Money flows through every business like blood flows through the body. Whether you run a neighbourhood store, manage a growing startup, or simply handle your household budget, one thing remains true: you need a way to track, measure, and understand where your money is going. That’s where accounting steps in.

Accounting is often called the “language of business” because it tells the financial story of any organisation. From knowing if you’re making a profit to preparing for taxes or securing a loan, accounting provides the clarity needed to make confident decisions. Without understanding accounting basics, businesses risk confusion, poor cash flow management, and even failure.

In fact, research from Sage reveals that:

82% of businesses fail because of poor cash flow management – a problem that strong accounting practices could easily prevent.

The good news? By learning the key accounting basics, the basic principles, concepts, and fundamentals of accounting, you can build a clear picture of your finances and take control of your future.

In this blog, we’ll break down accounting basics in simple terms, covering everything from the core accounting principles and basic concepts to the key fundamentals every small business owner should know. Whether you’re a beginner, a freelancer, or a small business owner, these insights will help you avoid costly mistakes and build stronger financial habits.

Table of Contents

What Are Accounting Basics?

The basics of accounting are simply the rules and methods that help us understand financial transactions. Think of it like learning the alphabet before writing sentences. If you know the basics, you can easily record, read, and explain financial activities.

Accounting is not only for big companies. Even a person managing a small store or a freelancer’s earnings needs to know basic accounting. With it, you can track profit, prepare taxes, and plan future expenses. Without it, you risk confusion, missed bills, and wrong decisions.

At its core, accounting basics cover the process of recording income and expenses, maintaining accurate books, and preparing financial statements like balance sheets and income reports. These fundamentals provide a clear picture of financial health, support better decision-making, and create a strong foundation for growth. Simply put, understanding accounting basics is the first step to building financial confidence and long-term stability.

Are you currently managing your bookkeeping in-house?

Core Accounting Principles Every Beginner Should Know

When learning accounting, it’s easy to feel lost in numbers and reports. But at the heart of it all are a few key principles that keep everything organised and consistent:

Accrual vs. Cash Basis Accounting

In accrual accounting, transactions are recorded when they happen, not when money changes hands. In cash accounting, you record only when cash is paid or received. Small businesses often start with a cash basis, while large ones follow accrual.

Revenue Recognition Principle

This basic accounting principle says revenue is recorded when it is earned, not when payment arrives. For example, if you finish a project today but get paid next week, you still record revenue today.

Matching Principle

Expenses must be matched with the revenue they helped to generate. For instance, if you spend money on ads this month but earn revenue from them next month, both should appear in the same report.

Cost Principle

Assets should be recorded at their original purchase cost, not at current market value. For example, if you bought land for $20,000 years ago, you still show it at $20,000 in your books.

By applying these core accounting principles, whether it’s recognising revenue correctly, matching expenses to income, or recording assets at cost, you bring structure and discipline to financial records.

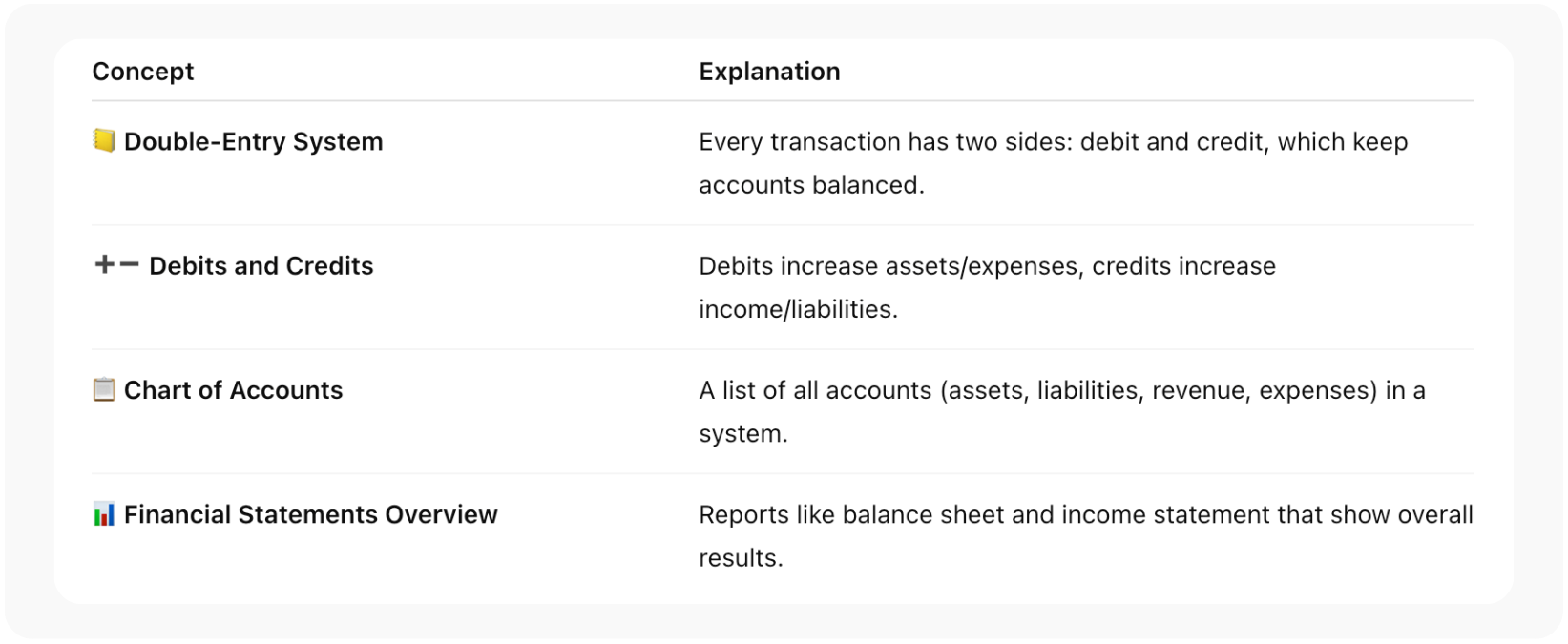

Basic Concepts of Accounting

Accounting works on certain concepts that give structure to financial records. Let us explain them in a table for easy understanding.

Below is a simple table to connect the main basic concepts of accounting with their importance. This will help you see how each concept builds the foundation of financial reporting.

These concepts work together to form the basic accounting equation, which is:

Assets = Liabilities + Equity. This single formula is the heart of accounting, as it ensures balance and accuracy.

Key Accounting Fundamentals for Small Businesses

For a small business, applying basic accounting for small businesses means more than just keeping receipts. It’s about creating a system for smooth cash flow, proper bookkeeping, and easy tax filing.

When you record sales daily, track expenses carefully, and prepare financial statements, you prevent errors and surprises. For example, monitoring invoices helps you avoid late payments. Good accounting also makes loan approvals easier, as banks like to see clear records.

Many small business owners choose expert accounting services from firms like Orbit Accountants. This gives them reliable data without wasting time, so they can focus on growth.

Benefits of Learning Accounting Basics

Learning basic principles of accounting comes with many benefits that include but are not limited to:

- Better decision-making:

When you know your profit and expenses clearly, you can decide where to cut costs and where to invest more. - Improved financial control:

You can easily spot if money is leaking somewhere and fix it quickly. - Easier compliance with taxes and regulations:

With organized records, filing taxes becomes stress-free, and you avoid penalties.

Myth:

Accounting is only for big companies.Fact:

Even small businesses and freelancers benefit from accounting because it helps in tax filing and financial clarity.

Common Mistakes Beginners Make with Accounting Basics

Beginners often make errors such as mixing personal and business expenses, ignoring receipts, or forgetting to back up records. Some also misapply the basic principles of accounting, like recording income without matching expenses.

To avoid these, keep separate bank accounts, use accounting software, and review books regularly. If unsure, professional accounting services can save you from costly mistakes.

Final Thoughts on Accounting Basics

Understanding basic accounting fundamentals is like learning how to read a financial story. From recording sales to preparing balance sheets, each step builds confidence and control. With simple knowledge of the basic concepts of accounting and the basic principles of accounting, anyone can manage money more wisely.

If you are a business owner, don’t wait until tax season to start. Apply these basics daily, or seek help from professionals to keep your books clean. Remember, knowing accounting is not just about numbers; it’s about making better choices.

At Orbit Accountants, we have been providing expert bookkeeping and accounting services for individuals and businesses across Canada. Whether it’s bookkeeping, payroll, tax filing, or financial reporting, we cover it all with accuracy and care. Our goal is to simplify numbers so you can focus on growth.

Contact us today to book a free consultation.

Frequently Asked Questions

What are the basics of accounting?

The basics of accounting are the foundation for managing financial information. They involve recording, summarizing, and reporting financial transactions in an organised way. These rules help businesses track income, expenses, assets, and liabilities accurately.

What is the basic accounting equation?

The basic accounting equation is: Assets = Liabilities + Equity. It ensures balance in financial records. This formula shows that everything a business owns is financed either through debt (liabilities) or owner’s investment (equity).

What are the basic principles of accounting?

The basic principles of accounting are guidelines that make financial reporting consistent and trustworthy. These include the cost principle, which records assets at purchase price; the revenue recognition principle, which records income when earned; the matching principle, which aligns expenses with revenues; and the accrual basis, ensuring accurate financial tracking.

What are the basic concepts of accounting?

The basic concepts of accounting include double-entry bookkeeping, where every transaction affects at least two accounts; the use of debits and credits; and consistent financial reporting. These concepts ensure accuracy and help prevent errors.

Why is learning accounting basics important for small businesses?

Learning accounting basics is important for small businesses because it helps owners manage money effectively, handle cash flow, and meet tax obligations on time. It also improves budgeting, prevents financial mistakes, and even supports smarter business decisions.

What are the fundamentals of accounting for beginners?

The basic accounting fundamentals are accurate record-keeping, applying double-entry, and preparing financial statements. These practices help beginners understand how money flows in a business.

What is the difference between accounting basics and bookkeeping?

Bookkeeping and accounting basics are related but different. Bookkeeping focuses on recording daily transactions, such as sales, purchases, and expenses, in an organised system. Accounting basics, on the other hand, go beyond recording to include financial analysis, reporting, and applying principles. Together, they provide complete financial clarity.

Disclaimer: This blog is for educational purposes only and does not constitute financial or tax advice. For tailored guidance, please consult Orbit Accountants or your professional advisor.