Running a business in Canada means wearing many hats — from managing customers to handling suppliers, taxes, and payroll. But when you start juggling receipts, bank statements, and year-end reports, the numbers can quickly take over your week. That’s where a good bookkeeper becomes your best ally.

For many Canadian small business owners, hiring the right bookkeeper isn’t just about keeping records straight. It’s about saving time, staying compliant, and gaining peace of mind knowing your financial health is in expert hands.

Let’s walk through how to find, evaluate, and hire the right bookkeeper for your business.

Table of Contents

Why Bookkeeping Matters for Every Small Business

Bookkeeping is more than recording financial transactions. It’s the heartbeat of your company’s financial management system. From sales taxes to income statements, every small business in Canada relies on accurate records to make smarter decisions.

Without proper bookkeeping, your accounts receivable and accounts payable can easily fall behind, making it harder to track cash flow or prepare an accurate tax return. When records aren’t up to date, even small errors can snowball into missed deductions or late filing penalties.

Hiring a professional bookkeeper helps ensure that every dollar earned or spent is recorded properly — giving you real-time visibility into your balance sheets, general ledger, and financial data.

Are you currently managing your bookkeeping in-house?

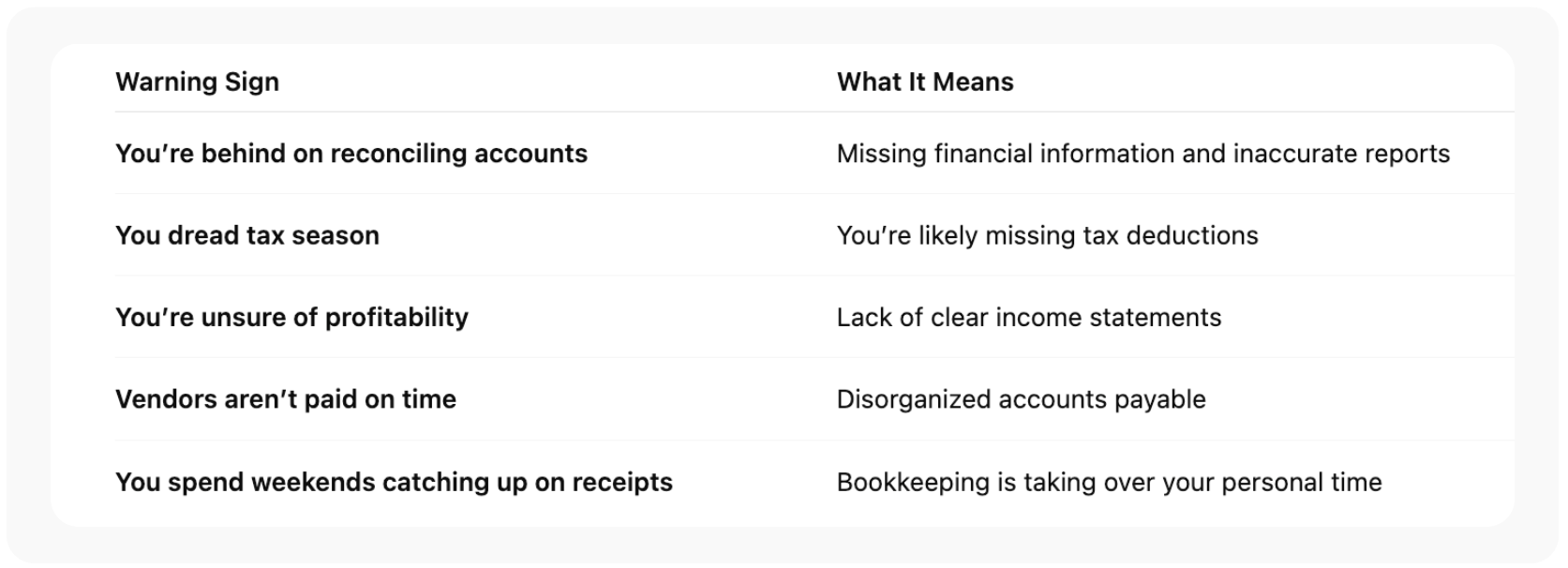

Signs You Need a Bookkeeper

It’s common for small business owners to handle the books in the early days, but as business grows, it quickly becomes unmanageable.

Here are clear signs it’s time to hire a bookkeeper:

If any of these sound familiar, outsourcing bookkeeping services might be your next smart move.

How to Find the Right Bookkeeper in Canada

a. Start with Referrals and Online Reviews

Word of mouth still goes a long way. Ask other small business owners who they use for bookkeeping or accounting services. Platforms like QuickBooks ProAdvisor, LinkedIn, and local business associations list certified bookkeepers across Canada.

b. Look for Canadian Experience

Your bookkeeper should understand CRA compliance, GST/HST filings, and provincial tax rules. Canadian-specific knowledge is vital to ensuring your financial records meet local requirements.

c. Prioritize Cloud-Based Skills

In today’s world, most small businesses rely on QuickBooks Online, Xero, or similar bookkeeping software. Cloud systems let you and your bookkeeper access reports, financial transactions, and invoices in real time.

Orbit Accountants, for instance, uses a fully cloud-based setup to keep clients connected from anywhere in Canada. Whether you’re in Alberta or Nova Scotia, your data is always synced, secure, and accessible.

What to Ask Before You Hire a Bookkeeper

Before you hire a bookkeeper, prepare a few essential questions to gauge fit and expertise:

- What bookkeeping systems do you use (QuickBooks, Xero, Wave)?

- Do you handle sales tax filing and tax preparation?

- How often will I receive reports like balance sheets and income statements?

- Do you work with other clients in my industry?

- What’s included in your monthly package — payroll, bank reconciliations, year-end reporting?

You’re not just hiring someone to enter data; you’re hiring a partner who keeps your financial information accurate, interprets results, and identifies red flags before they become problems.

Pro tip: Choose a bookkeeper who explains your numbers in plain English — not accounting jargon.

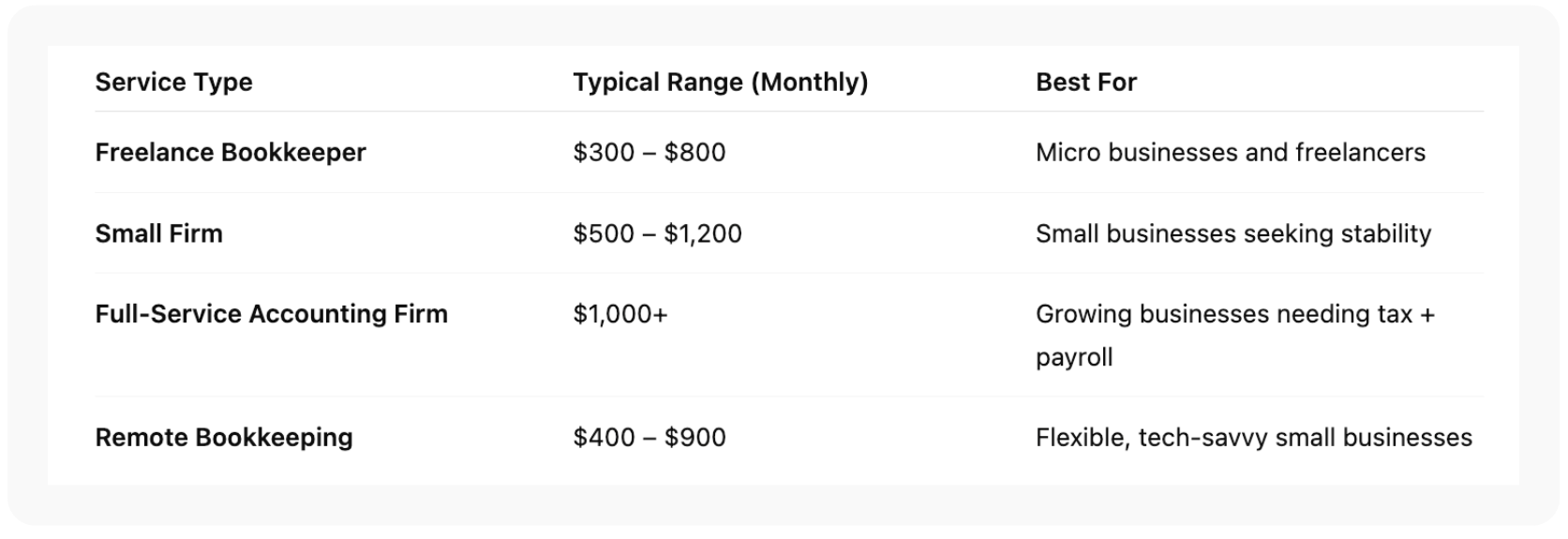

Comparing Bookkeeping Services & Pricing

Canadian bookkeeping rates vary widely depending on location, business size, and scope of work:

The best option depends on your comfort level, business complexity, and how hands-off you want to be.

Orbit Accountants, for example, offers flexible bookkeeping services and accounting support packages tailored to your growth stage — whether you need simple reconciliation or a full monthly close process.

In-House vs. Remote Bookkeeping Jobs in Canada

The rise of remote bookkeeping jobs has changed how Canadian companies access talent. With secure software and cloud platforms, businesses no longer need a bookkeeper in the same city.

In-house bookkeeping can make sense for larger companies with high transaction volume, but for small businesses, remote bookkeeping services offer cost savings and access to broader expertise.

A remote bookkeeper can handle your general ledger, bank reconciliations, and even payroll — all through encrypted online systems. Plus, you’ll save on workspace and equipment costs while still enjoying personalized support.

Tools Every Modern Bookkeeper Uses

A professional bookkeeper doesn’t rely on spreadsheets alone. Modern bookkeeping software streamlines reporting and integrates directly with your accounting system.

Top tools Canadian bookkeepers use:

- QuickBooks Online: Industry standard for small business bookkeeping.

- Xero: Popular with startups for real-time financial management.

- Hubdoc / Dext: Automates document collection for receipts and invoices.

- Gusto or Wagepoint: Simplifies payroll and tax return filings.

- Keeper / Client Hub: Improves team collaboration and quality control.

The goal is to ensure your financial data stays clean, categorized, and ready for reporting at any time.

The Bottom Line: Peace of Mind through Proper Bookkeeping

Hiring a skilled bookkeeper for small businesses is one of the smartest financial decisions you can make. It saves time, prevents compliance headaches, and helps you see where your money is truly going.

Whether you choose a local bookkeeper in Toronto or a remote team like Orbit Accountants, what matters most is trust, transparency, and timely communication.

When your financial records are accurate and your reports clear, you’re not just staying compliant — you’re building the foundation for better business decisions. That’s the real value of great bookkeeping.

Talk to Orbit Accountants today for a customized bookkeeping plan that grows with your business.

Frequently Asked Questions

1. How much does it cost to hire a bookkeeper in Canada?

Most small businesses spend between $300 and $1,200 per month, depending on transaction volume and service level. Cloud-based bookkeeping services offer transparent pricing and flexibility to scale as you grow.

2. Should I hire a bookkeeper or an accountant?

A bookkeeper handles day-to-day financial transactions, reconciliations, and balance sheets. An accountant focuses on analysis, strategy, and tax filing. Many Canadian firms — like Orbit Accountants — offer both under one roof.

3. Can bookkeeping services help with tax returns?

Absolutely. Proper bookkeeping ensures your income statements and general ledger are accurate, which makes tax preparation faster and error-free.

4. What software do Canadian bookkeepers use?

Most professionals use QuickBooks Online, Xero, or Wave Accounting for real-time visibility and integration with CRA systems.

5. How can I verify if my bookkeeper is qualified?

Ask for certifications like CPB Canada (Certified Professional Bookkeeper) or membership with CPA Canada. You can also request references and sample reports.

Legal Disclaimer: This article is provided by Orbit Accountants for general informational purposes only and does not constitute accounting, tax, or legal advice. Rules may vary by province and change over time. Always consult a qualified Canadian accounting professional before making business or tax decisions. Reading this content does not create a client relationship with Orbit Accountants. Orbit specializes in helping Canadian business owners with bookkeeping, tax planning, and financial management — so you can focus on running your business while we take care of the numbers.