Table of Contents

What Is Harmonized Sales Tax (HST) in Canada?

Ever noticed an “HST” charge on your Ontario receipt and wondered what it is?

HST stands for Harmonized Sales Tax. It’s a single tax that merges the federal Goods and Services Tax (GST) with a provincial sales tax (PST) into one unified rate. Ontario — along with a few other provinces — uses this system to simplify sales tax collection.

For business owners, HST isn’t just another acronym. It’s a core part of running your operations — from what you charge customers to what you report to the Canada Revenue Agency (CRA).

HST in Ontario: A Quick Primer

In Ontario, the HST rate is currently 13%, made up of:

- 5% federal GST

- 8% Ontario’s provincial portion

Once your business makes over $30,000 in gross sales in any 12-month stretch, you must register and begin charging HST.

Are you confident your business tax filings are fully optimized and compliant?

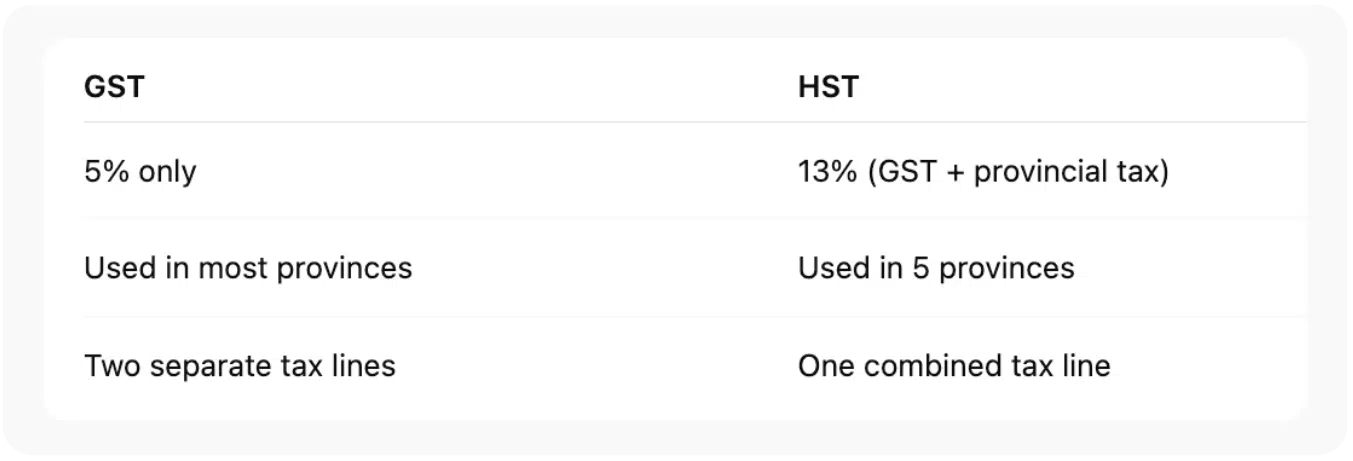

GST vs HST: What’s the Difference?

It’s easy to confuse GST and HST — here’s a quick comparison:

- GST is a federal tax (5%) collected across Canada.

- HST combines GST with a provincial share into a single tax. Ontario, Nova Scotia, New Brunswick, PEI, and Newfoundland & Labrador use HST.

The key benefit? Simplicity. Businesses in HST provinces only list one tax line on invoices.

How Much Is HST in Ontario?

Simple answer? It’s 13%.

Whether you sell online courses, graphic design services, or physical products — if they’re taxable, they typically carry this rate in Ontario.

That said, some items like basic groceries, prescription drugs, and most financial services are HST tax-exempt. When in doubt, check CRA’s GST/harmonized sales tax Canada guidelines or consult your accountant.

Do You Need to Charge GST/HST?

If your business earns more than $30,000 in revenue over 12 months, yes — you must charge GST/HST.

This applies across the board: sole proprietors, partnerships, and corporations. Once registered, you’ll:

- Add HST to customer invoices

- Collect the tax

- Remit it to CRA during your GST/HST filing

Registering for GST/HST

Getting registered is a straightforward process:

- Apply for a Business Number (BN) from CRA

- Choose your filing frequency — monthly, quarterly, or annually

- Track your total sales and HST collected

You can register online via CRA’s portal or ask a tax professional to handle it for you. After registering, you’re officially a GST/HST registrant — which means you’re also eligible to claim Input Tax Credits (more on that soon).

HST Filing Online: Step-by-Step

Filing your HST return online is easier than ever with CRA’s GST/HST Netfile system.

Here’s what to do:

- Visit the CRA website

- Sign into My Business Account

- Select your GST/HST account

- Click on “File Return”

- Enter your gross sales, HST collected, and ITCs

- Review and submit your return

Claiming Input Tax Credits (ITCs)

Running a business comes with costs — and some of that HST you pay can come right back to you.

If you spend money on rent, subscriptions, professional fees, or supplies and pay HST on those, you can offset it by claiming Input Tax Credits (ITCs). You’ll only need to remit the difference between HST collected and HST paid.

Just be sure:

- You keep all receipts and invoices

- You only claim business-related expenses

Your GST Filing and Return Explained

Every time you file a return, you’re reporting:

- HST collected from your customers

- HST paid on business expenses (your ITCs)

- The net amount you owe CRA — or the refund you’re due

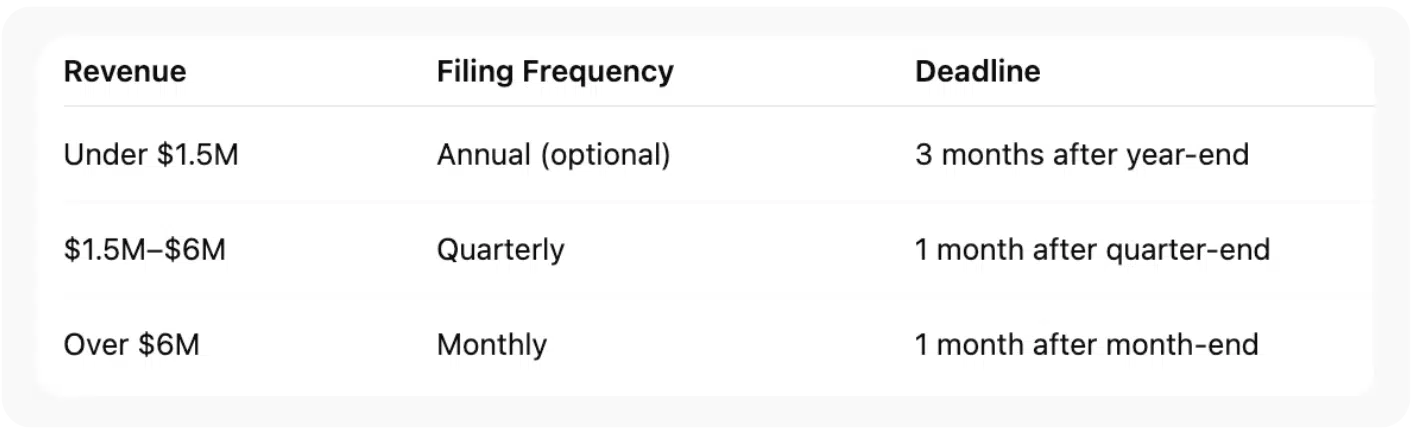

Your filing frequency depends on your annual revenue:

- Under $1.5M ➜ Annually (optional)

- $1.5M–$6M ➜ Quarterly

- Over $6M ➜ Monthly

Common Mistakes to Avoid

Avoid these common HST slip-ups:

🟥 Charging HST before registration

✔️ Always wait for CRA confirmation before adding HST to invoices.

🟥 Filing late

✔️ You could face interest and penalties. Mark your deadlines.

🟥 Forgetting to claim ITCs

✔️ That’s money back in your pocket — don’t leave it behind.

🟥 Using an outdated rate

✔️ Ontario’s HST is currently 13%. Always double-check.

Final Takeaway

If you’re doing business in Ontario, understanding HST is non-negotiable. From the rate you charge to the credits you can claim, it plays a big role in pricing and cash flow.

The upside? Once you’re set up and understand how it works, it becomes a routine part of doing business.

Pro tip: Stay compliant, file on time, and track your expenses to maximize ITCs. Smart money isn’t just about earning — it’s also about keeping what’s yours.

Frequently Asked Questions

How much is HST tax in Ontario right now?

The current Ontario HST rate is 13%, made up of 5% federal GST and 8% provincial portion.

How do I submit HST online in Canada?

Use CRA’s GST/HST Netfile portal, you can file GST return/ file HST online. Enter your business number, report sales and ITCs, and submit electronically.

What’s the difference between GST and HST?

GST is a federal tax. HST combines GST with a provincial tax — applicable in provinces like Ontario.

Can I claim HST back on business expenses?

Yes — as a registered business, you can claim Input Tax Credits (ITCs) for HST paid on eligible business expenses.

What happens if I miss my GST/HST filing deadline?

You could face interest and penalties from CRA. Filing on time is essential.

Disclaimer: This blog is for general informational purposes only and does not constitute legal, financial, or tax advice. While we strive for accuracy, tax laws may change, and your specific business situation may differ. Always consult with a licensed tax advisor or accountant before making decisions regarding GST/HST registration, filing, or compliance. Orbit Accountants disclaims liability for any actions taken based on this content.