Table of Contents

Why Small Business Owners Fall Behind on Their Books

Let’s face it — life as a small business owner in Canada is busy. Between managing clients, invoices, and tax filings, bookkeeping tasks often slip through the cracks.

It starts small — one missed reconciliation, a few receipts left unrecorded — until suddenly, months of transactions are waiting in your accounting software.

Common reasons include:

- Time-consuming manual processes

- Lack of up-to-date bookkeeping software

- Unclear accounting records or misplaced receipts

- Confusion about CRA tax filing requirements

Are you currently managing your bookkeeping in-house?

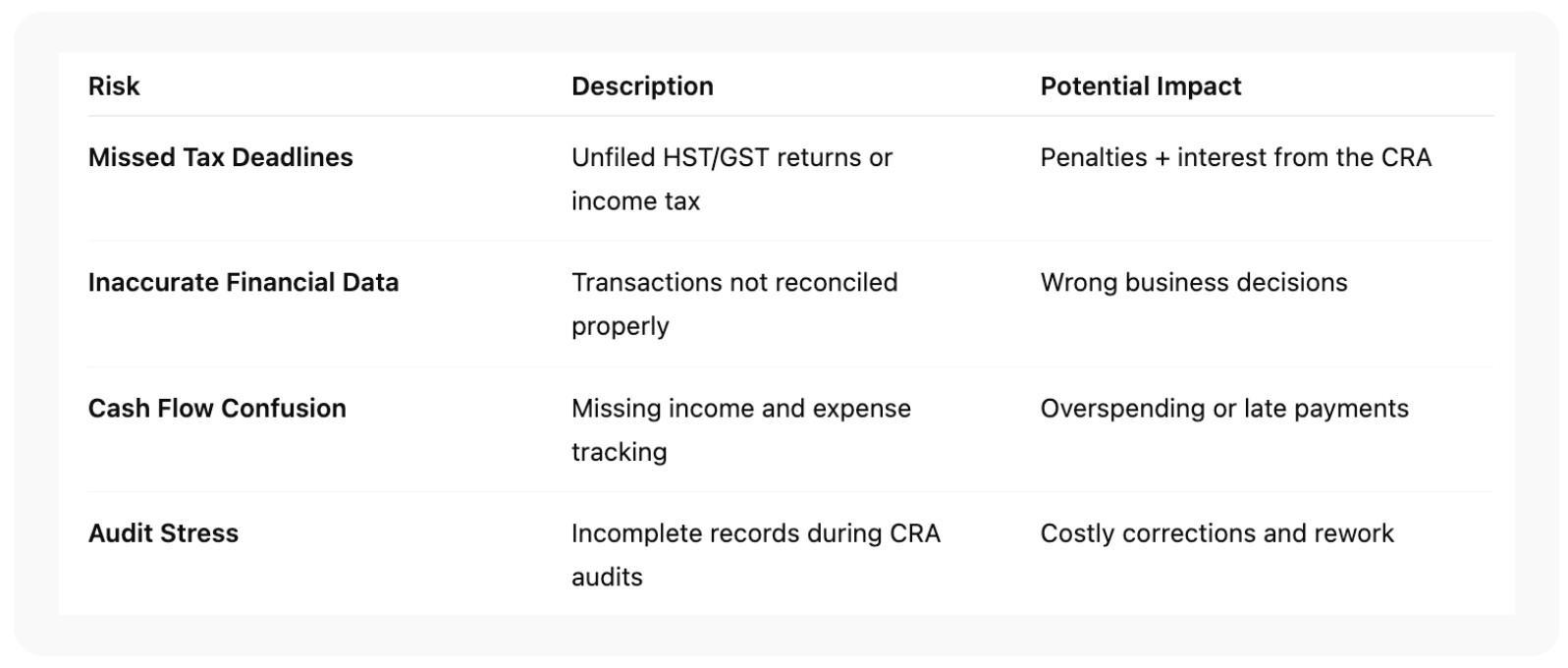

The Real Risks of Out-of-Date Bookkeeping

Being behind in bookkeeping doesn’t only mean disorganization. It can create real financial and legal problems, especially during tax season.

Here’s what can go wrong if your books aren’t current:

How to Start Catch-Up Bookkeeping Without Overwhelm

Catching up on bookkeeping doesn’t have to feel impossible. The key is to start small but structured.

Step 1: Gather all financial data — receipts, invoices, credit card and bank account statements, and payroll summaries.

Step 2: Sort them month by month, separating income and expenses.

Step 3: Choose a bookkeeping software (like QuickBooks Online, Xero, or Wave) that connects directly to your bank feeds.

Step 4: Begin data entry from the oldest month forward.

Tip: If you’re several months behind, focus first on reconciliations — they keep your books aligned with your real-world cash balance.

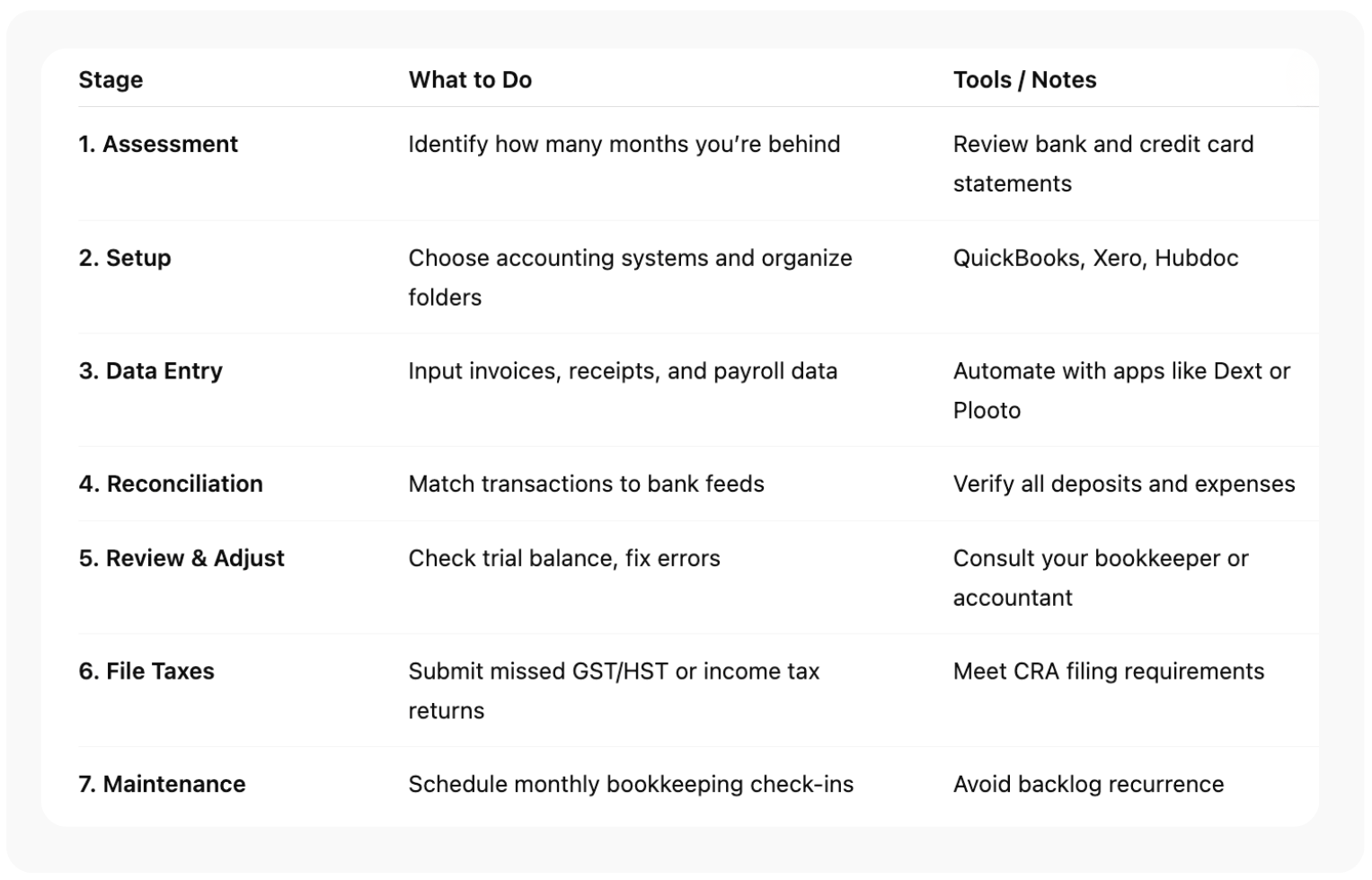

Step-by-Step Bookkeeping Recovery Plan

Here’s a simple bookkeeping recovery plan you can follow to get your records current again:

Tools and Systems to Simplify Catch-Up Accounting Tasks

The best way to fix backlog bookkeeping is to automate it. Modern bookkeeping catch-up services use integrated systems that link your bank account, credit card accounts, and cloud receipts.

Here are some tools Canadian business owners rely on:

- QuickBooks Online Canada – For automated reconciliation and tax prep.

- Hubdoc / Dext – For scanning and categorizing receipts.

- Plooto – For secure payments and approvals.

- Keeper / Xero Practice Manager – For working with your bookkeeper in real time.

When used together, these tools help you get bookkeeping up to date faster and with fewer errors.

When to Bring in a Professional Bookkeeper or Accountant

If you’ve fallen more than six months behind, or you’re preparing for a tax return or audit, it’s time to call in catch-up bookkeeping professionals.

A qualified bookkeeper or accountant can:

- Clean up data inconsistencies

- Rebuild missing financial information

- Prepare accurate statements for tax filing

- Coordinate with your CPA for year-end returns

They also save time — and time is money when tax deadlines loom.

Many bookkeeping cleanup services in Canada offer fixed-fee packages. That means predictable pricing and no surprises while they bring your books back to life.

Tips to Stay on Top After You Catch Up

Once your books are current, the goal is to stay on top.

Here’s how to make that stick:

- Block out time monthly for reconciliations.

- Automate data collection through your bookkeeping software.

- Back up financial data securely to the cloud.

- Hire part-time bookkeeping help during tax season.

- Review reports like profit & loss and cash-flow statements regularly.

Remember, clean books make tax preparation stress-free and give you a clear view of where your business stands — not just at tax time, but all year long.

Final Thoughts

Falling behind happens — it’s how you respond that counts.

By creating a bookkeeping recovery plan, using the right accounting systems, and leaning on professionals when needed, you can fix backlog bookkeeping quickly and confidently.

With accurate books, you’ll make smarter financial decisions, file taxes on time, and avoid CRA penalties — freeing you to focus on what really matters: growing your business.

Frequently Asked Questions

How far back should I catch up my bookkeeping?

Ideally, bring your books up to date for the current and previous tax years. The CRA can audit up to six years, so maintaining full records for that period is best.

Can I do catch-up bookkeeping myself?

Yes, but only if the backlog is small (one to three months). Anything beyond that benefits from professional bookkeeping catch-up services.

What happens if I file taxes with incomplete books?

You risk paying too much (missed deductions) or too little (CRA penalties and interest). Accurate books keep filings compliant.

How long does catch-up bookkeeping take?

Depending on how far behind you are, it can take anywhere from a few days to several weeks. Cloud software and automation can shorten that dramatically.

What’s the difference between bookkeeping cleanup and catch-up?

“Catch-up” gets books current; “cleanup” corrects old errors and reconciles historical data. Most small business owners need a mix of both.

Legal Disclaimer: This article is provided for general informational purposes only and does not constitute accounting, tax, or legal advice. Tax laws and filing requirements vary by province and may change over time. Always consult a qualified professional accountant before making financial or tax-related decisions. Reading this content does not create a client relationship with Orbit Accountants.