Table of Contents

What is HST and How Is It Different from GST or PST?

The Harmonized Sales Tax (HST) is a consumption tax in Canada that merges the federal Goods and Services Tax (GST) with a provincial sales tax (PST) into one streamlined rate. It simplifies tax collection in provinces that have harmonized their tax systems with the federal government.

While GST applies at a rate of 5% across Canada, PST rates vary by province. HST rates, too, differ:

- Ontario: 13% (5% GST + 8% provincial portion)

- Nova Scotia: 15%

- New Brunswick, Newfoundland and Labrador, Prince Edward Island: 15%

Provinces like British Columbia, Manitoba, and Saskatchewan charge separate GST and PST. Alberta and the territories only charge the 5% GST.

Understanding what is an HST and where it applies is essential to ensure compliance when doing business across provincial lines.

When Do You Need to Register for an HST Number?

You’re required to register for an HST number if your business earns over $30,000 in gross taxable revenue over four consecutive calendar quarters (or in a single quarter).

Goods and services that are taxable include:

- Professional services (consulting, legal, etc.)

- Physical products sold in Canada

- Software subscriptions

- Digital products and online courses

Voluntarily registering before reaching the threshold can be beneficial. It allows you to claim input tax credits (ITCs) on business expenses and appear more credible to suppliers and clients.

| Criteria | Required to Register? |

| Earns under $30,000 annually | Optional |

| Exceeds $30,000 in 1 quarter | Mandatory |

| Non-resident but selling in Canada | Often required (special rules apply) |

Being properly registered ensures you can collect GST/HST, remit it, and recover costs.

Are you confident your business tax filings are fully optimized and compliant?

How to Apply for an HST Number in Canada

To apply for an HST number, you need to register with the Canada Revenue Agency (CRA) for a Business Number (BN) and add a GST/HST account. Here’s how:

Ways to Register:

- Online: Use the CRA’s Business Registration Online (BRO)

- Phone: Call CRA at 1-800-959-5525

- Mail/Fax: Submit Form RC1 – Request for a Business Number

Your HST number format will be: 123456789 RT0001.

- The 9-digit number is your business identifier.

- “RT” indicates it’s a GST/HST account.

After registration, you’re obligated to:

- Charge GST/HST on taxable supplies

- File regular returns

- Remit collected taxes to the CRA

Finding or Looking Up an HST Number

If you’re doing business with a vendor or client and need to verify their registration, the CRA allows you to do a GST/HST registry search.

What You Need:

- HST number (or GST number)

- Business name (optional but helpful)

- Invoice or transaction date

Use the CRA’s GST/HST Registry to perform a GST number lookup or HST number lookup.

Why It Matters: Only GST/HST registrants can legally charge the tax. If you’re claiming an ITC, and the vendor wasn’t registered on the date of the invoice, your claim can be denied.

How to Use the GST/HST Registry to Check a Business

Doing a gst registration search is straightforward. Here’s how to navigate the process:

Steps:

- Go to the CRA’s online GST/HST registry.

- Enter the 9-digit GST number + RT0001.

- Add the transaction date.

- Submit and review registration details.

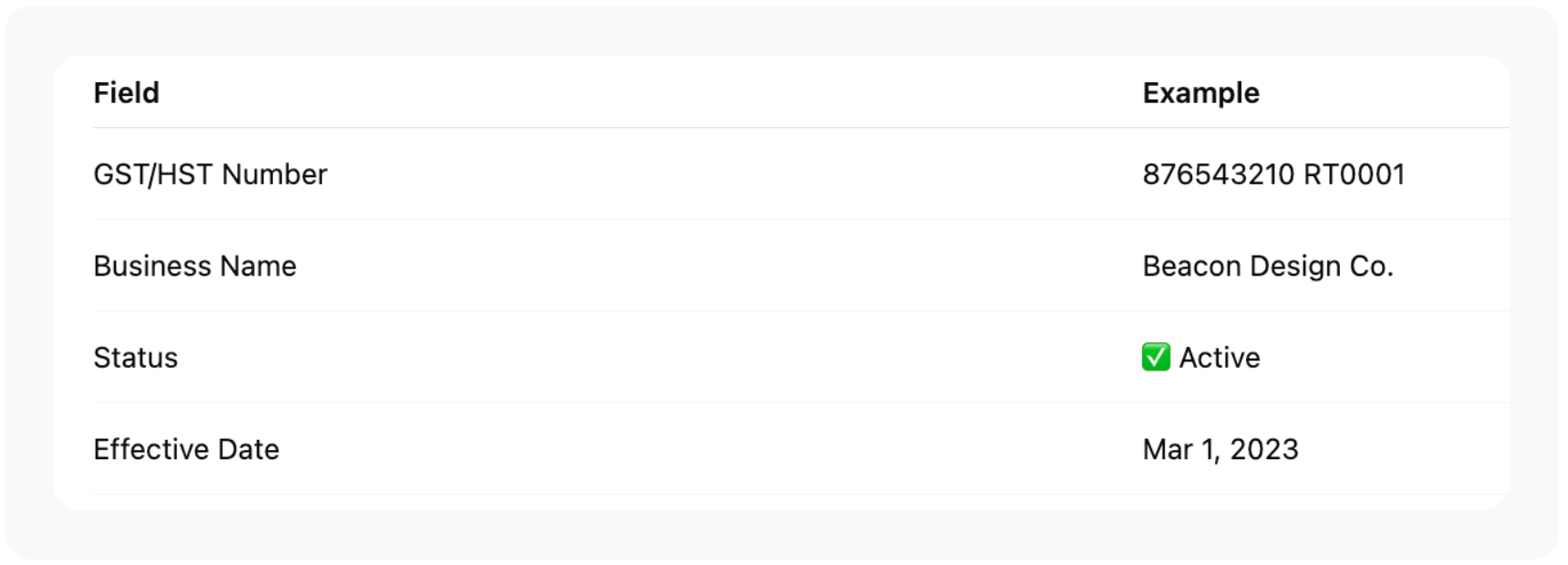

Sample Registry Output:

Checking registration is especially critical for freelancers, consultants, and B2B companies who rely on accurate ITC claims.

Charging the Right GST/HST Rate in Ontario

If your customer is in Ontario, you must charge 13% HST on most taxable goods and services. However, not everything is treated equally:

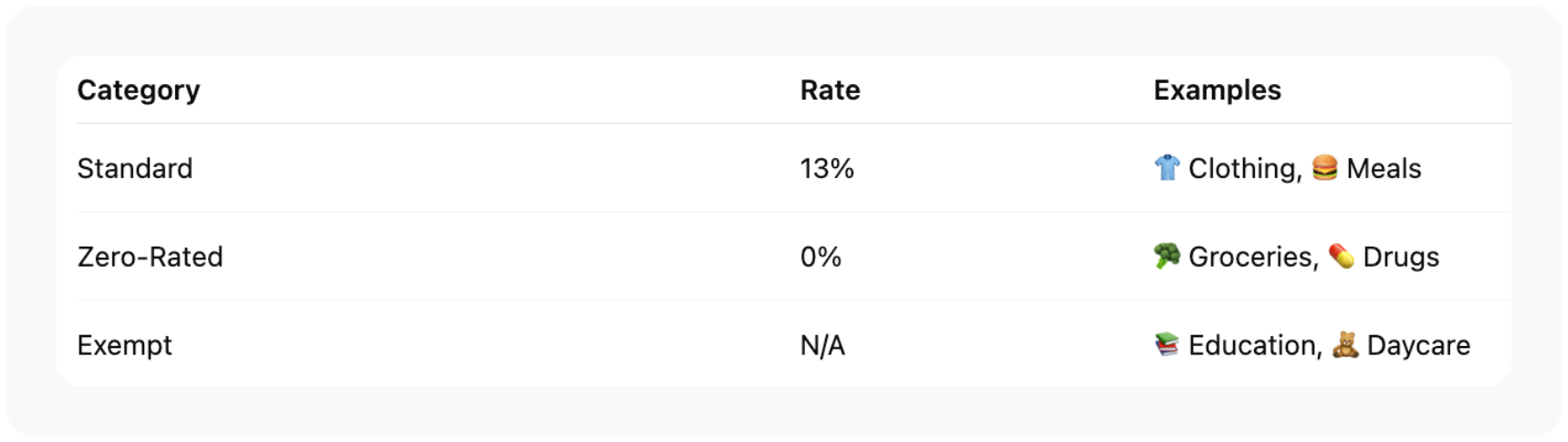

Tax Categories:

Understanding what is the HST for Ontario helps avoid charging incorrectly.

If you’re a business operating nationally, follow the CRA’s Place of Supply Rules to determine which rate to apply based on where the product or service is delivered.

Claiming Input Tax Credits (ITCs) Correctly

If you are registered for GST/HST, you can recover the tax paid on purchases related to your business through Input Tax Credits (ITCs).

Eligible Expenses Include:

- Rent for business premises

- Marketing and advertising

- Software subscriptions and office supplies

- Professional services (accounting, legal)

You must ensure:

- Your vendor had a valid GST registration number

- You have valid receipts showing GST/HST separately

- The expenses relate directly to taxable supplies

How to File HST Returns in Canada

Your HST return will summarize:

- GST/HST collected on sales

- Input tax credits claimed

- Net tax payable or refundable

Filing Frequency:

| Annual Revenue | Reporting Frequency |

| Over $6 million | Monthly |

| $1.5M – $6M | Quarterly |

| Below $1.5M | Annually |

How to File:

- CRA’s My Business Account (recommended)

- Certified third-party accounting software

- Paper filing (less preferred)

Keep track of deadlines and file even if you owe nothing. Late filings can result in penalties, interest, and missed ITC claims.

Avoiding Common HST Registration Mistakes

HST compliance can be tricky. Avoid these missteps:

| Mistake | Result |

| Not registering on time | You may owe tax retroactively |

| Charging HST without registration | CRA penalties and audits |

| Claiming ITCs on ineligible purchases | Reassessments and interest |

| Charging wrong rate by province | Over or undercharging clients |

If you’re unsure whether you’re required to register, consult a tax professional.

Tip: Review your GST/HST number on invoices regularly to ensure correctness.

Final Thoughts: Staying Compliant as a Canadian Business

Navigating the world of HST in Canada may seem complex at first, but staying organized is the key. Whether you’re issuing your first invoice, preparing to register for an HST number, or checking a supplier through the GST registry, every detail matters.

For growing companies, freelancers, and side hustlers alike, knowing how to manage GST/HST obligations is crucial to staying on the right side of the CRA. Register early, keep your receipts, verify vendors, and charge the right tax.

Want clarity on your HST responsibilities? Partner with a trusted tax advisor or bookkeeper who understands provincial nuances and CRA policies.

Frequently Asked Questions

What is an HST number?

An HST number is a business’s GST/HST account with the CRA, typically formatted as 123456789 RT0001.

How do I apply for an HST number?

You can apply online, by phone, or by submitting Form RC1 to the CRA.

How can I find my GST or HST number?

Check your CRA My Business Account or previous tax filings.

Where do I check someone else’s HST number?

Use the CRA’s GST/HST Registry to verify their active status.

What is the HST rate in Ontario?

13% — a blend of 5% federal GST and 8% provincial portion.

Do I charge HST if my customer is in another province?

It depends on their location—use CRA’s Place of Supply rules.

Is HST registration mandatory for freelancers?

Only if your annual taxable revenue exceeds $30,000.

Can I claim back the HST I pay on expenses?

Yes—if registered, you can claim eligible input tax credits (ITCs).

How do I update my HST number or business info?

Sign into CRA My Business Account to make changes.

What happens if I don’t register but should have?

CRA may assess you retroactively and charge penalties or interest.

Disclaimer: This blog is intended for informational purposes only. It does not constitute legal or tax advice. Please consult a qualified Canadian accountant or tax advisor to ensure your specific GST/HST obligations are met.