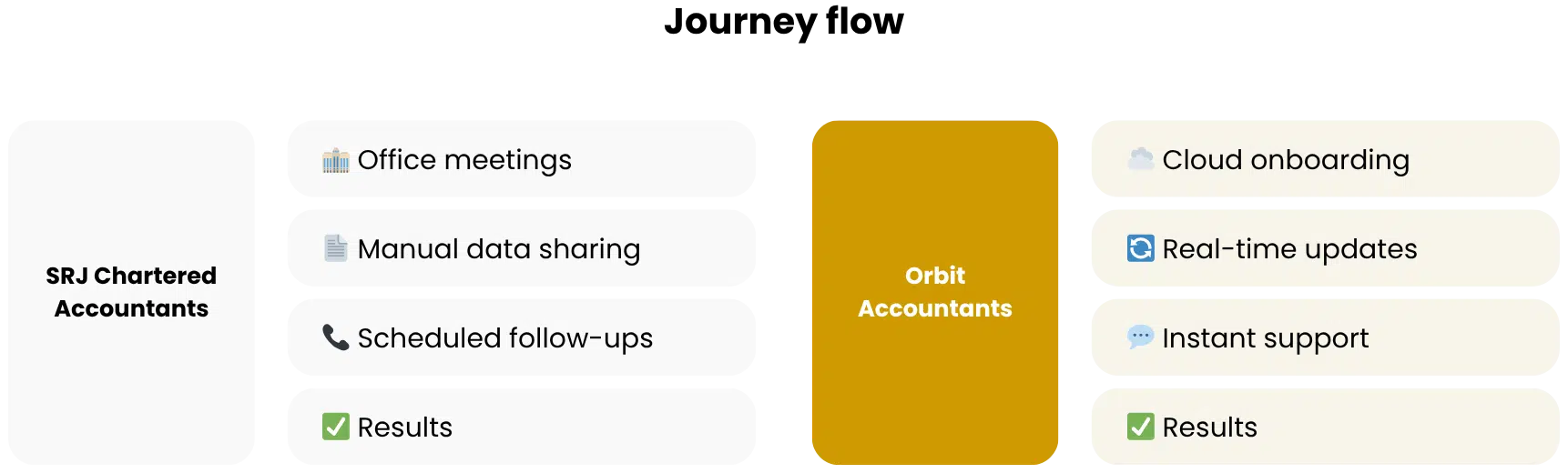

When small business owners or professionals in Canada start evaluating accounting partners, SRJ Chartered Accountants (SRJCA) often comes up — a well-known CPA firm with broad tax and assurance expertise. Orbit Accountants, meanwhile, represents the new breed of modern accounting: responsive, cloud-based, and built for efficiency.

Both firms deliver professional results. The difference lies in how they deliver them — speed, communication, pricing transparency, and client experience.

Table of Contents

SRJ Chartered Accountants: Strengths and Realities

What SRJCA does well

- Established CPA firm with offices in the Toronto area, offering corporate tax, bookkeeping, SR&ED, valuations, and assurance work.

- Full-spectrum capabilities for both individuals and small to medium-sized businesses.

- Familiarity with regulated industries, cross-border tax, and complex filings — all handled in-house by qualified professionals.

Where clients report challenges

While SRJCA’s technical capabilities are recognized, public reviews over several years show recurring service themes:

- Slow response times: Some clients reported delayed email replies, unreturned calls, or missed follow-ups.

- Communication gaps: Several mentioned unclear scheduling or not knowing who their primary accountant was after onboarding.

- Inconsistent handoffs: Clients described turnover or being routed to new team members mid-project without clear continuity.

- Variable service experience: For some, response quality depended heavily on the assigned accountant or partner.

These don’t negate SRJCA’s strengths — they’re common friction points in traditional CPA environments managing high client volume and layered team structures.

Are you currently managing your bookkeeping in-house?

Orbit Accountants: Full-Service Expertise, Modern Delivery

Orbit Accountants offers the same professional depth — corporate tax, bookkeeping, payroll, and advisory — but reengineered around responsiveness, transparency, and proactive planning.

Here’s how that looks in practice:

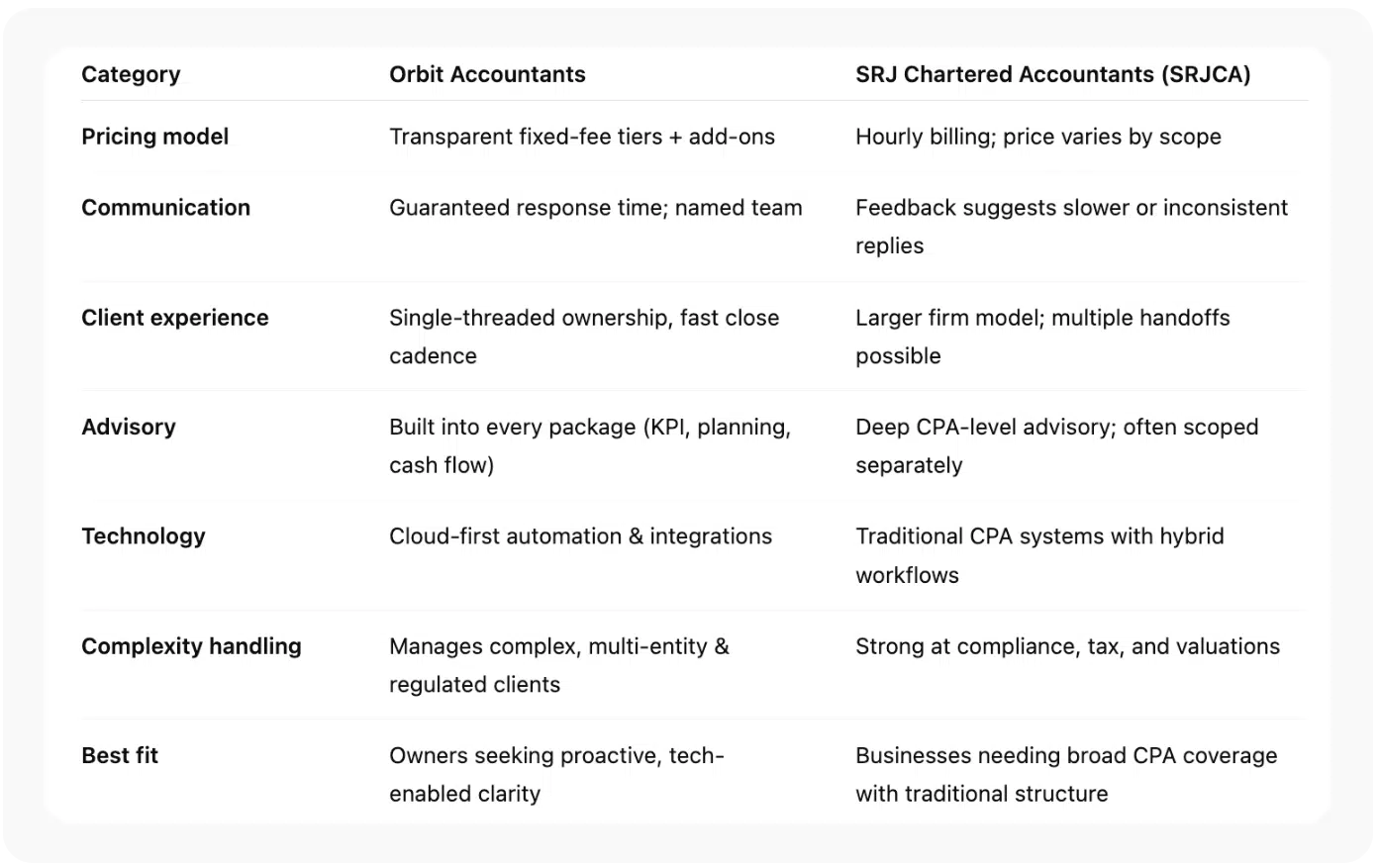

1. Fixed pricing and transparency

Orbit uses published pricing tiers instead of open-ended hourly billing. Each plan defines deliverables: bookkeeping frequency, tax filings, payroll, and advisory touchpoints. This gives clients cost predictability, avoids billing surprises, and simplifies decision-making.

For growing firms or professionals, that clarity can be the difference between financial control and ongoing guesswork.

2. A named team and guaranteed communication

Every Orbit client gets a dedicated bookkeeper and support team — not a rotating contact list. Communication standards are formalized: response times within hours, month-end close deadlines under 10 days, and escalation channels if needed.

This structure prevents the very issues some SRJCA reviewers describe, like waiting days for callbacks or losing contact mid-project.

3. Advisory that runs year-round

Orbit blends advisory and planning directly into the monthly cadence — offering quarterly reviews, cash flow forecasts, and KPI dashboards alongside bookkeeping and tax.

That means you’re not just getting books for compliance; you’re getting insights to drive better business decisions.

4. Capability for complex work

Orbit’s services extend beyond routine bookkeeping. The firm handles multi-entity structures, cross-border operations, regulated professionals, and inventory-heavy businesses. The key difference: Orbit delivers this complexity through a cloud-based, responsive model that avoids the bureaucracy of traditional firms.

5. Cloud-native automation

Orbit’s workflows integrate seamlessly with modern software stacks (QuickBooks, Xero, Stripe, Shopify, Gusto, and others).

Automations handle reconciliations, payroll syncs, and tax filings — giving you accurate data, faster closes, and fewer manual steps.

Orbit vs. SRJCA at a Glance

Both deliver professional quality — but Orbit’s focus on responsiveness, pricing transparency, and integrated advisory creates a smoother, more modern client experience.

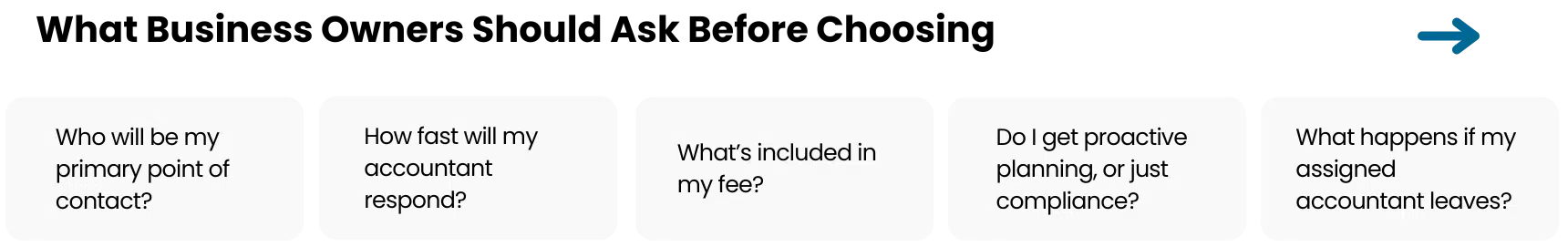

What Business Owners Should Ask Before Choosing

-

Who will be my primary point of contact?

Orbit guarantees named ownership; SRJCA may assign multiple staff depending on scope.

-

How fast will my accountant respond?

Orbit formalizes SLAs; larger firms may vary by workload and season.

-

What’s included in my fee?

Orbit’s public pricing outlines inclusions and add-ons clearly; SRJCA pricing may differ by engagement type.

-

Do I get proactive planning, or just compliance?

Orbit’s rhythm includes quarterly check-ins; traditional firms may focus on year-end filings.

-

What happens if my assigned accountant leaves?

Orbit’s team model ensures continuity; larger CPA structures may reassign accounts.

When Each Firm Makes Sense

- SRJCA is a great fit if your business demands traditional CPA assurance, such as audits, valuations, or intricate tax structures. Their experience and credibility make them well-suited for regulated industries and long-standing corporations.

- Orbit Accountants fits businesses that value real-time insight, clear pricing, and predictable delivery. Whether you’re a startup, consultant, or multi-entity company, Orbit combines CPA-grade skill with modern execution, making it an equally strong choice for advanced accounting scenarios.

Final Take

Both Orbit and SRJ Chartered Accountants bring professionalism, integrity, and strong accounting foundations. The key difference is the experience you’ll have as a client.

SRJCA offers depth and history — ideal for companies needing full CPA assurance or one-time complex filings. Orbit offers clarity, speed, and consistent communication, blending modern technology with accountant expertise.

If you value proactive service, transparent pricing, and a partner that scales with your growth, Orbit Accountants is built for your rhythm — not the other way around.

Legal & Ethics Disclaimer: This article is provided by Orbit Accountants for general informational purposes only. It does not constitute tax, legal, or accounting advice and should not be relied upon as such. All information is based on publicly available data and general market insights. Orbit Accountants makes no guarantee regarding the completeness or accuracy of third-party information or client feedback.

References to SRJ Chartered Accountants are for comparative context only. Orbit Accountants is not affiliated with SRJCA or any other company mentioned. Trademarks, names, and logos remain the property of their respective owners. Readers should independently confirm pricing, services, and terms before engaging any provider.

For personalized guidance, contact Orbit Accountants directly.