Table of Contents

Introduction: Why Financial Planning Matters More Than Ever

A coffee habit costs about $5/day. That’s $1,825/year.

Now imagine that going toward your RRSP, TFSA, or even a student loan repayment.

That’s the power of financial planning. It’s not just about budgeting — it’s about clarity. Knowing where your money goes, how it grows, and how it supports your short and long-term financial goals.

Especially in Canada, where rising inflation, housing prices, and tax changes are reshaping how we spend and save, building a comprehensive financial plan is no longer a luxury. It’s a necessity.

Would strategic financial oversight from a Fractional CFO add value to your operations?

What Is Financial Planning? (Canada centric examples)

Let’s start with the basics.

Financial planning is the process of organizing your money to reach your life goals — whether that’s buying a condo in Toronto, paying off your student loans, or retiring comfortably in PEI.

✅ Financial planning definition: A structured process to evaluate your income, expenses, assets, and liabilities, and create strategies to grow and protect your wealth over time.

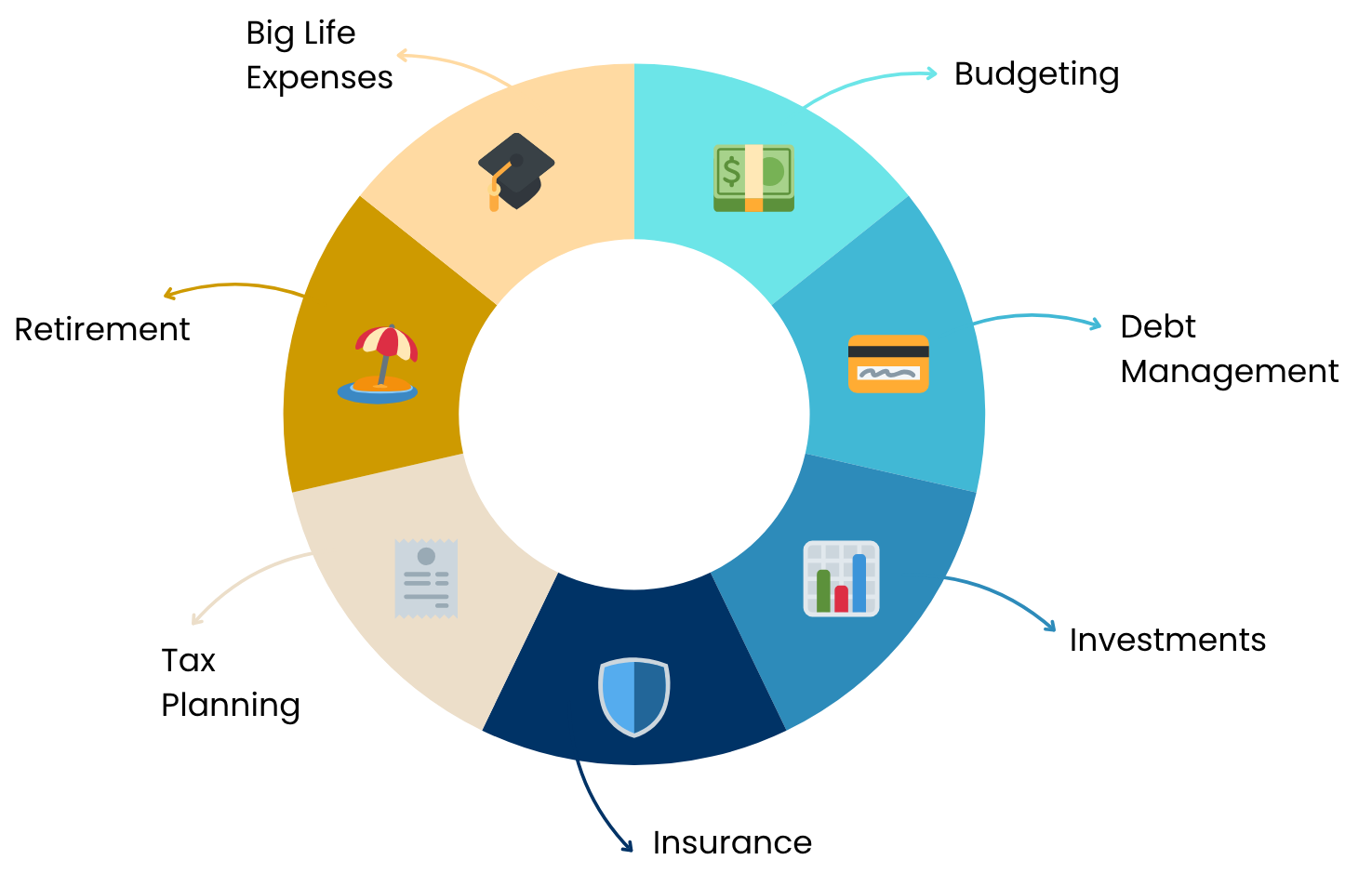

It includes:

- Budgeting your income and expenses

- Debt management (e.g., paying off credit cards, student loans)

- Savings and investment strategies

- Insurance planning (like life or disability insurance)

- Tax efficiency

- Retirement savings (RRSPs, TFSAs, employer pensions)

- Planning for big expenses (weddings, education, property)

Why Everyone Needs a Personal Finance Plan

Most Canadians say they “should” save more.

But without a roadmap, it’s easy to lose sight.

A solid personal finance plan helps you:

- Prioritize what’s truly important (kids’ education, home, early retirement)

- Understand your risk tolerance

- Tackle debt with confidence

- Make room for investment opportunities

- Avoid lifestyle inflation

- Sleep better at night

A financial plan is more than a spreadsheet — it’s your blueprint for freedom.

Core Elements of a Financial Plan

Here’s what goes into a typical financial planning process:

| Element | What It Covers | Canada-Specific Example |

| Income & Expenses | Monthly cash flow | Paycheques, freelance work, rent/mortgage, groceries |

| Assets & Liabilities | What you own vs owe | TFSA, RRSP, mortgage, credit card debt |

| Short and Long-Term Goals | Define timelines | Buying a home (short), retirement (long) |

| Savings and Investment | Growth strategies | RESPs for children, ETFs via Questrade |

| Insurance | Risk protection | Life/disability coverage, tenant insurance |

| Retirement Planning | Nest egg building | Employer pension + RRSPs, CPP eligibility |

| Tax Strategy | Minimizing liabilities | Claiming tuition, spousal RRSPs |

Each piece fits together — it’s like building financial Lego.

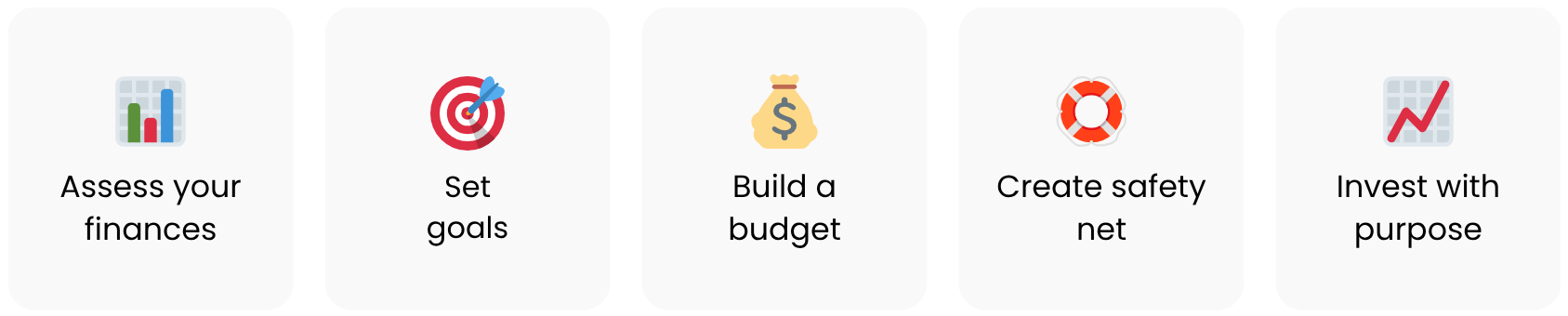

Step-by-Step: How to Create a Financial Plan in Canada

If you’re wondering, how do I create a financial plan that works?, here’s a simplified 5-step process:

Step 1: Assess Your Financial Situation

Start with your net worth: assets (home, car, savings) minus liabilities (mortgage, loans, credit card debt).

Then, map your income and expenses to identify leaks.

Step 2: Define Clear, Measurable Goals

Avoid vague goals like “save more.” Say instead:

- “Save $10,000 for a down payment by December 2026”

- “Pay off student loans in 4 years”

Step 3: Create a Budget (and Stick to It)

Use apps like Mint, YNAB, or Hardbacon (Canada-based) to build a real-time budget. Allocate money into essentials, savings, investments, and fun.

Step 4: Build Your Safety Net

Prioritize:

- Emergency fund (3–6 months expenses)

- Life insurance if you have dependents

- Critical illness coverage

Step 5: Invest with Purpose

Open a TFSA, RRSP, or investment account based on your goal timeline and risk appetite. Automate contributions if possible.

Working with a Financial Professional vs DIY

Option A: Work with a Financial Advisor or Wealth Manager

Pros:

- Tailored financial planning advice

- Expertise in tax strategies

- Ongoing monitoring

Cons:

- Can be pricey

- Conflicts if they earn commissions

Tip: Look for fee-only certified financial planners (CFPs) or wealth managers in Canada who are fiduciaries.

Option B: Do It Yourself

Pros:

- Cost-effective

- Full control

Cons:

- Time-consuming

- Risk of missed opportunities

Great middle ground? Use a hybrid approach — start DIY, then get a financial checkup every few years with a pro.

Mistakes Canadians Often Make With Financial Planning

Here are some common missteps:

- Focusing only on short-term wins, ignoring retirement savings

- Having no debt repayment strategy

- Relying solely on savings accounts for growth

- Not reviewing insurance needs annually

- Ignoring inflation’s impact on long-term financial goals

- Underestimating the importance of estate planning (yes, even in your 30s)

Each mistake adds up. But awareness is the first fix.

Staying on Track: Updating Your Plan Over Time

Life happens. Babies. Job changes. Market crashes.

That’s why a financial plan is not a “set and forget” exercise.

✅ Review your plan every 6–12 months

✅ Adjust based on major life changes

✅ Reassess your risk tolerance as you age

✅ Use tools like a retirement savings calculator or investment tracking app

Think of it like Google Maps rerouting you — always updating based on traffic (aka life).

Conclusion: Your Money, Your Future

You don’t need a finance degree to take control of your money.

You just need a plan.

Whether you’re saving for retirement, crushing debt, or figuring out how to pay off those student loans, building a thoughtful, actionable, and adaptable financial plan is your secret weapon.

And remember: financial planning isn’t about deprivation. It’s about direction.

Frequently Asked Questions

What is the meaning of financial planning?

Financial planning is the process of managing your finances to meet life goals—like buying a home, paying for school, or saving for retirement.

How do I create a financial plan in Canada?

Start with your income and expenses. Set short and long-term goals. Build a budget. Save and invest wisely. And revisit your plan at least once a year.

Why is financial planning important for personal finance?

Without a plan, it’s easy to overspend, stay in debt, or fall short of retirement goals. Financial planning keeps your money aligned with your values.

Should I get financial planning advice from my bank?

Banks offer basic planning tools, but may not be tailored. For a more detailed and independent plan, consider a fee-only financial planner.

How much does a financial planner cost in Canada?

It varies — many charge 1% of assets managed, others charge hourly (around $150–$300/hr). Fee-only planners offer transparent, unbiased advice.