Starting a business is exciting, but it is also filled with challenges. One of the biggest challenges every startup faces is how to handle money. Even if you have a great idea, strong marketing, and a good team, your business cannot survive if you do not control your money wisely. This is why cash flow management is so important for new businesses. It helps startups stay stable, pay bills on time, and keep growing without unnecessary stress.

Good money management is not only about earning profit, it is about knowing exactly when money is coming in and going out. Many startups fail, not because their idea was bad, but because they ran out of cash too soon. With proper planning and guidance, startups can avoid this problem. Partnering with experts like Orbit Accountants can make this journey much easier.

Table of Contents

What is Cash Flow Management?

Before we go deeper, let’s understand the cash flow management definition. In simple terms, cash flow management means keeping track of how much money comes into your business (income) and how much goes out (expenses). It helps you make sure your business always has enough money to cover costs like rent, salaries, and supplies.

Without proper planning, businesses can run short of cash even if they are profitable on paper. That is why cash flow is one of the most important parts of business finance. For startups, learning how to manage cash flow properly can make the difference between success and failure.

Are you currently managing your bookkeeping in-house?

Why Cash Flow and Cash Management Matter for Startups

For startups, cash flow isn’t just about numbers; it’s about survival. Understanding and managing cash effectively can make the difference between scaling successfully and shutting down too soon.

The role of cash flow in business survival:

Cash is the lifeline of any business. According to a study by CB Insights, 38% of startups fail because they run out of money. This shows how important cash flow and cash management are for survival. Without enough cash, even profitable businesses may struggle to pay employees or buy materials.

Common cash flow challenges startups face:

Startups often face irregular income. Some months may bring in good money, while others may be very slow. On top of that, unexpected costs can appear suddenly. Problems like late customer payments, high overhead expenses, and slow sales cycles can create serious financial stress.

Signs of poor cash flow management:

Some warning signs include constantly borrowing money to cover expenses, delaying payments to suppliers, or not being able to pay staff on time. These are red flags that a startup needs stronger cash flow practices before the problem gets worse.

By recognising cash flow challenges early and improving management practices, startups can avoid financial stress, keep operations running smoothly, and focus on building a sustainable, profitable business for the long term.

How to Manage Cash Flow Effectively

Managing cash flow effectively is about being proactive rather than reactive. By tracking income, forecasting future needs, and building a safety reserve, startups can stay prepared and maintain financial stability even during challenging times.

- Tracking income and expenses: The first step in controlling money is to track it. Startups must record every bit of income and every expense, no matter how small. This gives a clear picture of the business’s financial health.

- Creating accurate cash flow forecasts: Forecasting means predicting future income and expenses. By doing this, businesses can prepare for slow months and plan better for growth. Accurate forecasts help avoid surprises.

- Building an emergency cash reserve: Every startup should keep some extra money aside for emergencies. This acts as a safety net when unexpected expenses appear or income slows down. A reserve fund can help a business keep running smoothly.

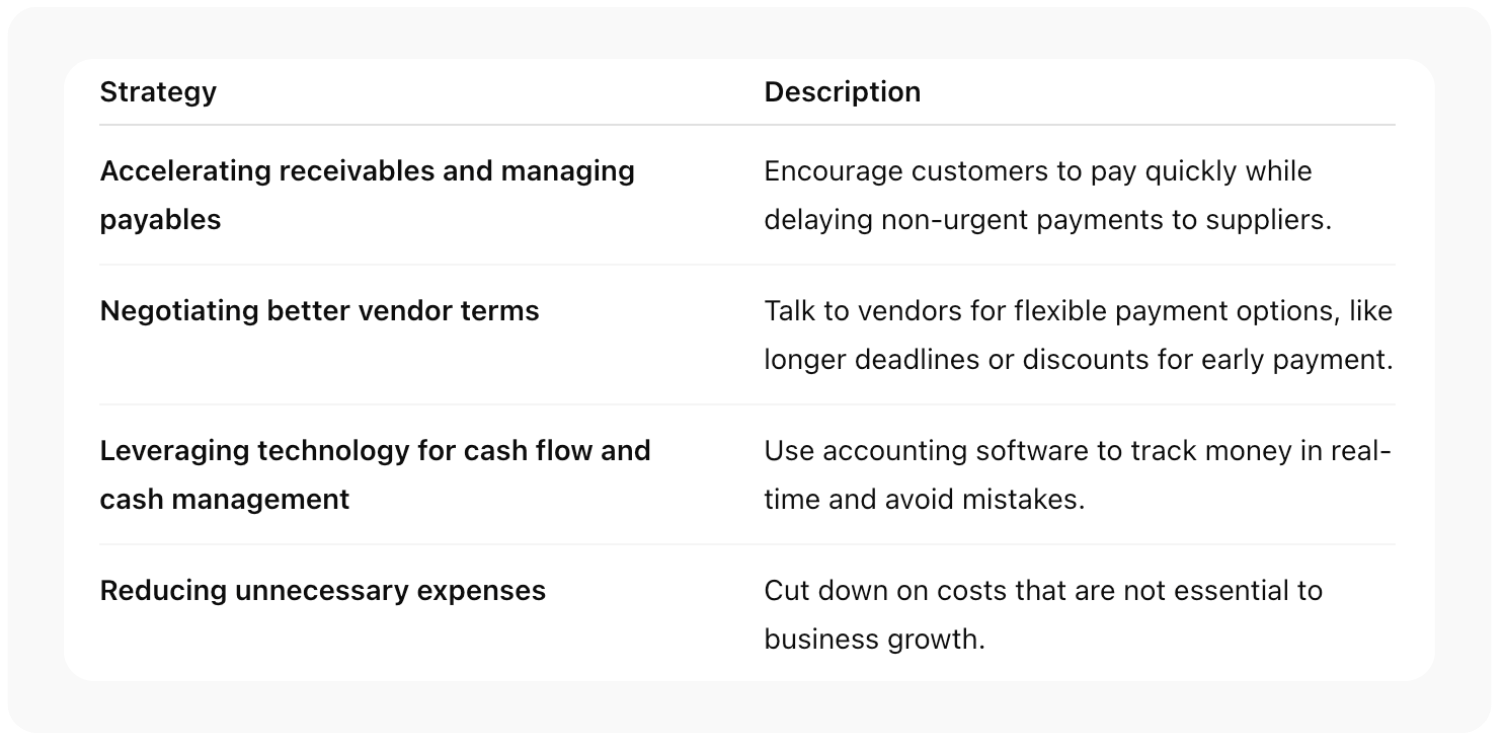

Proven Cash Flow Management Strategies

Startups often need practical methods to handle their cash flow better. Below is a simple table that explains a few effective cash flow management strategies in easy words.

These strategies may look simple, but they can make a huge difference in a startup’s financial health. By applying them regularly, businesses can achieve better control and stability.

Managing Cash Flow During Growth and Uncertain Times

Managing cash flow becomes even more critical when a business is growing or facing uncertainty. Careful planning helps ensure stability, meet obligations, and seize opportunities without running into cash shortages.

Cash flow in scaling businesses

When startups begin to grow, expenses also increase. More staff, bigger offices, and higher production costs can strain cash flow. Without planning, rapid growth can lead to cash shortages.

Managing cash flow during seasonal fluctuations

Some businesses earn more in certain seasons and less in others. For example, a gift shop may earn more during holidays. During low seasons, careful planning is needed to ensure bills are still paid on time.

Cash flow and access to financing options

When money gets tight, financing options like loans or credit lines can help. However, startups must use them wisely and not rely on debt for everyday expenses.

Strong cash flow management gives growing businesses the confidence to handle challenges and invest in future opportunities. With the right strategies, even uncertain times can become a springboard for sustainable growth.

In Essence,

Cash flow is more than just numbers; it is the heartbeat of a startup. Proper planning, tracking, and forecasting can save a business from failure and open doors to success. Startups that take cash flow seriously will enjoy smoother operations, stronger growth, and less stress. By adopting smart practices, startups can secure their future.

This is where experts like Orbit Accountants come in. At Orbit Accountants, we have been providing expert accounting and financial services tailored for startups and small businesses. Our team helps with bookkeeping, payroll, tax planning, and most importantly, cash flow guidance. We cover everything from simple record-keeping to advanced financial strategies, making sure your startup is always ready for growth.

To get started, contact Orbit Accountants for a consultation today.

Frequently Asked Questions

What is cash flow management in simple terms?

Cash flow management means tracking all the money coming into your business and all the money going out, so you always have a clear picture of your financial health and position.

Why is managing cash flow important for startups?

Startups usually operate with limited funds. Proper cash flow management ensures they can pay employees, suppliers, and bills on time, helping them stay operational and avoid unnecessary financial stress or funding gaps.

What are the best cash flow management strategies?

Effective strategies include encouraging faster customer payments, cutting unnecessary expenses, and using accounting software. These steps help maintain a steady flow of cash and support better decision-making for your business.

How do you forecast cash flow for a small business?

You forecast cash flow by predicting future income and expenses based on past financial data, upcoming sales, and seasonal trends. This helps small businesses plan ahead and avoid cash shortages.

What are common mistakes in managing cash flow?

Common mistakes include mixing personal and business finances, not saving for slow months, overestimating future income, and assuming profits automatically mean cash is available for immediate use.