Running an Airbnb in Canada looks easy—until goods and services tax rules collide with sales timing, change-in-use, and condo dispositions. Reclassify a unit as hotel-like, toggle between short-term stays and long-term leases, or sell after an STR period, and the usual exemption for residential properties can vanish. Add the Income Tax Act denial of deductions for non-compliant STRs and cash flow can suffer fast. This guide lays out the mechanics, from how to claim input tax credits to audit-ready records that survive a CRA audit (yes, many owners search “cra audit” exactly like that).

Table of Contents

What changed (and why it matters now)

Two levers now drive risk:

- Income-tax deductibility: Beginning with 2024 tax years, the Income Tax Act denies expenses for non-compliant short-term rentals (e.g., you needed a municipal licence and didn’t have it). That doesn’t change GST/HST, but it directly erodes after-tax yield for income tax purposes.

- Condo sale characterization: Where near-sale use resembles a hotel (predominantly <60-day stays), the unit may not be a “residential complex” at sale—so the transfer is taxable, not exempt.

Core rule: when a home stops being a “residential complex”

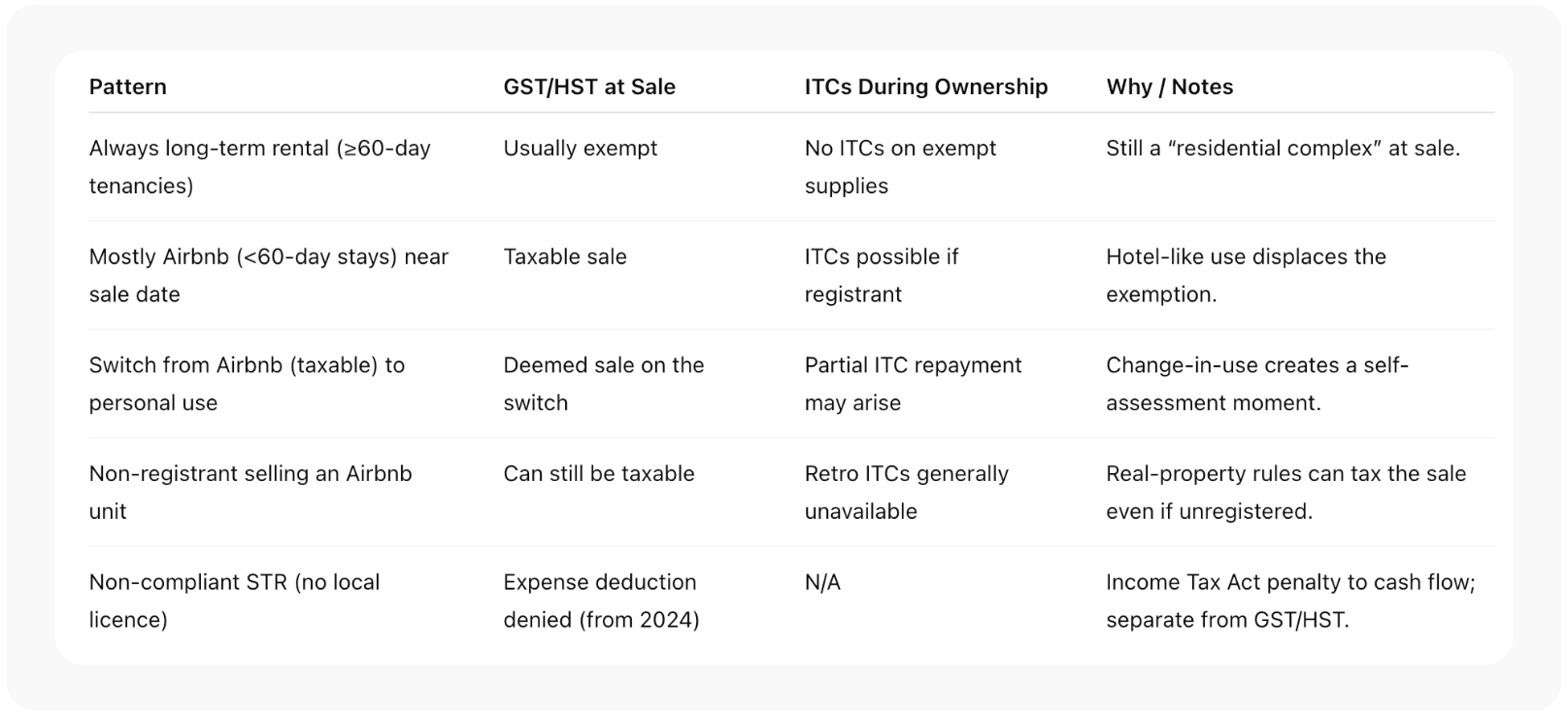

Ordinarily, a used condo or house sold by a non-builder is exempt from GST/HST. The exemption falls away if all or substantially all (≈90%+) of supplies are for continuous occupancy of under 60 days—that is, hotel-like use. In that case, the sale is a taxable supply under the goods and services tax regime and HST/GST applies on the transaction.

Are you confident your business tax filings are fully optimized and compliant?

Change-in-use: deemed sales, self-assessment, and timing traps

You don’t need an actual sale to trigger GST/HST. Switching how you use the property can create a deemed supply:

- Moving from commercial short-term rental to personal occupation or long-term exempt rental can deem a sale at that switch, requiring you to self-assess on the tax paid basis tied to basic tax content.

- Moving the other way (exempt → taxable STR) can deem an acquisition and start an input tax credits baseline.

Input tax credits: eligibility, baselines, and adjustments that stick

- When you can claim input tax credits: Only to the extent you carry on taxable commercial activity (e.g., short-term stays) and are registered/required to register. Expenses tied to exempt long-term residential rent don’t generate ITCs.

- Allocation and adjustments: Use a rational allocation (nights, area, or revenue) to establish commercial-use percentage. On any change-in-use, re-measure against basic tax content and adjust—some previously claimed ITCs may need partial repayment if commercial use drops.

- Terminology clarity: Use “input tax credit (ITC)” consistently; many owners even search for “input tax credit itc” verbatim. Internally, align receipts, invoices showing GST/HST, and your working papers to the percentages you applied.

Rule of thumb

- Short-term (<60 days for GST/HST) → taxable → potential ITCs.

- Long-term (≥60 days) → exempt → no ITCs on related costs.

Mixed-use property: personal + Airbnb + long-term rental

Real life is mixed-use property: a few weeks of Airbnb, periods of personal use, then a tenant. Keep a night-by-night calendar and reconcile to statements so your rental income split and ITC allocation are defensible. For periods of exempt use, segregate expenses clearly to avoid overstating claims.

Quick scenarios table (at-a-glance)

Condo sale HST: what appellate guidance means in practice

Courts have emphasized the use at the time of sale. Where the unit is offered and used for <60-day stays near closing, it’s not a “residential complex,” and the sale is taxable under HST/GST. A last-minute attempt to “flip” to personal use can itself trigger a change-in-use deemed sale before closing—two tax touchpoints instead of one.

Audit-proofing: the file that passes CRA review

Expect a CRA audit to test use patterns, registration, and ITC math. Build a file that can be handed to an auditor without explanation:

Provincial angle and place-of-supply (GST vs HST vs provincial taxes)

For real property, the supply occurs where the property sits. In HST provinces (e.g., Ontario), a taxable supply draws HST; elsewhere, GST applies. Remember, provincial sales taxes and local accommodation levies are separate from the federal goods and services tax. Some owners also refer to this as “services tax gst”; keep your paperwork consistent and use the statutory term “GST/HST” in filings.

FAQs

We ran long-term leases for years, switched to Airbnb for a quarter, then sold. Is the sale taxable?

Likely yes if, at the time of sale, use was predominantly <60-day stays. Characterization follows contemporaneous use.

If I stop Airbnb and move in for two months before listing, do I avoid GST/HST on sale?

Not necessarily. That pivot can create a change-in-use deemed sale (self-assessment) before you even reach closing.

I’m not registered. Can my sale still be taxable?

Yes. Registration affects mechanics and input tax credits eligibility—not whether the sale is a taxable supply.

Can I claim input tax credits on cleaning, supplies, and platform fees?

Only to the extent of taxable activity (short-term stays) and if you’re registered/required to register. Expect ITC adjustments if your commercial-use percentage falls.

Why do I see both 60-day and 90-day thresholds online?

Different statutes. The 60-day test is a GST/HST concept tied to “residential complex.” The Income Tax Act uses 90-day language in the STR deduction-denial regime for income tax purposes.

Do related-party transfers (e.g., to a spouse) avoid GST/HST?

No blanket exemption. If the unit is not a “residential complex” at that moment—or a change-in-use deeming rule applies—tax can still arise.

Conclusion & next steps

Airbnb economics hinge on classification and timing. Hotel-type use can convert an otherwise exempt disposition into a taxable sale, change-in-use can create interim tax events and ITC reversals, and non-compliance can deny deductions under the Income Tax Act. Plan the sequence, document aggressively, and price the tax before you list.

5-step playbook

- Map monthly use (personal vs long-term vs <60-day stays).

- Confirm registration; model input tax credits and basic tax content.

- If a sale/switch is imminent, model deemed events and self-assessment.

- Confirm place-of-supply and rate, separate from any provincial sales taxes or levies.

- Get a pre-sale checkpoint with an indirect-tax pro.

Want a one-page Airbnb tax playbook for your unit? Book a Free Consultation—we’ll model exposure, optimize when to switch use, and assemble a CRA-ready folder.

Legal disclaimer: This article is for general information only and does not constitute tax or legal advice. Outcomes vary by facts, timing, documentation, and registration status. Indirect-tax results depend on actual use, change-in-use events, and place-of-supply rules; provincial sales taxes and local levies are separate layers. For income tax purposes, consult the Income Tax Act and current administrative positions. Always obtain advice for your specific property, including any related-party transfers or financings, and consult official CRA publications for additional information. Reading this article does not create a client–advisor relationship with Orbit Accountants.