Table of Contents

Introduction: Why “Up-to-Date” Isn’t Optional

If you run a small business in Canada, you already juggle a dozen priorities—clients, employees, and operations. But there’s one silent engine that drives all of them: up-to-date bookkeeping.

Without accurate, timely records, it becomes nearly impossible to file taxes correctly, forecast cash flow, or secure funding. The truth? Up-to-date bookkeeping isn’t about numbers—it’s about peace of mind and control.

Are you currently managing your bookkeeping in-house?

What Up-to-Date Bookkeeping Really Means

Up-to-date bookkeeping doesn’t just mean entering transactions at year-end. It means continuously updating and reconciling your books—weekly or monthly—so your data reflects reality.

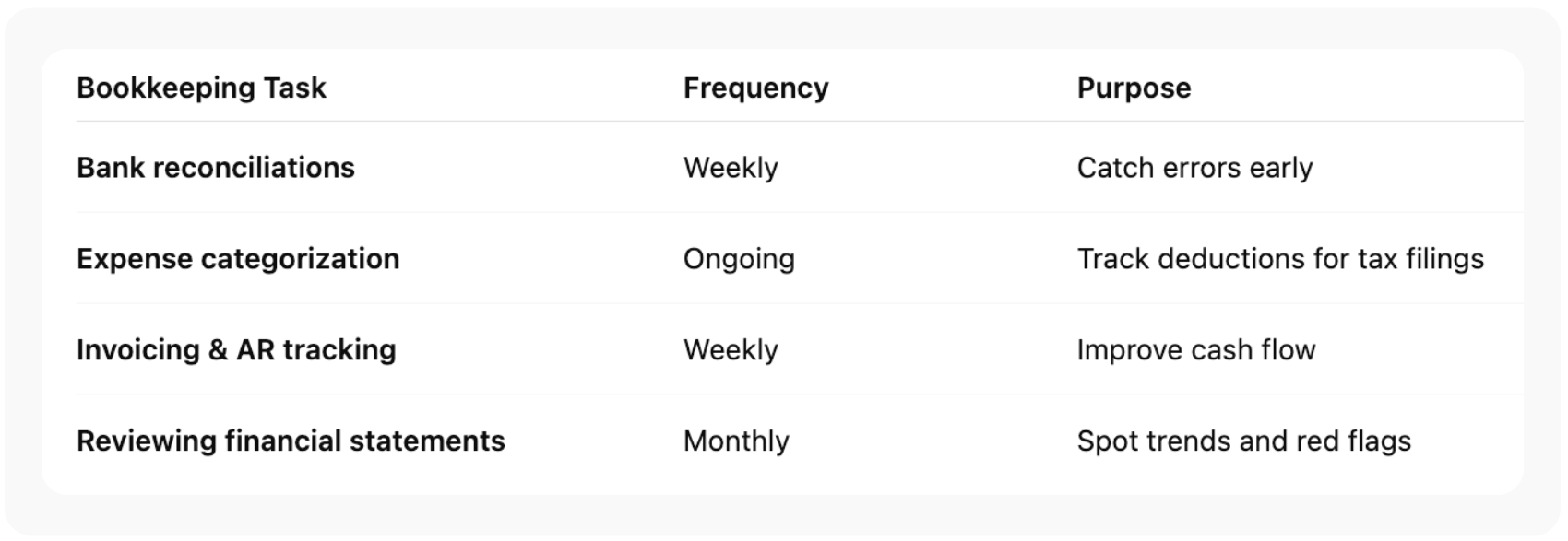

Here’s what it typically involves:

Accurate bookkeeping records also help ensure your income statements and balance sheets align with CRA reporting standards—preventing compliance headaches later.

The Hidden Costs of Falling Behind on Bookkeeping

Many small business owners delay bookkeeping until “tax season.” That’s where trouble starts. Late or inaccurate entries can snowball into bigger problems:

- Missed HST/GST remittances or payroll deductions

- CRA penalties for incorrect filings

- Inaccurate cash flow projections leading to poor financial decisions

- Stressful year-end rushes that cost more in accountant fees

Falling behind doesn’t just hurt compliance—it affects your ability to stay on top of operations and plan for growth.

Key Benefits of Maintaining Accurate Bookkeeping Records

Here’s what timely bookkeeping brings to your business:

- Better financial management – You always know where your money goes.

- Tax readiness – Come tax time, you save time and avoid CRA penalties.

- Improved cash flow – You spot unpaid invoices and can act fast.

- Easier loan or grant approvals – Lenders and investors love clean books.

- Peace of mind – No last-minute scrambling or surprise tax bills.

When your books are current, financial statements tell the real story—making decisions like hiring, expansion, or inventory control far more confident.

Small Business Bookkeeping Tips That Actually Work

Here are a few bookkeeping best practices that help small business owners across Canada stay organized:

- Automate repetitive tasks: Use automated bookkeeping software to categorize expenses and sync bank accounts.

- Separate business and personal accounts: Avoid mixing transactions—it simplifies tax preparation.

- Schedule a “money hour” weekly: Spend an hour reconciling and reviewing numbers.

- Save every receipt digitally: Cloud bookkeeping solutions make CRA audits less stressful.

- Review monthly income statements: They highlight trends before they become problems.

How Cloud Bookkeeping Solutions Save Time and Stress

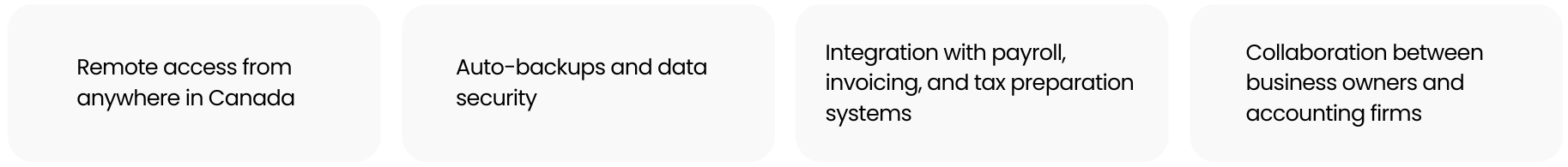

Modern cloud bookkeeping solutions like QuickBooks Online and Xero have made bookkeeping simpler and faster.

They automatically sync with your bank accounts, categorize transactions, and generate financial reports in real time.

Key advantages include:

Efficient bookkeeping for small businesses doesn’t have to mean extra work. The right system can save hours each week—time better spent growing your business.

When to Consider Outsourced Bookkeeping Services

If your bookkeeping tasks are taking more time than they should, consider outsourced bookkeeping services.

Professional bookkeepers ensure your data stays accurate, reconciled, and CRA-ready every month.

When to outsource:

- You spend more than 5 hours/week on bookkeeping tasks

- You’re missing HST or payroll deadlines

- You lack a clear financial picture before tax season

- You want professional oversight without hiring full-time staff

Working with a good bookkeeper or a trusted firm near you adds expertise while keeping costs predictable. Searching for bookkeeping services near me can connect you with certified professionals who offer virtual or hybrid options.

How Bookkeeping Fuels Better Financial Decisions

Bookkeeping isn’t just compliance—it’s your decision-making backbone.

Accurate records allow you to:

- Identify profitable products or services

- Monitor expenses and cash flow in real time

- Make informed hiring or pricing decisions

- Spot seasonal trends for inventory management

Reliable data translates into better strategy. When small business owners use clean books to plan, they don’t just stay compliant—they grow.

Final Thoughts: Turning Bookkeeping Into a Growth Engine

Keeping your books up to date isn’t a chore—it’s one of the best investments you can make in your business.

From tax filings to financial management, it underpins every decision that helps your business thrive.

If bookkeeping feels overwhelming, start small. Adopt simple tools, block out time weekly, and partner with experts when needed. Over time, these habits turn chaos into clarity—and numbers into insight.

FAQs

How often should I update my bookkeeping records?

Ideally, weekly or monthly. Waiting until year-end can lead to missed transactions and inaccurate financial data.

Is cloud bookkeeping secure for my business?

Yes. Reputable cloud bookkeeping solutions use encryption and secure servers. Always choose providers that comply with Canadian data privacy standards.

Can I do my own bookkeeping as a small business owner?

You can, but once your business grows or you deal with payroll and HST, outsourcing to professionals can save you time and ensure compliance.

What happens if I fall behind on bookkeeping?

It can lead to incorrect tax returns, CRA penalties, and limited insight into your business’s financial health.

How does up-to-date bookkeeping help with taxes?

Accurate records simplify tax preparation and ensure every eligible expense and credit is captured—reducing your overall tax burden.

Legal Disclaimer: This article is for informational purposes only and does not constitute accounting, tax, or legal advice. Regulations and requirements may change and vary by province. Always consult a qualified accounting professional before making business or financial decisions. Reading this content does not create a client relationship with Orbit Accountants.