Starting a business in Canada means more than just selling a product or service—it means building something sustainable. But before growth, there’s structure. Your business structure defines how your company will be taxed, how profits are shared, and how protected you are as an owner.

If you’re a starter company in Ontario or exploring incorporation in Canada, this guide breaks down how your business can evolve—from a sole proprietorship to a corporation, and eventually into holding and trust structures that maximize protection and tax efficiency.

Table of Contents

Business Meaning and Types of Business in Canada

Before you create a company, it’s important to understand the business meaning and what qualifies as a legal entity in Canada.

When you start a business, you can operate as:

- A sole proprietorship

- A general partnership

- A corporation

- Or under a trust structure

Each type carries its own tax advantages, liability rules, and documentation requirements. The Government of Canada allows flexibility—you can incorporate a business federally or provincially depending on where your business will operate.

Would strategic financial oversight from a Fractional CFO add value to your operations?

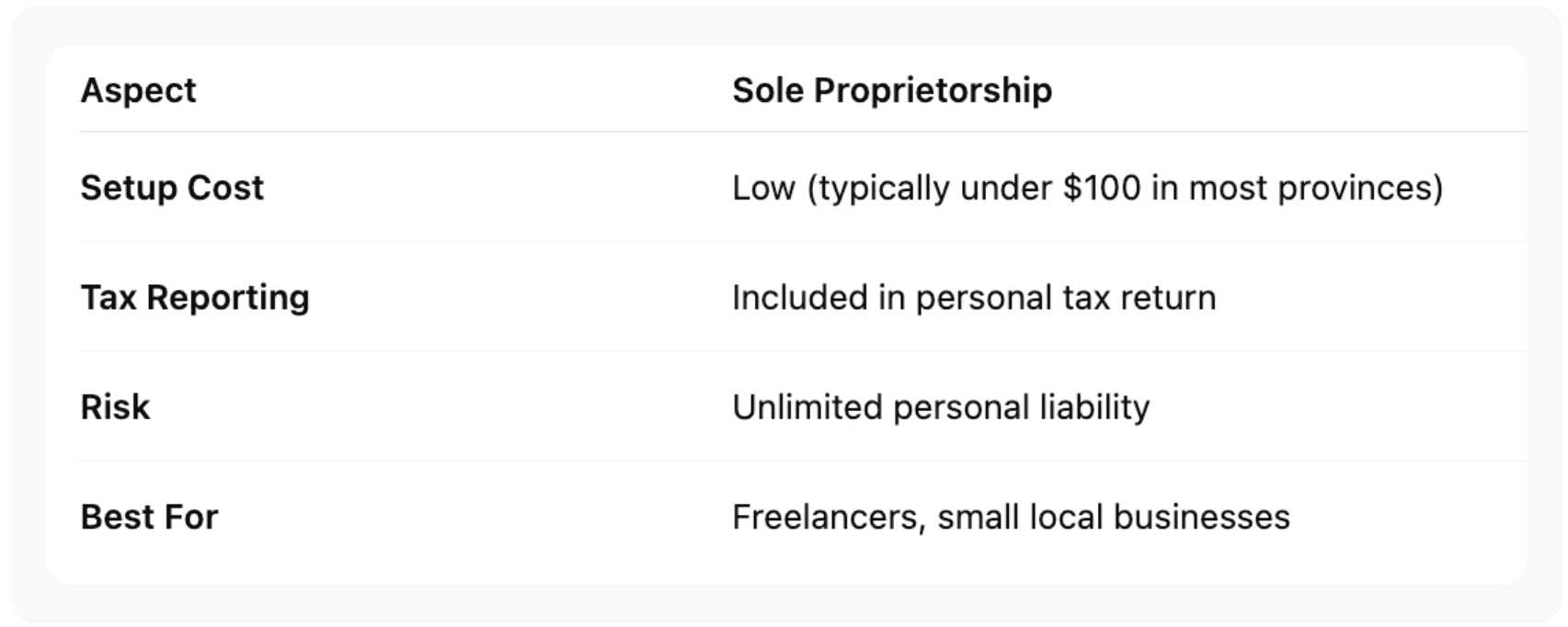

Sole Proprietorship: The Simple Beginning

Most Canadians started a business as a sole proprietorship because it’s easy, fast, and cost-effective.

You and your business are the same legal entity, meaning you report your income earned directly on your personal income tax return.

It’s ideal when you’re testing a business idea or offering a simple service. But as profits grow, so do risks—and that’s when you consider incorporating.

Incorporation in Canada: Creating a Separate Legal Entity

Incorporation means your business becomes its own legal entity, distinct from you. You can form limited liability companies—often called corporations—under provincial laws (like in Ontario) or federally.

When you incorporate a business, you protect your personal assets and enjoy better access to capital from financial institutions and investors.

Advantages of Incorporation

- Limited liability: Your personal assets are shielded.

- Lower corporate tax rate: The corporate tax rate for small businesses can be as low as 9% on the first $500,000 of active income.

- Access to funding: Banks prefer incorporated businesses for loans.

- Credibility: A structured business looks professional to partners and clients.

- Board of directors: Corporations must appoint directors to oversee decisions, adding a layer of governance.

Tip: When your businesses operating under one umbrella start to grow, you might also explore multiple corporations under a single ownership plan.

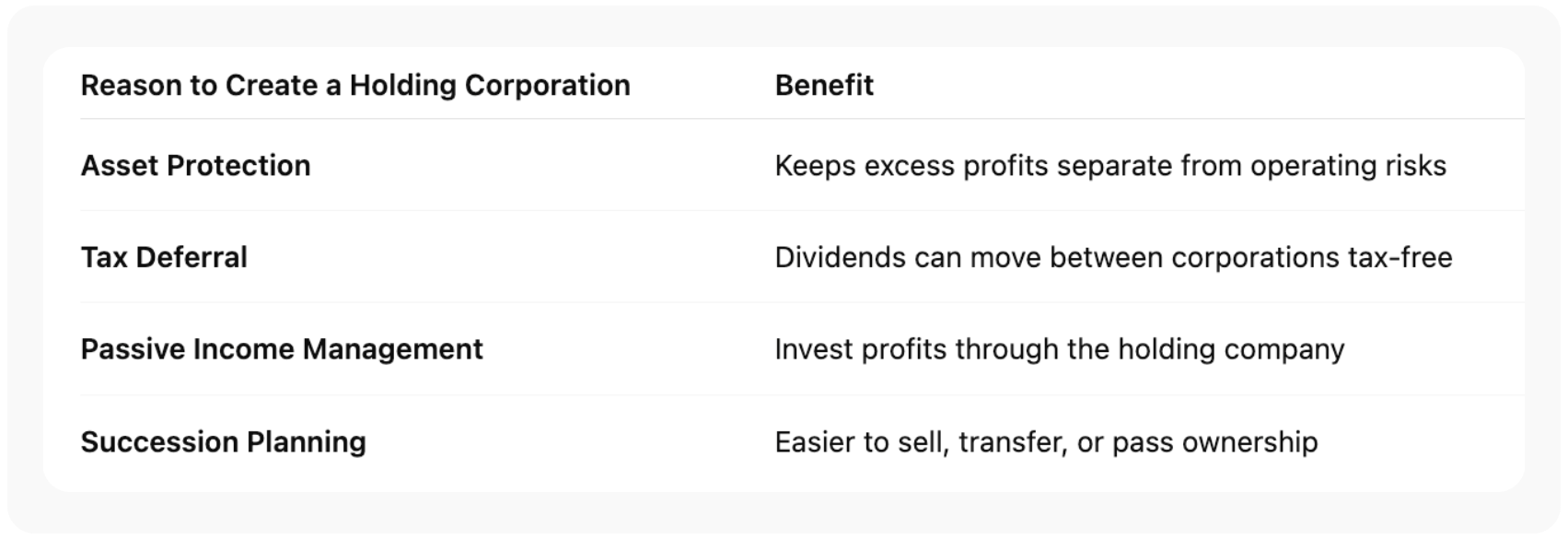

Holding Corporations: Building Layers for Growth

A holding corporation doesn’t operate a business directly—it owns one or more operating corporations. This setup offers protection, flexibility, and better control of income earned.

Many successful Canadian owners combine incorporation Canada with a holding company to secure long-term wealth. You can even design a business plan that connects your operational companies under one holding legal entity for tax-efficient scaling.

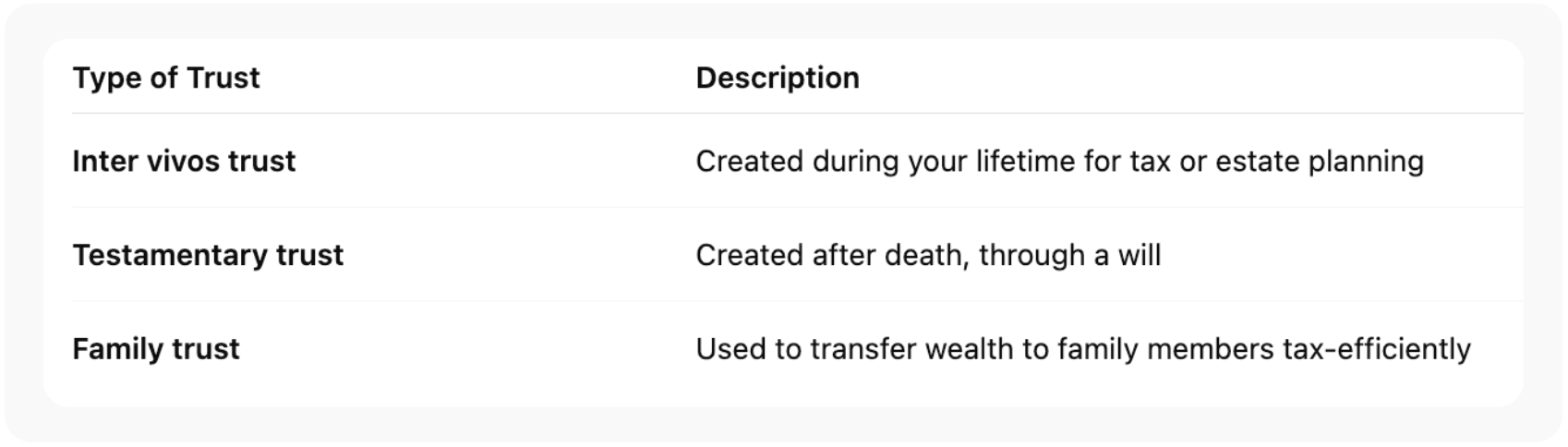

Trust Structures: What They Are and How They Help

Eventually, you might consider creating a trust. A trust structure lets you transfer ownership or assets to a trustee who manages them on behalf of trust beneficiaries.

A trust is created using a trust document or trust agreement, outlining the terms of the trust, who manages it, and who benefits from it.

Types of Trusts in Canada

The trustee definition: a person or entity responsible for managing assets according to the trust law and the terms of the trust.

Key Benefits

- Tax advantages: Distribute income to beneficiaries in lower tax brackets.

- Estate planning: Transfer future growth of the business to children tax-free.

- Asset protection: Trusts can help shield assets from lawsuits and creditors.

A well-drafted trust, created with proper legal guidance, can provide significant tax advantages for high-income earners and business families in Canada.

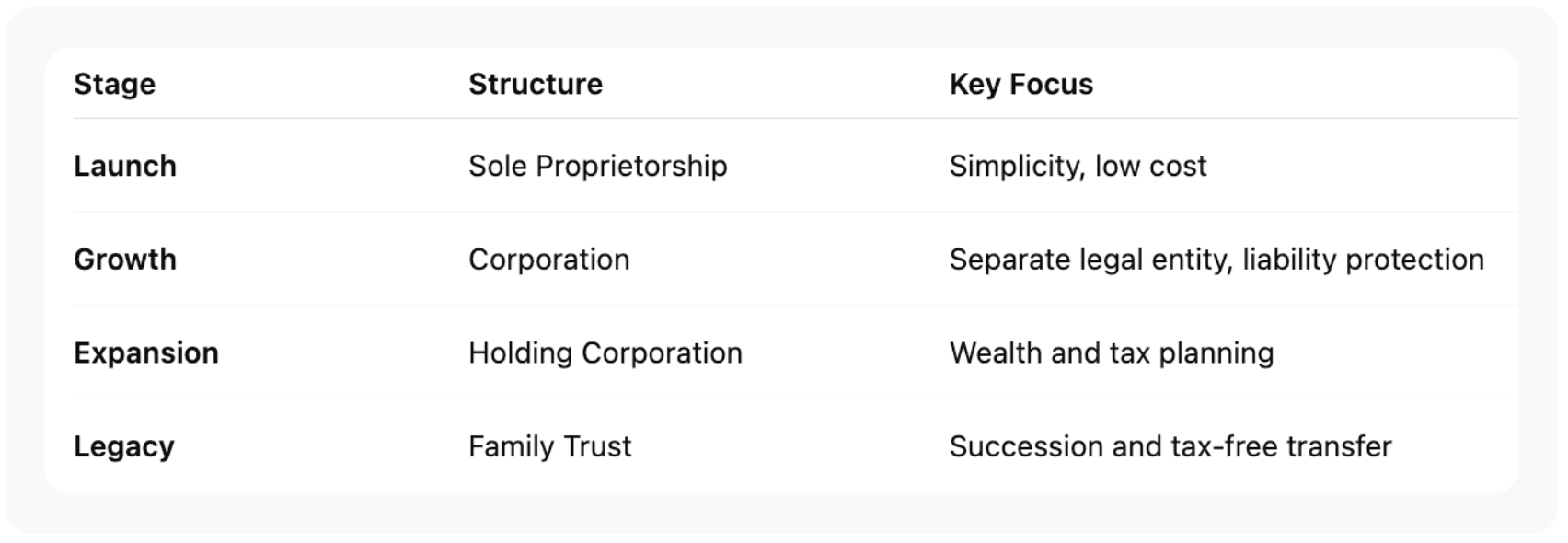

How Business Structures Evolve Over Time

Here’s how a typical Canadian business might progress:

This structure helps minimize risk, maximize growth, and ensure smoother ownership transition when you create a trust or sell your business.

Tax Advantages, Passive Income, and Financial Insights

Smart structuring is all about managing your income earned and taxes efficiently.

Key Tax Considerations

- Corporations: Enjoy a lower corporate tax rate (around 9%) under the Small Business Deduction.

- Holding Corporations: Help isolate passive income investments.

- Trusts: Can shift taxable income to family members or heirs.

Be mindful that passive income over $50,000 can reduce your Small Business Deduction limit. Using holding companies and trusts helps keep active and passive streams separated.

When you file your income tax return, ensure that income allocations between corporations, trusts, and individuals are reported correctly.

Choosing the Right Structure for Your Situation

There’s no one-size-fits-all business structure. Your best option depends on:

- The nature of your businesses operating

- Growth potential and risk tolerance

- Family and succession goals

- Desire to access capital from financial institutions

Checklist Before You Incorporate or Create a Trust

- Review your business plan and financial projections.

- Evaluate whether a general partnership or corporation best fits your startup stage.

- Consider the type of trust if long-term estate planning is a goal.

- Understand provincial vs. federal incorporation requirements.

- Consult a professional to ensure compliance with trust law and the Income Tax Act.

When your business expands, think beyond incorporation—plan for long-term asset protection, tax advantages, and succession.

Conclusion

Every entrepreneur begins somewhere. From a sole proprietorship to a corporation, and from a holding company to a trust, the right business structure builds a strong foundation for wealth and stability.

These structures help you manage income earned, protect your assets, and ensure your hard work benefits your family for generations. Whether you’re just starting out or already running multiple limited liability companies, understanding your structure is the key to sustainable success.

Frequently Asked Questions

What is the best business structure in Canada for a small business?

A sole proprietorship works when starting out, but incorporation provides liability protection and lower taxes as your business grows.

What is a trust and how does it work in Canada?

A trust is a legal entity managed by a trustee who holds assets for beneficiaries. The trust document defines its purpose and rules.

What’s the difference between inter vivos and testamentary trusts?

An inter vivos trust is set up during your lifetime, while a testamentary trust is created after death as part of your estate plan.

Why should I incorporate my business in Canada?

Incorporation offers limited liability, access to a low corporate tax rate, and makes it easier to raise capital from financial institutions.

Can I change my business structure later?

Yes. Many owners evolve from a sole proprietorship to a corporation and later add a trust or holding company as they scale.

Disclaimer: This article is provided by Orbit Accountants for general information only and does not constitute accounting, tax, or legal advice. Tax laws change over time and vary by province. Always consult a qualified Canadian tax professional before making incorporation or structuring decisions. Reading this content does not create a client relationship with Orbit Accountants. Orbit specializes in helping Canadian business owners with incorporation, tax planning, and bookkeeping—so you can focus on growth while we take care of the numbers.