Table of Contents

Why Incorporate in Canada?

Many Canadians begin as sole proprietors because it’s quick and simple. For example, a sole proprietorship in BC Canada requires little more than registration and reporting income on your personal return. But simplicity comes at a cost: you’re personally liable for debts and taxed on every dollar you earn.

By contrast, when you incorporate, you form a corporation small business that becomes its own legal entity. This change—called becoming “incorporated”—shifts how taxes, liability, and ownership work. The incorporated meaning is straightforward: your company is no longer you. It can own assets, sign contracts, and limit personal exposure.

The tax benefits for small business are powerful. A Canadian-controlled private corporation (CCPC) enjoys the reduced Canada corporate tax rate on active income up to $500,000, leaving more after-tax profit inside the company to reinvest and grow.

The Tax Math: Sole Proprietorship vs. Corporation

This difference is why owners often move from sole proprietorship to incorporation once profits rise—they want more control over corporate corporations and how money is taxed.

Are you confident your business tax filings are fully optimized and compliant?

How the Small Business Rate Works

A corporation small business that qualifies as a CCPC can access the tax benefits for small business via the small business deduction. The Canada corporate tax rate federally is just 9% on the first $500,000 of active income, plus the provincial rate.

But watch for traps:

- Passive income grind reduces your small-business limit if corporate investment income exceeds $50,000.

- Growth may require restructuring—sometimes even becoming re-incorporated in another jurisdiction for expansion or compliance reasons.

Paying Yourself: Salary, Dividends, and a Mix

One of the biggest advantages of incorporating is control over how you pay yourself. You can choose salary, dividends, or a mix—each with different tax and planning outcomes.

- Salary – Deductible to the corporation, creates RRSP room, builds CPP.

- Dividends – Paid from after-tax profits, no CPP or RRSP room, sometimes more tax efficient.

- Mix – Combine both to balance RRSP goals with lower personal tax.

- Family pay – Reasonable wages are allowed, but dividends to family may trigger TOSI rules.

Using a Corporation to Grow Wealth

Retained corporate earnings can fund:

- Business reinvestment

- Real estate acquisitions

- Investment portfolios (careful with passive income grind)

Capital growth also comes into play when selling. Canada taxes capital gains at a 50% inclusion rate—sometimes referred to as the corporate gains tax. But the Lifetime Capital Gains Exemption (LCGE) lets owners of qualified small business corporation shares shield up to $1.25 million in gains, reducing or even eliminating the tax on a successful exit.

Professional Corporations

For regulated fields like doctors, dentists, lawyers, and engineers, a professional corporation offers tax advantages and flexibility, while following provincial rules.

- Tax benefits – Access to small business deduction and lower Canada corporate tax rate.

- Earnings – Retain profits in the company for investments or future planning.

- Limits – Professional liability (e.g., malpractice) remains personal.

- Ownership rules – Provinces may restrict shareholding to licensed professionals or allow family shares.

- Planning tool – Useful for retirement savings, insurance, or holding company setups.

Common Traps to Avoid

- Mixing personal and corporate accounts—your corporate corp must be kept separate.

- Forgetting that passive investment income can impact your corporation small business rate.

- Not planning ahead for the LCGE rules when structuring your corporate corporations.

Step-by-Step: How to Incorporate

- Decide between federal incorporation or provincial (e.g., BC for a sole proprietorship upgrade).

- Name your business or go with a numbered company.

- File Articles of Incorporation.

- Draft a share structure flexible enough for future investors or family trusts.

- Register for a Business Number and HST/GST.

- Keep corporate records to avoid future issues.

If your growth expands across Canada, you may need to re incorporate federally or extra-provincially.

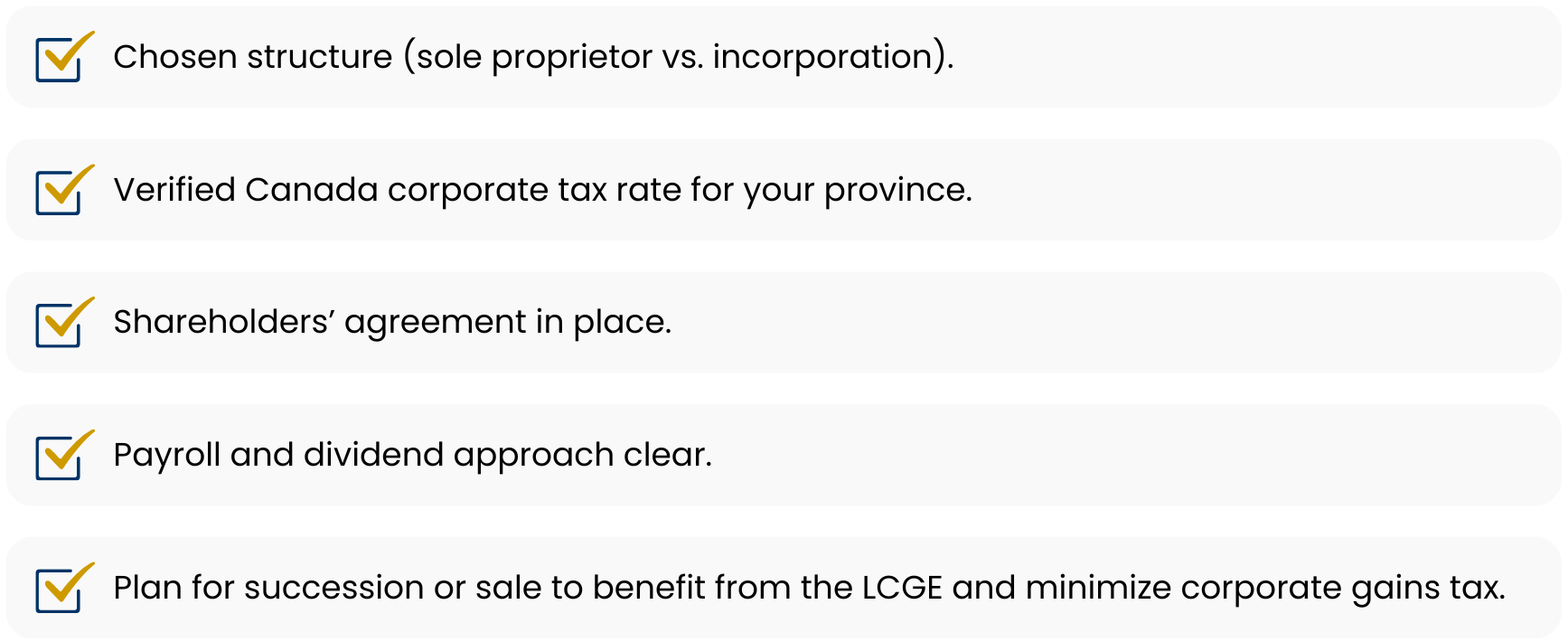

Quick Checklist Before You File

Conclusion and Next Steps

Switching from a sole proprietorship in BC Canada or any other province to a corporation small business can deliver meaningful tax benefits for small business, liability protection, and long-term wealth opportunities.

Whether you want to reinvest profits, build real estate holdings, or plan for a tax-efficient exit, incorporation gives Canadian entrepreneurs flexibility. And with Orbit’s guidance, you don’t just get incorporated—you get structured for growth.

Frequently Asked Questions

Is incorporation always better than a sole proprietorship?

Not always. If profits are low and you need all cash personally, the tax deferral advantage is limited.

What’s the difference between federal incorporation and provincial incorporation?

Federal offers nationwide name protection; provincial is simpler if you operate in one place.

Can I hire my spouse or adult child and split income?

Yes, if wages are reasonable for real work. Otherwise, TOSI rules apply.

How does the $1.25M LCGE work?

It shelters gains on qualifying small business shares, but tests must be met—plan early.

Can my corporation buy real estate or investments?

Yes, but passive income above $50k may reduce your small business limit.

What does “incorporated” actually mean?

It means your business is a separate legal entity that can own assets, sign contracts, and issue shares.

Is there a corporate gains tax in Canada?

Capital gains are taxed at a 50% inclusion rate, with special relief through the LCGE.

Do I need a shareholders’ agreement if I’m the only owner?

It’s still useful for banks and future investors.

What records do I keep after incorporation?

Minute books, share registers, and financial statements are essential.

Legal Disclaimer

This article is provided by Orbit Accountants for general information only and does not constitute tax, legal, or accounting advice. Rules can vary by province and change over time. For guidance specific to your situation, consult directly with Orbit Accountants. Reading this content does not create a client relationship with Orbit. Orbit specializes in helping Canadian business owners with incorporation, tax planning, and bookkeeping—so you can focus on growing your business while we take care of the numbers.