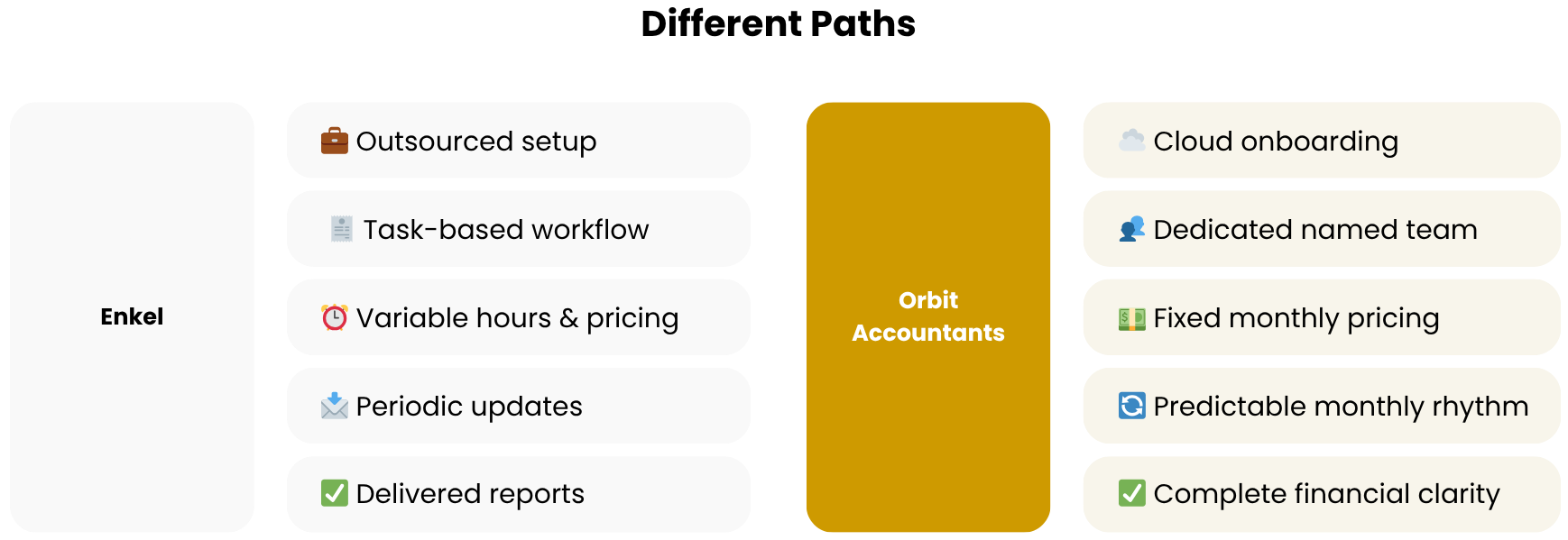

Both Enkel and Orbit Accountants promise modern, cloud-enabled bookkeeping and accounting support. Enkel presents itself as an outsourced back office with bookkeeping, payroll, AR/AP, and fractional controller/CFO offerings. Orbit covers the same ground—plus catch-up, tax, payroll, and planning—delivered through a named team, fixed pricing, and a predictable monthly operating rhythm.

This overview is designed to be fair, acknowledging where Enkel is strong and where owners often ask for more structure—then showing how Orbit addresses those gaps.

Table of Contents

What Enkel is known for

Scope & positioning

Enkel markets a tech-enabled, outsourced back office: bookkeeping, payroll, AR/AP, financial reporting, and controller/CFO services, delivered remotely with cloud tools. Their site highlights modern workflows, integrations, and process standardization across solutions and packages (see links below).

Where customers say Enkel shines

- Cloud-first execution: Clients often praise the tech stack and paperless workflows.

- Accurate reporting: Several reviews acknowledge quality reports when delivered.

- Time savings: Outsourcing recurring finance tasks frees teams to focus on operations.

What customers say could be better (common public-review themes)

- Reliability & follow-up: Reports of recurring issues or delays after feedback had been shared.

- Responsiveness: Difficulty reaching the right person or getting timely callbacks.

- Timeliness: “Accurate but late” reporting; payroll errors cited as a reason to switch.

These patterns don’t invalidate Enkel’s strengths; they’re simply useful context when you’re scoping expectations and service-level commitments.

Are you currently managing your bookkeeping in-house?

Orbit’s model: designed to avoid the usual pain points

1) Fixed pricing you can plan around

Orbit publishes package pricing for bookkeeping with add-ons (payroll, tax, catch-up, fractional CFO). You know what’s included up front, and any extra scope is agreed before work begins. That predictability reduces invoice surprises and helps owners budget the full year with confidence.

2) Named team + response standards

Every client gets a dedicated lead and a small team that knows your stack. Orbit sets reply-time expectations and a calendarized close (e.g., <10-day month-end) so you’re not chasing updates or wondering who has the ball.

3) Advisory built into the month

Beyond compliance, Orbit’s rhythm includes KPIs, budget-vs-actuals, cash timing, and tax planning—so decisions about pricing, hiring, and spend are made on fresh numbers, not year-end hindsight.

4) Catch-up & migration—without the chaos

If you’re behind or switching providers, Orbit runs a structured path: assess → cleanup/catch-up → first close + KPI pack → quarterly planning. Owners get clear timelines and deliverables—not open-ended discovery.

5) Equally comfortable with complexity

Orbit supports multi-entity structures, cross-border needs, inventory-heavy and e-commerce workflows, and regulated professions. You don’t need a legacy firm to handle advanced scenarios; you need discipline, ownership, and clean execution.

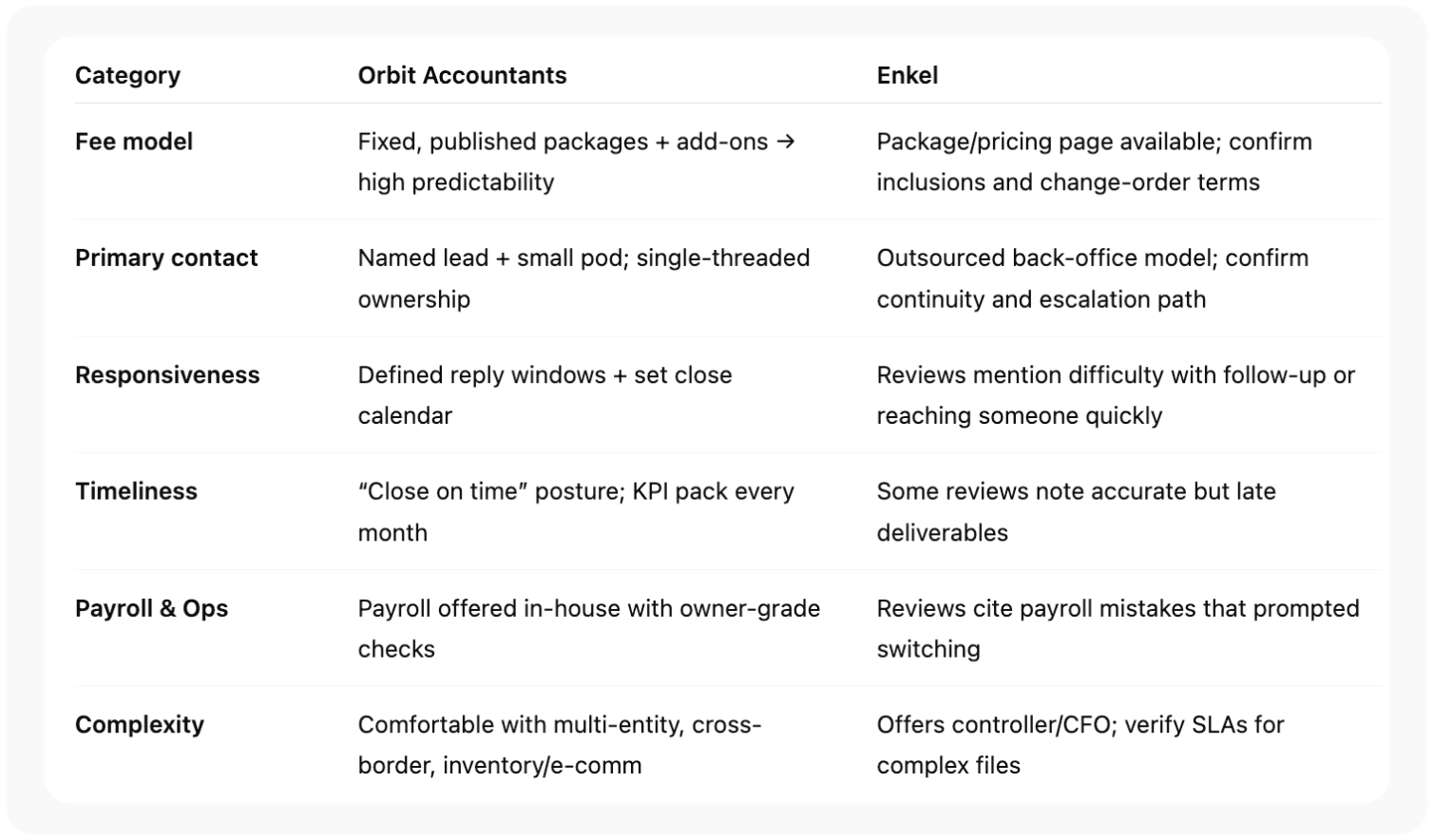

Experience differences at a glance

The takeaway: Orbit and Enkel both offer modern, cloud accounting. Orbit differentiates on reliability, accountability, and cadence—areas frequently highlighted in public feedback about outsourced providers.

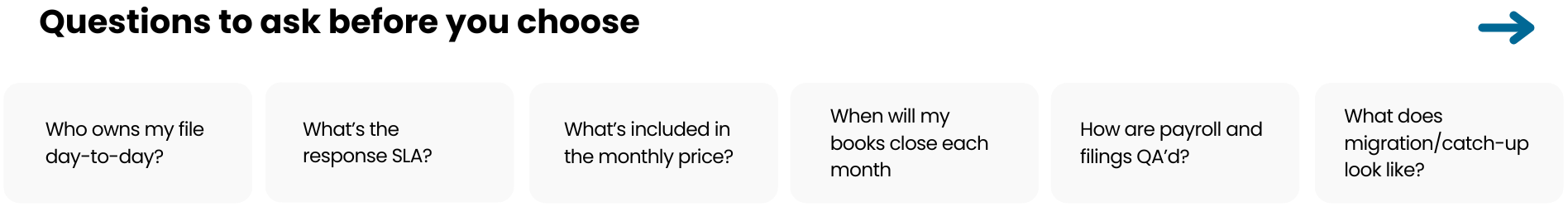

Questions to ask before you choose

-

Who owns my file day-to-day?

Orbit: named lead and pod. With any outsourced model, ask who does the work, how handoffs are handled, and how escalation works.

-

What’s the response SLA?

Orbit sets expectations in hours, not days. Ask any provider to specify reply times—especially during peak tax periods.

-

What’s included in the monthly price?

Orbit’s inclusions and add-ons are published. For others, confirm what triggers out-of-scope charges and how change orders are approved.

-

When will my books close each month?

A standing close date avoids “accurate but late.” Orbit’s cadence is designed to deliver reports and KPIs on time.

-

How are payroll and filings QA’d?

Understand review steps and error-prevention checks; ask for the rework process if anything goes wrong.

-

What does migration/catch-up look like?

Orbit uses a defined playbook with timelines. Ask any provider for a similar plan in writing.

When each makes sense

- Choose Enkel if you specifically want an outsourced back office and are comfortable managing SLAs and continuity through a centralized service structure. Their tech-enabled approach and controller/CFO options can be a good fit for teams that prefer vendor-run processes.

- Choose Orbit Accountants if you want predictable pricing, a named team, fast replies, and an on-time monthly close—with advisory and planning built in. For most small and mid-size Canadian businesses (including multi-entity and cross-border operations), that structure translates into fewer surprises and stronger day-to-day control.

Final take

Enkel and Orbit both speak “modern accounting.” The difference is operating rhythm. If you’ve ever dealt with late deliverables, unclear ownership, or hard-to-reach teams, Orbit’s model is built to eliminate that friction—while still giving you the depth (payroll, tax, catch-up, CFO) to scale confidently.

Legal & Ethics Disclaimer: This article is provided by Orbit Accountants for general informational purposes only and does not constitute tax, legal, or accounting advice. Observations about third-party providers reflect publicly available information and common client-feedback themes; we make no guarantees regarding the completeness or current accuracy of third-party data. Orbit Accountants is not affiliated with Enkel; all trademarks, names, and logos belong to their respective owners. Always verify pricing, scope, and service levels with any provider before engaging.