Table of Contents

Introduction: Why Bookkeeping Cadence Matters for Nonprofits

Every nonprofit organization in Canada needs clear, reliable books. But how often should you update them—monthly or quarterly? This “bookkeeping cadence” sets the rhythm for how financial data flows through your system. It impacts everything from cash flow visibility and audit readiness to board reporting and tax filings.

The choice isn’t one-size-fits-all. A small charity with a handful of donors may not need the same reporting frequency as a larger nonprofit preparing annual reports for grantmakers. This blog breaks down monthly vs quarterly nonprofit bookkeeping to help you find the most cost-effective, scalable process for your organization’s financial health.

Are you currently managing your bookkeeping in-house?

The Case for Monthly Bookkeeping

Monthly bookkeeping offers nonprofits constant visibility into their finances. Here’s why many Canadian nonprofits prefer it:

- Cash flow visibility – Tracking financial transactions monthly means you spot cash shortages or donation delays quickly.

- Timely financials for decision-making – Board members often want up-to-date statements of activities and cash flow statements to guide programs.

- Nonprofit audit readiness – Keeping income statements, bank reconciliations, and expense reports up to date every month makes audit season far less stressful.

- Compliance with grant conditions – Some funders require monthly reporting frequency as part of their agreements.

When Quarterly Bookkeeping Makes Sense

Quarterly bookkeeping, though less frequent, has its advantages:

- Cost effective bookkeeping – Fewer bookkeeping hours can lower fees, a priority for smaller nonprofits with tight budgets.

- Lower administrative burden – Less time-consuming for nonprofits with limited staff.

- Sufficient for low transaction volume – Organizations with few donations or financial transactions may not need monthly updates.

But there’s a trade-off: quarterly bookkeeping can limit visibility. If cash flow problems arise, you may only catch them months later.

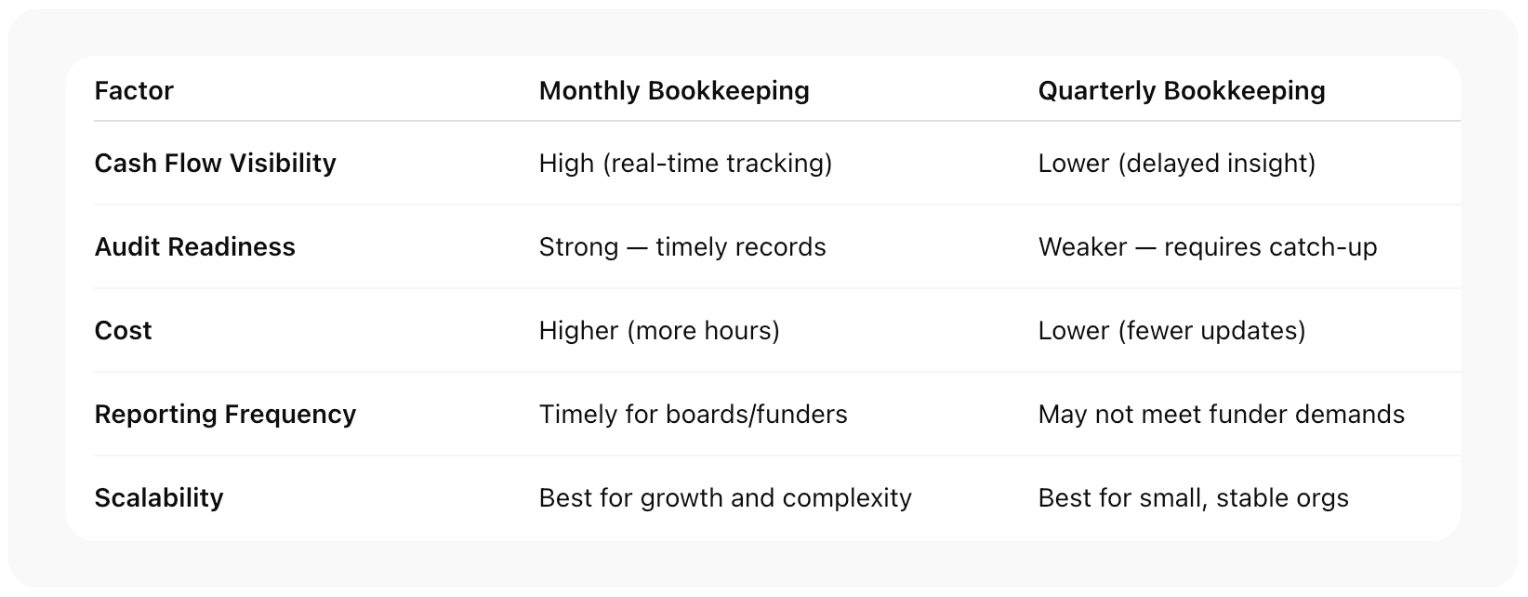

Comparing Monthly vs Quarterly Bookkeeping

Key Considerations for Choosing Your Nonprofit Bookkeeping Schedule

How do you pick between monthly and quarterly bookkeeping in Canada? Consider:

- Transaction volume – The more donations, grants, or program expenses, the more often books should be updated.

- Board member expectations – Active boards want timely financials, not outdated quarterly snapshots.

- Audit readiness needs – If your nonprofit is likely to face audits, monthly cadence reduces year-end stress.

- Budget for bookkeeping services – Some nonprofits save money with quarterly updates but risk missing cash flow red flags.

How Cadence Impacts Cash Flow Visibility and Timely Financials

Your nonprofit’s financial health depends on how often you measure it. Monthly bookkeeping gives you clear cash flow statements and income statements every 30 days. That means if donations dip or expenses spike, you can react fast.

Quarterly bookkeeping risks hiding problems. Imagine realizing three months later that a recurring expense has been eating into your reserves. The right cadence ensures your nonprofit saves time and avoids nasty surprises.

Nonprofit Audit Readiness and Reporting Frequency

Nonprofit audit readiness is often underestimated. Auditors expect accurate, organized books. Monthly bookkeeping helps ensure financial transactions are reconciled continuously—making internal controls stronger and errors easier to spot.

Quarterly bookkeeping can still work, but auditors may find more discrepancies. If your nonprofit relies on grants, monthly or even semi-monthly updates may be required by funders.

Cost-Effective and Scalable Bookkeeping for Nonprofits

Every nonprofit leader asks the same question: how do we keep bookkeeping cost effective but scalable?

- Monthly bookkeeping costs more upfront but prevents expensive mistakes later.

- Quarterly bookkeeping is cheaper but can create a backlog when your nonprofit grows.

Think of bookkeeping as a scalable bookkeeping process. Starting with quarterly may work when you’re small, but as your nonprofit expands, shifting to monthly bookkeeping in Canada can ensure your organization’s financial stability.

Tools and Services That Save Time for Canadian Nonprofits

Modern bookkeeping services and accounting software can make monthly or quarterly updates easier and less time-consuming.

- QuickBooks Online – Widely used by nonprofit accountants for bank reconciliation, income statements, and cash flow statements.

- Cloud-based bookkeeping services – Outsourced bookkeeping can save time while ensuring audit readiness.

- Internal controls – Setting up approval processes for financial transactions ensures accuracy, no matter your cadence.

Final Thoughts

There’s no universal answer to whether nonprofits in Canada should choose monthly or quarterly bookkeeping. The decision depends on your reporting frequency needs, audit readiness, budget, and board expectations.

If you’re a growing nonprofit organization, monthly bookkeeping delivers better cash flow visibility, timely financials, and stronger audit readiness. Smaller nonprofits with fewer transactions might start with quarterly bookkeeping as a cost-effective option.

Frequently Asked Questions

Should nonprofits in Canada always choose monthly bookkeeping?

Not always. Monthly bookkeeping offers better visibility, but small nonprofits with very few financial transactions may find quarterly bookkeeping sufficient and more cost effective.

How does bookkeeping cadence affect audit readiness?

Monthly bookkeeping keeps your nonprofit audit-ready by ensuring transactions are reconciled regularly. Quarterly cadence may leave gaps that are harder to fix later.

What is the role of bookkeeping in nonprofit reporting frequency?

Bookkeeping cadence directly determines how often you can prepare income statements, cash flow statements, and board reports. Monthly updates mean more timely reporting.

Can bookkeeping services help nonprofits save time?

Yes. Outsourced bookkeeping services or tools like QuickBooks Online can save time and reduce the burden of manual data entry, while ensuring compliance with tax filings and financial reporting standards.

Is quarterly bookkeeping less scalable for nonprofits?

Quarterly bookkeeping can work in the early stages, but as your nonprofit grows, monthly bookkeeping becomes the scalable process needed for audit readiness and timely reporting.

Disclaimer: This blog is for informational purposes only and should not be considered professional accounting or legal advice. Nonprofit organizations in Canada should consult qualified nonprofit accountants or financial advisers before making decisions about their bookkeeping cadence, tax filings, or audit readiness. Orbit Accountants accepts no liability for reliance on this content.