When choosing an accounting partner, it’s not just about who files your taxes — it’s about how the firm communicates, follows through, and supports your growth.

GTA Accounting and Orbit Accountants both serve Canadian businesses with professional bookkeeping, tax, and advisory services. GTA brings CPA depth and years of market presence, while Orbit delivers a cloud-native model built for responsiveness, fixed pricing, and hands-on support.

Here’s how the two compare — fairly, transparently, and with insights from real client experiences.

Table of Contents

GTA Accounting: Strengths and Boundaries

Where GTA Accounting excels

- A full-service CPA firm covering corporate and personal tax, bookkeeping, payroll, and cross-border filings.

- Offers specialty services like SR&ED, audit representation, and international taxation.

- Strong brand awareness across Toronto and nationwide — trusted for technical tax depth and regulatory compliance.

Common pain points mentioned by clients

Public feedback from multiple review platforms reflects recurring themes worth noting:

- Follow-up delays: Some clients mention waiting days or weeks for responses or call-backs after onboarding.

- Handoffs between staff: Work occasionally passed from one accountant to another without full context, leading to confusion.

- Inconsistent accuracy: A few reviewers describe missing documents, return errors, or revisions requiring re-filing.

- Transparency concerns: Several clients highlight unclear billing or add-on charges not discussed upfront.

To GTA’s credit, such challenges are not unusual in larger, multi-tiered CPA practices managing thousands of files. But for smaller or fast-moving businesses, responsiveness and predictability can be critical.

Are you currently managing your bookkeeping in-house?

Orbit Accountants: The Modern, Full-Service Alternative

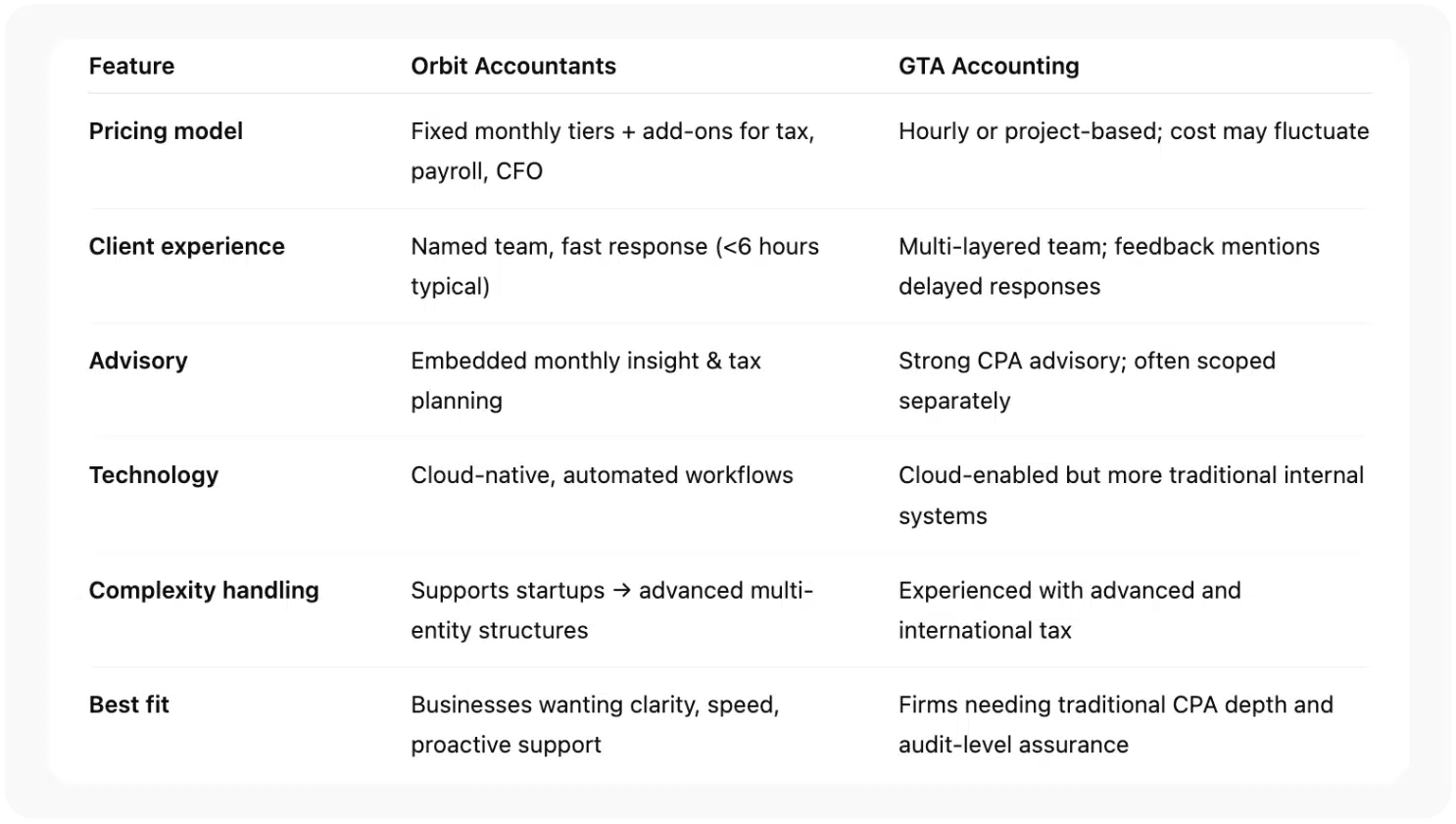

Orbit Accountants combines CPA expertise with the structure and consistency of a tech-enabled firm. Rather than hourly billing or opaque scoping, Orbit’s approach focuses on clarity, dedicated teams, and measurable outcomes.

1. Predictable pricing and clear scope

Orbit publishes transparent pricing tiers — from starter bookkeeping to full advisory bundles — so business owners always know their costs. Packages include bookkeeping, payroll, tax filing, and year-round tax planning. Add-ons like catch-up bookkeeping and fractional CFO support scale as needed.

This eliminates guesswork and keeps budgeting stable, even as your complexity grows.

2. Dedicated team, real accountability

Every Orbit client has a named lead accountant and small supporting team — not a rotating roster. You know who’s working your books, and you know when to expect updates.

With standard response windows and a defined monthly close process, you won’t be chasing replies or wondering if something slipped through the cracks.

3. Advisory built into operations

Orbit integrates financial advice directly into your monthly cadence. Clients receive practical insight on cash flow, KPIs, hiring runway, and pricing margins — not just compliance.

This makes Orbit an operational partner, not just a tax preparer.

4. Capable of handling advanced and complex needs

While Orbit is known for helping startups, e-commerce firms, and professional practices, it also supports multi-entity businesses, cross-border structures, inventory-heavy operations, and regulated industries.

Complex bookkeeping or planning work doesn’t have to mean choosing a legacy CPA firm — Orbit combines deep accounting skill with modern execution.

5. Cloud-first systems and automation

Orbit’s workflows are fully digital, with integrations across payroll, banking, and sales platforms. Automation speeds up reconciliation and reduces human error.

That means faster closes, cleaner data, and fewer manual touchpoints — especially useful for growth-stage firms managing multiple channels.

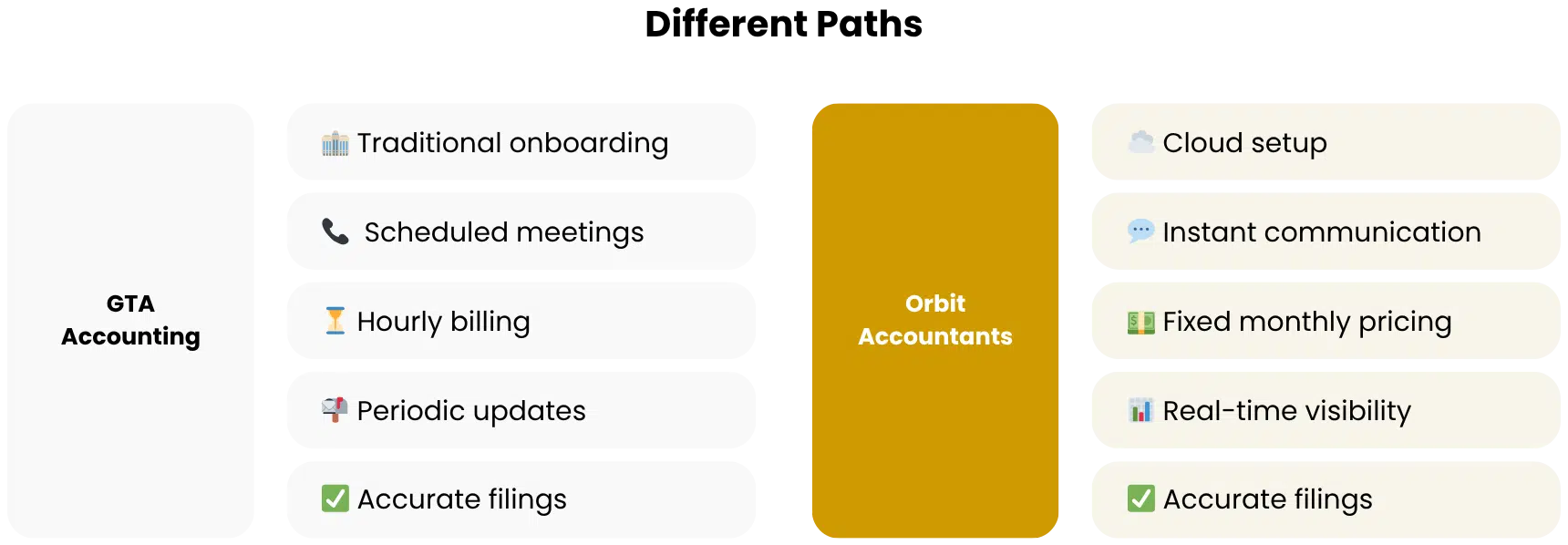

Side-by-Side Comparison

Both firms deliver quality accounting — the difference lies in how they deliver it.

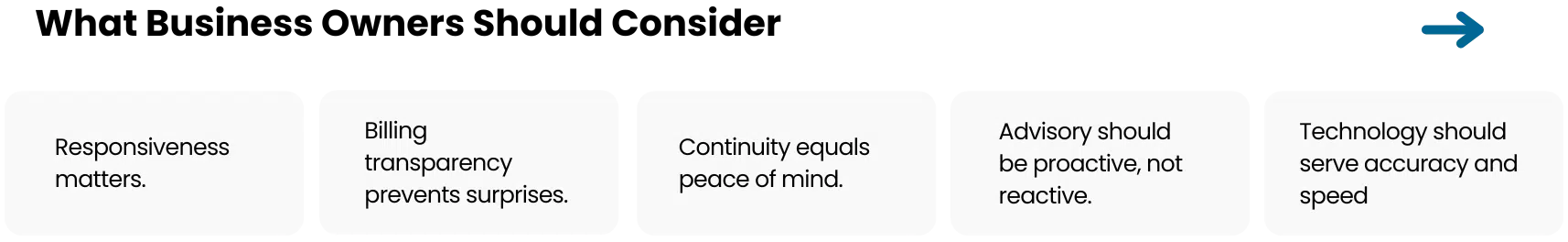

What Business Owners Should Consider

-

Responsiveness matters.

If you’ve ever waited days for an email back or had your accountant change mid-project, you know how disruptive that can be. Orbit’s dedicated team and guaranteed reply windows reduce that stress.

-

Billing transparency prevents surprises.

GTA Accounting follows a classic engagement model — fair for complex one-offs but less predictable for ongoing bookkeeping. Orbit’s pricing tiers eliminate variable hourly billing.

-

Continuity equals peace of mind.

Orbit’s single-threaded ownership means fewer handoffs and better context retention. If staff changes, your account stays on schedule.

-

Advisory should be proactive, not reactive.

Both firms offer strategic advice, but Orbit builds that directly into its monthly deliverables, not as an upsell.

-

Technology should serve accuracy and speed.

Orbit’s automation reduces risk and manual lag, while maintaining CPA-grade accuracy and review oversight.

Who Each Firm Serves Best

- GTA Accounting remains a good fit for established companies seeking deep CPA infrastructure or specialized advisory (e.g., audits, complex cross-border taxation).

- Orbit Accountants is ideal for small to mid-size businesses — and even complex organizations — that value speed, accountability, and predictable partnership. Whether you’re a consultant, medical practice, e-commerce brand, or multi-entity enterprise, Orbit provides scalable support without losing personal touch.

Final Take

Both Orbit and GTA Accounting can manage your books and filings — but how they manage your experience is where the difference lies.

GTA Accounting provides strong CPA heritage and tax depth. Orbit brings that same technical capability into a modern, transparent, and highly responsive framework that keeps small and growing businesses in control of their finances — not waiting for them.

If you want predictability, speed, and advisory that grows with you, Orbit Accountants stands out as the more adaptable, future-focused choice.

Legal & Ethics Disclaimer: This article is provided by Orbit Accountants for general informational purposes only. It does not constitute tax, legal, or accounting advice and should not be relied upon as such. All observations are based on publicly available information and general market analysis. Orbit Accountants makes no guarantees regarding the completeness or accuracy of third-party data or reviews.

References to GTA Accounting or any other firms are for comparative context only. Orbit Accountants is not affiliated with these organizations, and all trademarks, logos, or brand names remain the property of their respective owners. Readers should independently verify pricing, scope, and service details before making any business decisions.

For advice tailored to your situation, please contact Orbit Accountants for a consultation.