Table of Contents

Introduction: Why Tax Planning Matters for Small Businesses

Running a small business in Canada is rewarding—but every dollar saved on taxes can go straight back into growth. Smart tax planning helps you manage cash flow, reduce your overall tax liability, and build financial resilience for the long term.

Canadian entrepreneurs face unique rules around business tax rates, deductions, and credits. Whether you’re a sole proprietor, an incorporated business, or planning to grow into a Canadian-controlled private corporation (CCPC), understanding how to save on taxes can make a meaningful difference to your bottom line.

Tax planning isn’t about loopholes—it’s about structure, timing, and using legitimate incentives the Canada Revenue Agency (CRA) provides to support small businesses.

Are you confident your business tax filings are fully optimized and compliant?

Incorporate Early to Maximize Small Business Tax Benefits

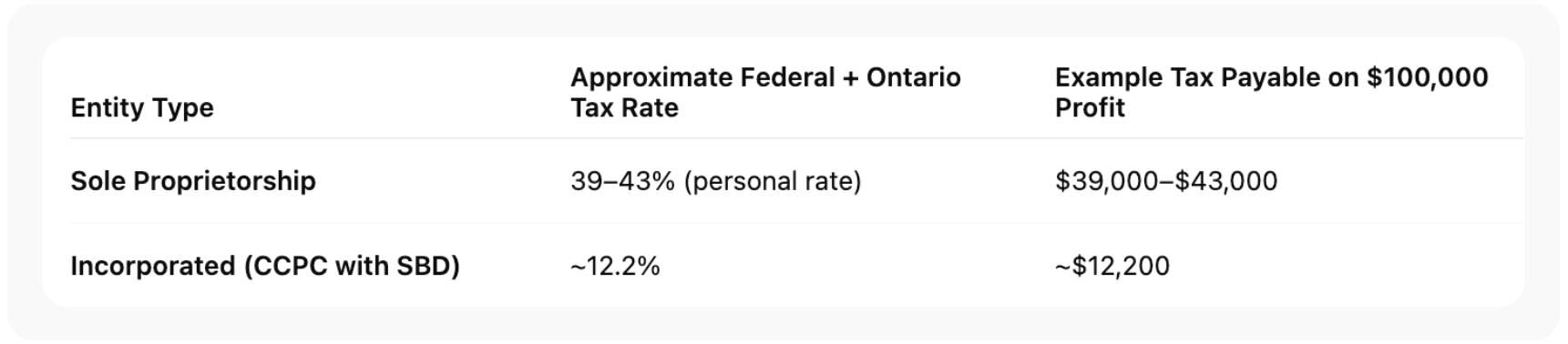

If your business earns consistent profit, incorporation can be one of the most effective ways to save on taxes. Once you incorporate, your company becomes a separate legal entity, taxed at the small business deduction (SBD) rate—much lower than the personal income tax rate.

This business tax rate in Ontario gives incorporated companies a big advantage, allowing owners to defer personal taxes by leaving profits in the corporation and drawing income later when in a lower bracket.

Shift Income Within Your Family Smartly

One legal way to reduce taxes is by employing family members who contribute to your business. For example, hiring your spouse or children for bookkeeping, marketing, or administrative work lets you shift income into lower tax brackets—reducing the total amount of tax paid across the household.

To stay compliant with the CRA:

- Pay a reasonable wage for actual work performed.

- Maintain records such as job descriptions and pay stubs.

- Deduct the salary as a business expense.

This technique also provides family members with RRSP contribution room, strengthening the family’s long-term financial plan.

Make the Most of RRSPs and IPPs

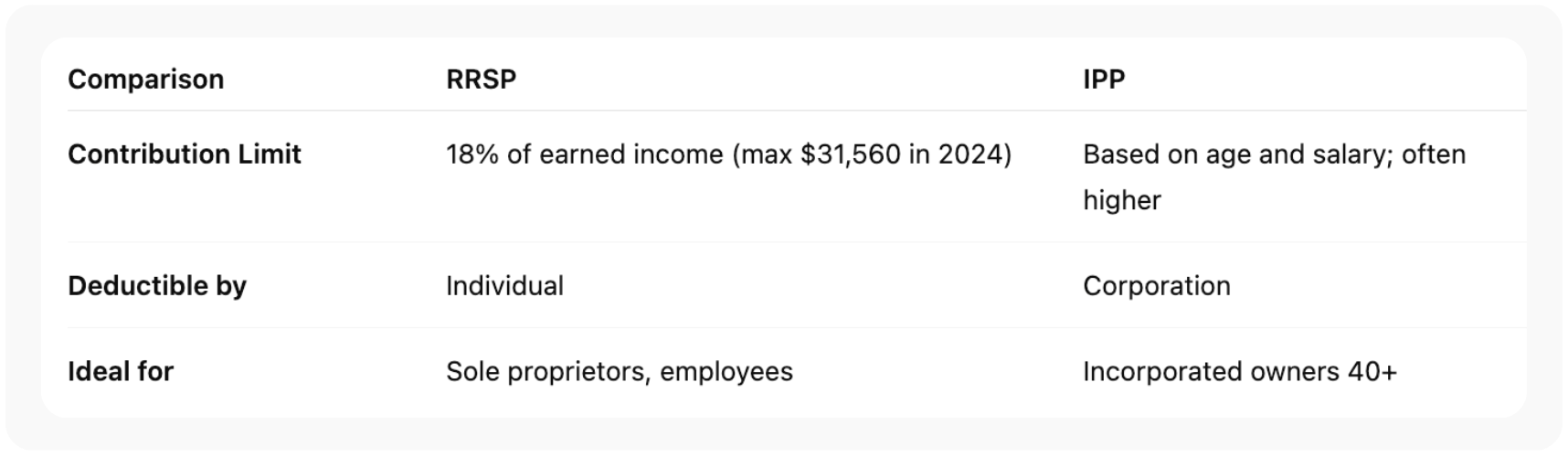

Retirement planning is another powerful tax strategy. Contributing to a Registered Retirement Savings Plan (RRSP) lets you deduct contributions from your taxable total income, reducing the tax rate applied today while growing funds tax-deferred until retirement.

If you’re an incorporated owner, an Individual Pension Plan (IPP) can offer even higher contribution limits, particularly for those over 40. IPPs also allow your corporation to make tax-deductible contributions on your behalf.

Plan Ahead for the Lifetime Capital Gains Exemption (LCGE)

Selling your business one day? The Lifetime Capital Gains Exemption can help you pocket up to $1 million in profit tax-free when you sell shares of a qualifying small business corporation.

To qualify:

- Your company must be a Canadian-controlled private corporation.

- At least 90% of its assets must be used in an active business in Canada.

- You must have owned the shares for 24 months or more.

This exemption rewards entrepreneurs who build and hold genuine operating businesses. Planning early—by cleaning up passive assets or real estate in the corporation—ensures you don’t miss out later.

Claim SR&ED and Other Investment Tax Credits

If your business invests in innovation or process improvement, you could qualify for the Scientific Research and Experimental Development (SR&ED) credit. It’s one of the most generous tax benefits for small businesses in Canada.

- Federal credit: up to 35% of eligible expenditures for CCPCs.

- Provincial top-ups: Ontario, Quebec, and British Columbia offer additional credits.

Eligible costs include salaries for technical staff, subcontractor fees, and prototype materials. The SR&ED credit can even generate a cash refund if it exceeds your business tax obligations.

Other credits worth exploring:

- Digital Media Tax Credit (for tech and gaming firms)

- Apprenticeship Job Creation Tax Credit (covered next)

- Investment Tax Credit for clean technology or manufacturing assets

Deduct Legitimate Home Office Expenses

Many Canadian entrepreneurs run part or all of their business from home. The CRA allows a deduction for a reasonable portion of expenses directly tied to your home office.

You can claim part of:

- Mortgage interest or rent

- Utilities (hydro, heat, water)

- Property taxes

- Home insurance

- Internet or phone

To qualify, the workspace must be used regularly to earn business income and meet clients. Keep careful receipts in case the CRA asks for proof.

Take Advantage of the Apprenticeship Job Creation Tax Credit

Hiring apprentices not only strengthens your workforce but also lowers your business taxes. The Apprenticeship Job Creation Tax Credit (AJCTC) provides a 10% non-refundable credit on wages paid to eligible apprentices in Red Seal trades, up to $2,000 per year.

This incentive is especially valuable for manufacturers, construction firms, and trades-based businesses in Ontario. It directly offsets tax payable, improving cash flow while you invest in skilled labour.

Invest Surplus Corporate Cash Strategically

Leaving large sums of cash idle inside a corporation can increase passive income, which affects your small business deduction eligibility. Instead, look for smart, tax-efficient ways to invest retained earnings.

Some options include:

- Corporate-owned life insurance, which can shelter investment growth.

- Investment portfolios that generate capital gains instead of interest.

- Reinvesting in business expansion, equipment, or digital transformation.

Work with a financial adviser or your accountant to balance liquidity and tax efficiency.

Don’t Forget Year-End Planning

Before year-end, review your books and make moves that can lower your upcoming tax bill:

- Buy business assets (equipment, computers) before Dec 31 to claim depreciation earlier.

- Pay bonuses or salaries to reduce retained earnings.

- Write off bad debts or obsolete inventory.

- Prepay expenses like insurance or rent if cash flow allows.

These actions ensure your business structure remains optimized and that you only pay the tax you owe, not a dollar more.

Conclusion: Smart Planning, Bigger Savings

Every Canadian entrepreneur can benefit from proactive tax planning. Whether it’s incorporation, family income splitting, or leveraging credits like SR&ED, early and consistent action ensures you keep more of what you earn.

Taxes don’t have to be a year-end surprise. With careful structure and advice, your small business can thrive while staying compliant with CRA rules.

👉 “Book a free consultation with Orbit Accountants to explore how much tax you could save this year.”

Frequently Asked Questions

How much can a small business save by incorporating in Ontario?

Most small incorporated businesses in Ontario pay about 12.2% on the first $500,000 of active business income, compared to 39–43% personal tax for unincorporated income.

What counts as active business income for the Small Business Deduction (SBD)?

Income from day-to-day operations such as sales, services, or manufacturing in Canada. Passive income from investments doesn’t qualify.

Can a sole proprietor still claim tax deductions?

Yes. Sole proprietors can deduct legitimate business expenses—home office, vehicle, or professional fees—against their total income before paying tax.

Are RRSP contributions better than leaving money in a corporation?

It depends on cash-flow needs. RRSPs reduce your personal taxable income, while retained corporate earnings benefit from lower business tax rates. A mix of both often works best.

When should I start planning for the Lifetime Capital Gains Exemption?

Ideally 2–3 years before you plan to sell. Ensure your company qualifies as a CCPC and that 90% of assets are active business assets.

Legal Disclaimer:

This article is provided by Orbit Accountants for general information only and does not constitute accounting, tax, or legal advice. Rules can vary by province and may change over time. Always consult a qualified Canadian tax professional before making business or investment decisions. Reading this content does not create a client relationship with Orbit Accountants. Orbit helps Canadian business owners with incorporation, tax planning, and bookkeeping—so you can focus on growing your business while we take care of the numbers.