Bookkeeping Services in Halifax, NS — For Businesses & Nonprofits

If you’re a Halifax small-to-mid-size business or nonprofit, you need books you can trust—without month-end slippage or surprise bills. Orbit delivers cloud bookkeeping for Halifax and HRM: HST (15%), payroll, clean reconciliations, and audit-ready files—every month.

An Accounting Firm you can rely on!

0 %

Late Filings

<6 hours

Email Response

100%

Fixed Fee

<10 days

Month End Close

Meet the Founders

Sophie Dillon, CPA,CA

Co-founder

At Orbit, we’ve built a practice that’s grounded in clarity, care, and consistency. From onboarding to ongoing support, our focus is always on making accounting feel less like a burden and more like a growth tool. We’re here to simplify the process, not complicate it.

Malay Matalia

Co-founder

Orbit was born out of a simple idea: organizations should have access to timely, accurate books and clear, transparent pricing. As clients grow and expand globally, our job is to keep their finances grounded with smart systems and proactive support, every step of the way.

What Makes Orbit the Best Accountant for non-profits?

As a non-profit organization, your focus should be on fulfilling your mission, not managing finances. At Orbit Accountants, we offer specialized bookkeeping for non-profit organizations tailored to non-profits. From tracking donations and expenses to ensuring tax compliance, we handle the financial details, so you can concentrate on making an impact.

Quick Answers

Why Halifax SMBs choose Orbit

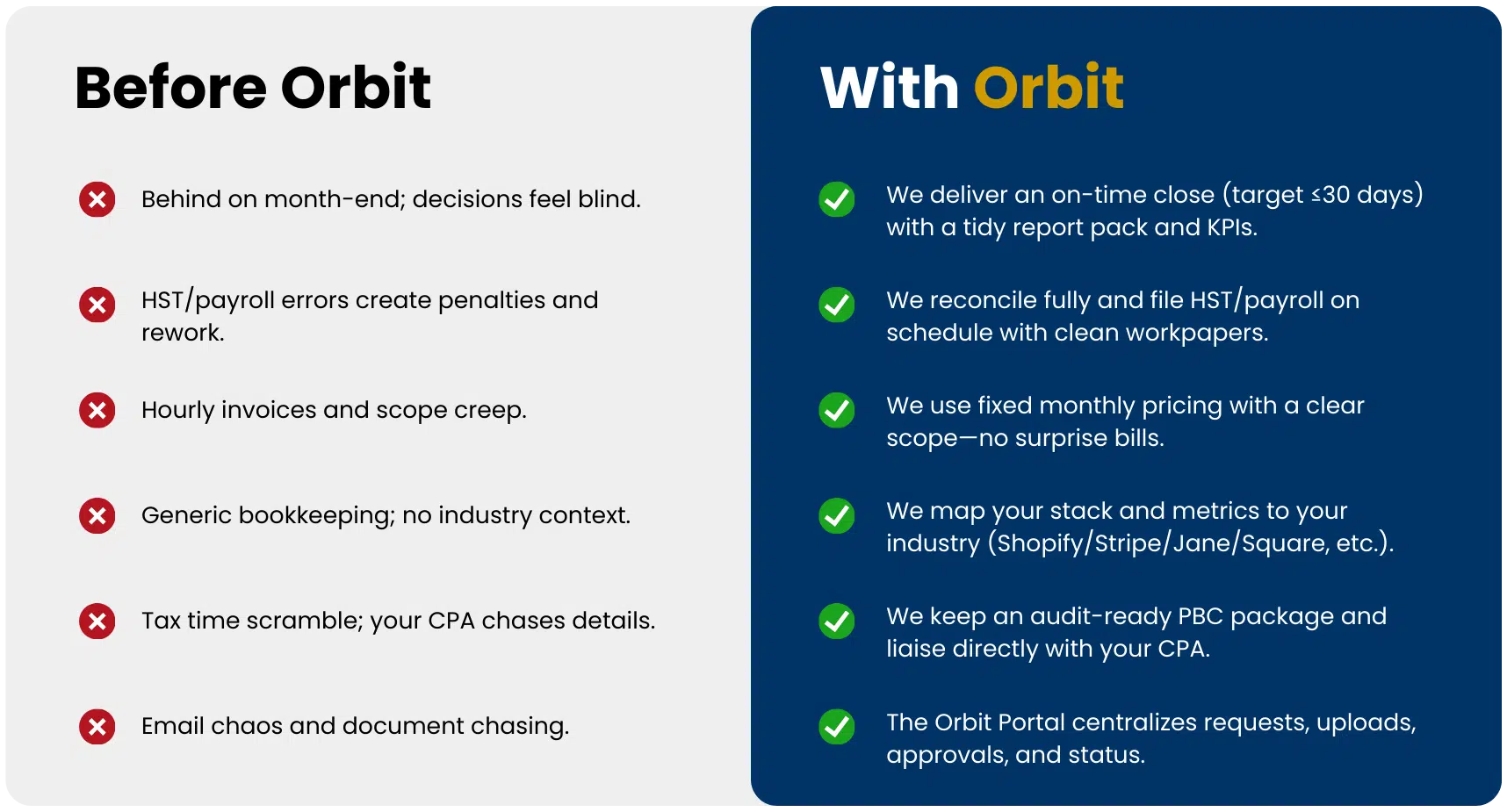

Orbit VS Others

| Need | Orbit | Others |

| Timely month-end | Close within ~30 days, with KPIs and commentary | Variable; often slips to 45–60+ days |

| Accuracy & audit-readiness | Full reconciliations, roll-forwards, HST/PST workpapers, PBC pack | Basic GL entries; limited documentation |

| Pricing model | Fixed monthly fees; no surprise hours | Hourly; scope creep and bill-shock |

| Industry context | Sector-specific charts of accounts & KPIs | Generic bookkeeping, little domain nuance |

| Advisory (light CFO) | Cash-flow forecasts, budget vs. actuals, KPI dashboards | Minimal analytics; bookkeeping only |

| Portal & comms | Orbit Portal for uploads, approvals, request tracking | Email threads & spreadsheets |

| Tooling | QBO/Xero + Dext/Hubdoc; Shopify/Stripe/Jane integrations | Limited integrations or manual imports |

| Payroll & remittances | Wagepoint/Gusto/ADP setup + on-time remittances | Manual processes, risk of penalties |

| Year-end handoff | Tidy CPA handoff; we liaise with your tax accountant | Client manages back-and-forth |

| Scalability | Packages that grow with you (add locations/programs) | Rebuilds needed as complexity increases |

How Orbit Works with Your Halifax Business

1. Kickoff chat

30–45 minutes to learn your model—revenue streams, programs/locations, entities—and confirm deadlines (HST, payroll, board cadence)

2. Scope & price (fixed fee)

Clear deliverables and timelines. If cleanup is required, we scope it first, then lock in your monthly cadence.

3. Portal onboard

Secure Orbit Portal access with a checklist: prior-year TB, bank/credit statements, payroll files, and app connections.

4. Connect your stack

QBO or Xero + Dext/Hubdoc. We connect Shopify/Stripe/Jane/Square/Helcim, map HST codes and payroll GLs, and set reliable bank feeds.

5. Clean the books

Reconcile accounts, fix historical coding, rebuild the chart of accounts for your industry, and set opening balances.

6. Close in ≤30 days

Bank/CC/loan reconciliations, AR/AP review, payroll entries, accruals/deferrals, ongoing HST tracking—QA before publish.

7. KPIs & insights

P&L, Balance Sheet, Cash snapshot plus KPIs (cash, gross margin, runway, AR/AP aging). We flag exceptions and next actions.

8. Year-end ready

Tidy PBC workpapers and liaison with your CPA/auditor. Need more? Add light CFO support as you scale.

The Orbit Portal – no more document chasing

What You Get Each Month

Every Halifax client gets a consistent package—delivered on time, with no surprises:

- Financials: P&L, Balance Sheet & Cash snapshot—accurate, reconciled, management-grade.

- Reconciliations: Bank, credit card & loan—every account tied out, exceptions flagged.

- AR & AP aging: Who owes you, who you owe, with overdue balances highlighted.

- Payroll & source deductions check: Entries reconciled to remittances.

- HST (15%) workpapers: Filings prepared with supporting schedules.

- KPIs dashboard: Cash runway, gross margin, AR/AP trends, program/channel metrics.

- Exceptions list: Short, plain-English notes of what needs your review.

- Orbit Portal delivery: Reports, workpapers, and action items in one secure place.

You see exactly where the month stands, within ≤30 days—no guesswork, no messy year-end surprises.

Industries we serve in Halifax

- Tech & SaaS

- Non-profits & charities

- Healthcare & wellness (clinics, physio, chiro, spa, yoga)

- Restaurants & cafés

- Retail & e-commerce

- Psychology & mental health

- Realtors

- Management consultants

- Marketing/creative agencies

- Legal & professional services

- Construction & trades

- Manufacturing/light industrial

- Hospitality

- Education providers

- Crypto & digital assets.

- No weapons or cannabis.

Proof Halifax businesses can trust

Packages & pricing

Choose a plan that matches your stage. Upgrade anytime as you grow.