash Flow Forecasting

- Monthly basis: Best for small businesses with seasonal sales (e.g., retailers in Toronto during holiday peaks).

- Long term: Strategic forecasting—used by larger corporations and lenders for credit assessments.

Tip: Forecasts are never perfect, but they force discipline and highlight cash gaps.

Cash Flow and Working Capital Management

Cash flow is tied closely to working capital. If accounts receivable take too long to convert into cash, liquidity dries up. Similarly, stretching accounts payable too far can damage supplier relationships.

Canadian companies often use cash forecast templates to test scenarios: “What happens if sales drop by 10%?” or “What if interest rates climb?”

Linking Cash Flow to the Balance Sheet & Income Statement

The three core financial statements are interconnected:

- The income statement shows profit.

- The balance sheet shows what you own and owe.

- The statement of cash flows shows if you can pay bills.

A business can be profitable on paper but still fail because of poor cash flow management. That’s why lenders and investors often request a statement of cash flows template before approving financing.

Best Practices for Canadian Entrepreneurs

- Use a cash flow template: Don’t reinvent the wheel.

- Track inflows and outflows weekly: Especially critical for seasonal businesses.

- Prepare both a projection and forecast: Cover both short-term survival and long-term strategy.

- Stress test your forecast: What happens if a major client delays payment?

- Use visuals: Spreadsheets, graphs, and dashboards make trends clear.

Frequently Asked Questions

What is the difference between a cash flow forecast and a cash flow projection?

A forecast is strategic, often longer-term. A projection is shorter-term, tactical, and highlights immediate liquidity risks.

How often should I update my cash flow spreadsheet?

On a monthly basis at minimum, though weekly is ideal for businesses with tight margins.

Do lenders in Canada require a statement of cash flows?

Yes. Banks and investors often review your statement of cash flows template to ensure you can handle loan repayments.

What’s included in a cash flow projection template?

Opening balance, cash inflows, cash outflows, and a closing balance. Some templates also add variance analysis against actuals.

Can I create my own cash forecast template in Excel?

Yes. Most Canadian SMEs start with Excel or Google Sheets. Many free versions are available, but ensure they capture operating, investing, and financing activities.

Conclusion: Building Strong Financial Habits

Cash flow forecasting isn’t just for accountants. For Canadian businesses, it’s a discipline that improves resilience. Using an example cash flow spreadsheet, cash flow projection template, or cash flow forecast template ensures you never fly blind.

Whether you’re a startup in Vancouver or a manufacturer in Ontario, tracking cash inflows and outflows regularly is the difference between guessing and making informed decisions. By using structured tools like a statement of cash flows template, businesses can avoid surprises and build long-term stability.

Disclaimer: This article is for informational purposes only and does not constitute financial or legal advice. Cash flow management can vary depending on your industry, province, and business structure. Always consult with a professional accountant or financial adviser before making decisions. Neither the author nor Orbit Accountants accepts liability for actions taken based on this content.