Table of Contents

What Is AI in Accounting?

AI in accounting refers to the integration of artificial intelligence (AI) technologies into financial workflows to enhance speed, accuracy, and decision-making. These tools leverage machine learning, data analytics, and language models to simplify complex tasks such as transaction categorization, bank reconciliation, and financial reporting.

Accounting AI is not futuristic anymore. It’s here, it’s practical, and it’s reshaping how accounting teams across the globe work.

Are you currently managing your bookkeeping in-house?

Why AI Is Revolutionizing the Accounting Industry

The accounting industry has long been bogged down by repetitive processes, tight reporting deadlines, and pressure for perfect accuracy. Artificial intelligence AI is turning that around.

With the help of AI, accounting teams are now:

- Closing books faster

- Reducing compliance errors

- Delivering real-time insights

- Taking on more clients with fewer resources

And all of this is done while significantly cutting down on costs.

AI doesn’t just make things faster—it makes accountants more strategic, allowing them to focus on advisory roles and value-added insights instead of raw data entry.

The Core Technologies Behind Accounting AI

Behind every good AI-driven accounting tool are a few core technologies that make the magic happen:

- Machine Learning: Learns patterns in data, like vendor codes or recurring expense categories.

- Natural Language Processing (NLP): Powers chatbots or auto-generated narratives in financial reporting.

- Optical Character Recognition (OCR): Reads receipts, invoices, and documents.

- RPA (Robotic Process Automation): Executes rule-based tasks like file uploads or form population.

These technologies work behind the scenes to automate routine tasks that would otherwise consume hours.

QuickBooks Artificial Intelligence: A Real-World Game Changer

QuickBooks artificial intelligence is often the first exposure many small firms get to AI. Its built-in features are a game-changer:

- Receipt Capture: Converts photos of receipts into ledger entries.

- Smart Categorization: Learns your habits and improves over time.

- Cash Flow Projections: Predicts future trends based on historical patterns.

QuickBooks AI doesn’t just automate—it learns. That’s the power of embedded artificial intelligence in user-friendly platforms.

How GPT and Language Models Are Assisting Accountants

Generative AI models—like GPT—are transforming how accountants interpret, report, and communicate financial information.

Here’s what an accounting GPT can help with:

- Drafting executive financial summaries

- Responding to internal client queries

- Translating complex data into plain English

Imagine asking, “Why did profits dip in Q2?” and getting an instant answer based on your ledger data. That’s the power of AI in accounting.

Financial Reporting, Reimagined With AI

AI eliminates reporting fatigue. No more 50-tab Excel files or delayed closings. With AI:

- Reports are generated automatically

- Data flows from multiple systems into one place

- Accuracy improves, especially when integrated across ledgers

This transforms financial reporting from a back-office bottleneck into a real-time decision tool.

AI-Enhanced Bookkeeping: Reducing Human Error and Saving Time

Bookkeeping is where many firms start their AI journey. The results speak volumes:

- Auto-posting: Bank feeds post directly with correct tags

- Pattern recognition: Flags unusual transactions instantly

- Fewer errors: Less manual entry = fewer mistakes

The accounting team can now spend less time reviewing and more time optimizing.

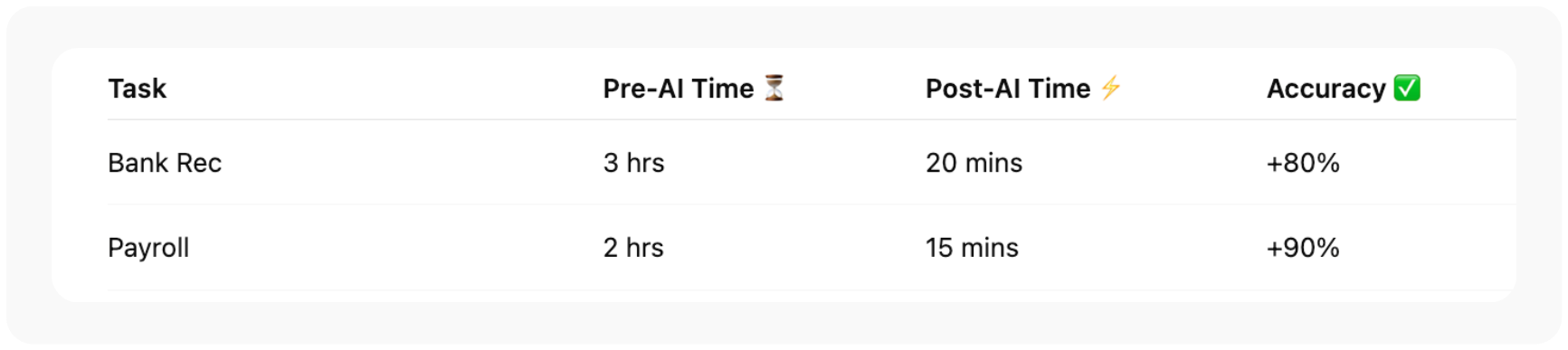

Automate Routine Tasks: From Tedious to Effortless

Routine tasks are time thieves. AI helps automate:

This time saved allows accounting teams to focus on strategic planning and growth.

AI’s Role in Fraud Detection and Real-Time Compliance

One of the least talked-about—but most valuable—benefits of AI is fraud detection.

Artificial intelligence AI platforms scan massive transaction volumes and flag:

- Duplicate payments

- Suspicious vendors

- Odd timing patterns (e.g., late-night transfers)

Compliance becomes proactive, not reactive.

Better Forecasting and Predictive Insights

Forecasting with spreadsheets is outdated. AI-based tools provide:

- Real-time forecasting with rolling updates

- Visual cash flow projections

- Alerts before hitting financial thresholds

AI doesn’t just predict—it guides decisions.

Strategic Decision-Making Backed by AI

When integrated into financial systems, AI becomes a powerful tool for strategic planning:

- Analyze gross margins per product or client

- Run best-case/worst-case scenarios

- Determine optimal tax timing strategies

This elevates accountants into the role of business strategists.

Implementation Hurdles and How to Overcome Them

Even the best technology faces resistance. Common AI adoption hurdles include:

- Fear of job loss

- Budget concerns

- Change management challenges

Solutions:

- Start small (automate one task)

- Highlight team wins

- Offer training and support

AI doesn’t replace people—it augments them.

What AI Means for the Modern Accounting Team

With AI, the accounting team evolves:

- Junior staff spend less time on grunt work

- Seniors become more analytical

- Partners shift into strategic advisory roles

AI amplifies human value—it doesn’t diminish it.

How Integrated AI Systems Are Changing Financial Management

Integrated AI breaks down silos. It connects:

- Accounting systems

- CRM platforms

- Inventory data

- Tax software

One data set, endless insights. Accounting teams gain a holistic view of business performance.

What the Future Looks Like for AI in Accounting

Looking ahead, expect:

- Real-time audits

- AI assistants for every accountant

- Seamless compliance with changing tax laws

The accounting industry is no longer reactive. It’s responsive, agile, and predictive—with AI leading the charge.

The Small Firm Advantage: Getting Started with AI

You don’t need a big budget to begin.

- Start with free or low-cost tools (e.g., QuickBooks AI)

- Identify a repetitive task to automate

- Train your team and document the gains

Over time, you’ll see increased capacity, better client service, and reduced stress.

Conclusion: Why AI Is a Powerful Tool for Every Accountant

The message is clear: AI is not just a tech trend—it’s a necessary leap for any accounting team wanting to stay competitive.

It improves accuracy, saves time, cuts costs, and empowers professionals to do their best work. With tools like QuickBooks artificial intelligence and accounting GPT assistants, the shift is already underway.

Smart firms aren’t asking whether to adopt AI. They’re asking: where do we start?

The real power of artificial intelligence AI lies in its adaptability. Whether you’re a solo accountant managing a handful of clients or a midsize firm scaling operations, AI offers tools that flex with your needs. You can start small—automate your invoice capture or expense categorization—and gradually implement more advanced capabilities like cash flow forecasting and risk analytics.

In the long run, firms that embrace AI will gain a distinct edge. They’ll respond to client questions faster, deliver sharper financial insights, and operate with a level of precision and efficiency that’s impossible with manual-only systems. AI doesn’t eliminate the need for good accountants—it makes good accountants great.

By making AI part of your firm’s DNA today, you’re preparing for a smarter, more strategic, and more scalable tomorrow.

Frequently Asked Questions

What are examples of AI in accounting today?

OCR invoice scanning, smart categorization, cash flow forecasting, and fraud detection tools.

Will AI eliminate accounting jobs?

No. It transforms roles and frees teams from manual work, allowing them to focus on analysis and strategy.

What is accounting GPT?

A generative language model trained to read, explain, and generate financial content, reports, or answers.

Is QuickBooks using AI now?

Yes. QuickBooks artificial intelligence features include smart tagging, auto-categorization, and predictive insights.

How can small firms afford to implement AI?

Start with free or included tools in your existing software, measure ROI, and scale slowly.

How does AI improve financial reporting?

AI tools reduce reporting lag by automatically generating reports, consolidating data from different systems, and identifying inconsistencies before submission.

Are AI tools secure for sensitive accounting data?

Most reputable AI tools offer encryption, user access controls, and audit logs to maintain data integrity and confidentiality.

Can AI help with tax preparation?

Yes. AI can analyze past filings, flag missing documents, and even suggest deductions based on transaction history.

What are some common challenges when adopting AI?

Data quality, team training, cost concerns, and integration with legacy systems are typical hurdles.

How can AI support compliance efforts?

AI can monitor transactions in real-time for red flags, provide documentation trails, and keep systems aligned with changing regulatory frameworks.

Disclaimer

This article is for informational purposes only and should not be interpreted as professional accounting, legal, or financial advice. Consult a certified professional before implementing any AI solution in your practice.