Table of Contents

Understanding Corporate Tax Returns in Canada

In Canada, every incorporated business must file an annual tax return with the Canada Revenue Agency (CRA). This return, known as the T2 Corporation Income Tax Return, details your business’s taxable income, available tax credits, and tax payable based on your fiscal year.

It’s not just a compliance task—it’s a key part of responsible financial management. Knowing your corporate filing obligations helps you stay ahead of the curve and avoid unnecessary penalties or interest.

When Are Corporate Taxes Due in Canada?

There isn’t one universal deadline for taxes in Canada when it comes to corporations. Your business’s corporate tax return is generally due six months after your fiscal year-end. However, any balance owed must typically be paid within two or three months of that same year-end.

For instance:

Fiscal year-end: December 31, 2024

- Tax return deadline 2025: June 30, 2025

- Pay taxes date: March 31, 2025 (or April 30, 2025 for eligible Canadian-Controlled Private Corporations)

The distinction is important. Filing and payment are separate, and meeting only one obligation isn’t enough. Late payments trigger interest, even if your return is submitted on time.

Are you confident your business tax filings are fully optimized and compliant?

Key Filing and Payment Deadlines for 2024 and 2025

Here’s a table to help you stay on top of your business tax deadlines in Canada. These apply regardless of your company’s size:

| Fiscal Year-End | Tax Return Deadline | Tax Payment Due Date |

| December 31, 2023 | June 30, 2024 | March 31, 2024 or April 30, 2024 |

| December 31, 2024 | June 30, 2025 | March 31, 2025 or April 30, 2025 |

| March 31, 2024 | September 30, 2024 | May 31, 2024 or June 30, 2024 |

| June 30, 2024 | December 31, 2024 | August 31, 2024 or September 30, 2024 |

These business tax deadlines help structure when returns should be filed and when the payments must be made.

If you’re a new business owner, don’t confuse this with the income tax deadline 2024 that applies to individuals, which is April 30.

Instalments and the Quarterly Tax Payment Schedule

If your corporation owed more than $3,000 in taxes this year or last year, you’ll likely need to pay by instalments. These quarterly payments are based on your expected tax obligation.

Quarterly instalment dates for calendar-year businesses:

- March 31

- June 30

- September 30

- December 31

If your tax file deadline 2025 is approaching, make sure these payments are made by each due date to avoid interest.

Missing a payment by even one business day can result in compounded interest and complications.

Penalties for Missing the Tax Deadline

What happens if you miss a deadline to file taxes 2024 or pay late? The CRA charges a late-filing penalty of 5% of your unpaid taxes, plus 1% for each month your return is late (up to 12 months).

This means missing the business tax deadline 2024 by even a single month can be costly. Repeat failures increase the penalty.

On top of that, interest is charged daily until the full amount is paid. It’s calculated on unpaid balances from the original tax due day.

Pro tip: Even if you can’t pay your full tax bill, it’s better to file than delay.

Tax Tips for Small Businesses and Canadian-Controlled Private Corporations

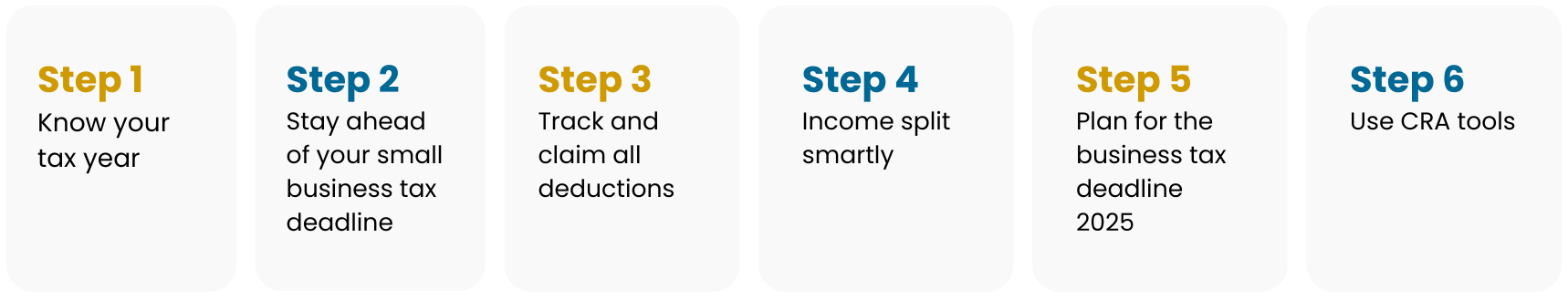

Here are smart strategies tailored for small businesses and CCPCs:

- Know your tax year: Most go with a December 31 year-end, aligning with calendar schedules.

- Stay ahead of your small business tax deadline: Mark important CRA filing and payment dates in your calendar.

- Track and claim all deductions: Salaries, office rent, subscriptions, and travel expenses can all lower your taxable income.

- Income split smartly: Consider income-sharing with your spouse or common law partner (if allowed).

- Plan for the business tax deadline 2025 by automating payments and reminders.

- Use CRA tools: My Business Account makes it easier to check deadlines and view filed returns.

What to Expect After Filing Your Business Tax Return

Once your return is filed, CRA generally issues a Notice of Assessment within 60 to 90 days. If you’ve submitted on time and paid by the proper pay taxes date, this process is smooth.

Late returns or irregularities may trigger an audit. That’s why it’s crucial to prepare ahead of your deadline for taxes 2025.

And yes, if CRA identifies errors, you’ll get a notice—but it doesn’t always mean penalties. Keep your records organized and aligned with your declared figures.

Frequently Asked Questions

When are corporate tax returns due in Canada?

Six months after your fiscal year-end. If your year-end is December 31, 2024, the return is due June 30, 2025.

When is the deadline for taxes 2024 for small businesses?

If your fiscal year ends December 31, 2023, your small business tax deadline to file the return is June 30, 2024.

What is the business tax deadline 2025?

For fiscal years ending in 2024, most payments will be due by March 31 or April 30, 2025. The filing deadline is typically June 30, 2025.

What’s the difference between the tax return deadline 2025 and tax due date?

The tax return deadline is when your forms must be filed; the tax due date is when the payment must be received. Often, the latter comes 2-3 months earlier.

What happens if I miss the deadline to file taxes 2024?

CRA charges late-filing penalties and daily interest. File as soon as possible to reduce costs.

When is tax deadline 2025 Canada?

This depends on your business’s fiscal year. For many, the deadline for taxes 2025 (payment) will be March 31 or April 30.

What if I miss a business tax payment by just one business day?

Interest applies starting the very next day. CRA interest is compounded daily.

How do I confirm that I filed my return?

Log into CRA’s My Business Account. It shows your return status and tax balance.

When is the last day to file taxes if I have a non-calendar fiscal year?

Count six months from your fiscal year-end. That’s your tax return deadline.

Can I amend a return filed early?

Yes, you can file an amended return if you discover an error before or after the tax file deadline 2025.

Final Takeaway

Deadlines matter—especially tax deadlines. Whether you’re preparing for the business tax deadline 2024 or forecasting obligations for 2025, staying proactive is key.

Mark your calendar with your business’s tax return deadline, your pay taxes date, and any quarterly instalments. File and pay on time, even if just to avoid late penalties.

And if you’re ever unsure, get help. One call to a tax professional can keep you from making costly errors down the line.

Need support with your corporate taxes? Orbit Accountants helps Canadian businesses stay on top of every tax due day—filing, payments, and strategy included.

Legal Disclaimer: This article is provided for general informational purposes only and does not constitute professional advice. For tax guidance tailored to your specific business, consult a certified accountant. Filing deadlines, interest rates, and CRA rules are subject to change.