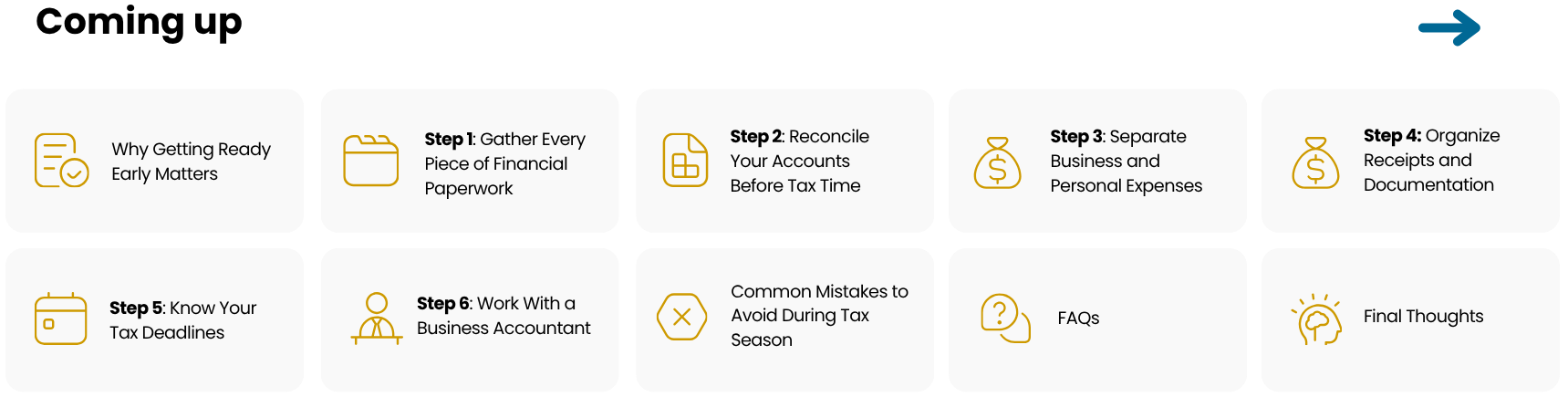

Table of Contents

Why Getting Ready Early Matters

Every Canadian small-business owner knows tax season comes around faster than expected. One week you’re sending invoices, and before you know it, it’s April 30, 2025—the deadline for most to file personal or business income taxes. Preparing your books early keeps your financial data accurate, prevents last-minute stress, and helps you claim every credit and deduction you’re entitled to.

When you stay organized, your accountant for tax purposes can focus on strategy instead of scrambling for missing documents. Think of it as setting the stage for a smoother, smarter filing process—and possibly a larger tax refund.

Are you confident your business tax filings are fully optimized and compliant?

Step 1: Gather Every Piece of Financial Paperwork

Start by collecting all records from the previous tax year:

- T-slips (T4s, T5s, T5018s for contractors)

- Invoices and receipts (digital and paper)

- Bank and credit-card statements

- Payroll summaries and expense reports

If you use tax software or cloud-based accounting systems, export your reports by category—income, expenses, and assets.

Step 2: Reconcile Your Accounts Before Tax Time

Reconciliation sounds technical, but it’s simple. You’re matching your internal records to your bank and credit-card statements. This confirms that no payment, deposit, or refund is missing.

Tip: Run a monthly reconciliation in your bookkeeping software. By year-end, you’ll only need to check December’s activity instead of twelve months’ worth.

A properly reconciled set of books helps your accountant spot deductible expenses faster, especially when calculating income taxes and business adjustments for the tax year.

Step 3: Separate Business and Personal Expenses

Mixing business and personal spending is one of the most common bookkeeping errors among small-business owners in Canada.

Open a dedicated business account and credit card. Doing this makes it easier to track deductible expenses—everything from office rent and utilities to mileage and supplies.

When you sit down with your accountant during tax season, clear separation can lower your penalties and interest risk and save hours of sorting through receipts.

Step 4: Organize Receipts and Supporting Documentation

Receipts are your proof if the Canada Revenue Agency (CRA) ever reviews your return. You don’t need fancy tools—apps like Hubdoc or Wave can scan and categorize receipts automatically.

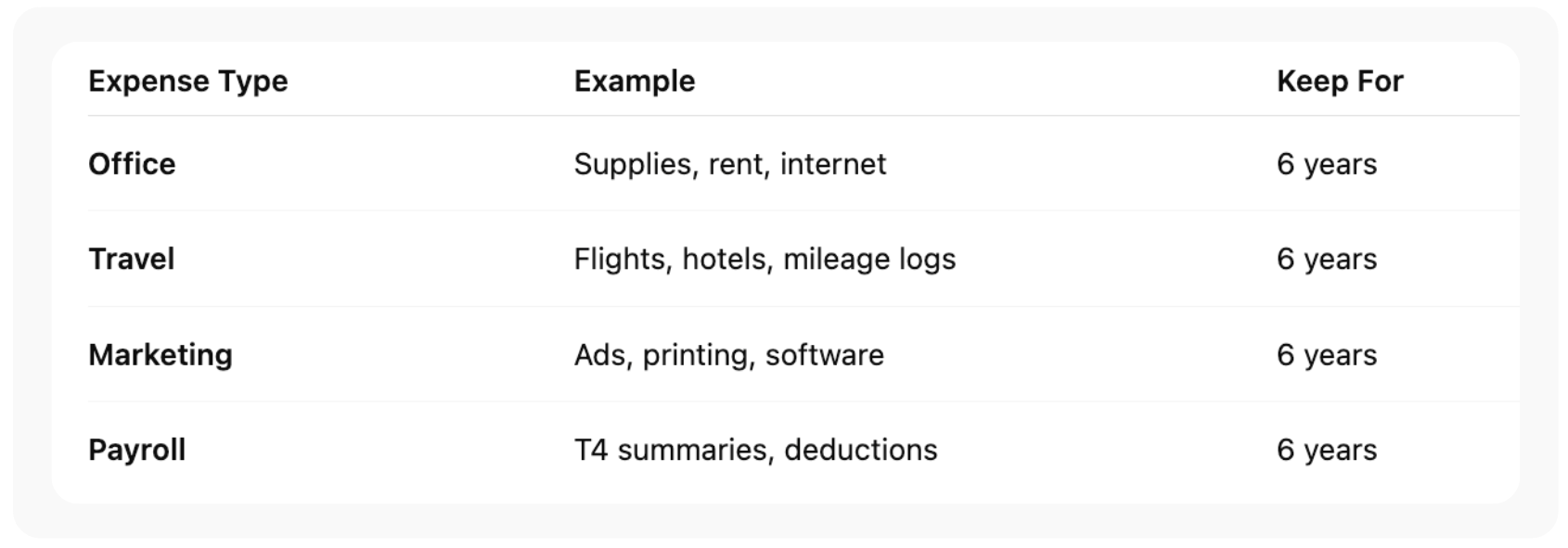

Sort them by category:

Make sure each receipt matches the entry in your books. Missing documentation could delay your tax refund or raise red flags about your tax situation.

Step 5: Know Your Tax Deadlines

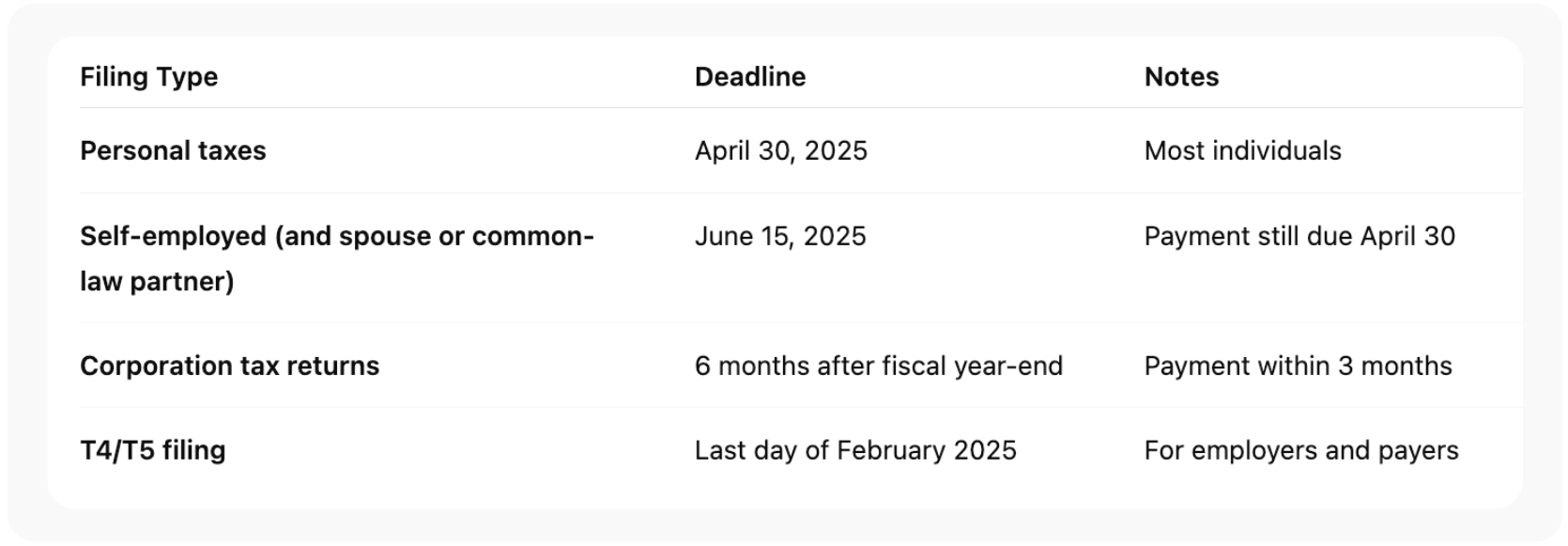

Timing is everything at tax time. Here are the key Canadian due dates for 2025:

Mark these on your calendar and aim to close your books a few weeks earlier. That gives your tax expert time to catch any missing entries.

Step 6: Work With a Business Accountant

Even with digital tools, a business accountant is your best ally at tax season. They interpret your numbers, spot credits, and ensure compliance with CRA rules.

A professional accountant for tax work in Canada understands deductions specific to your industry—such as vehicle expenses, home-office claims, or capital cost allowances.

They can also help you plan ahead. If your income fluctuates, they’ll advise how to smooth cash flow or set aside funds for the next tax year.

Common Mistakes to Avoid During Tax Season

- Waiting until the last minute. The CRA portal slows down near deadlines; start early.

- Forgetting prior-year carryforwards. Missed credits from a previous year can be applied now.

- Not reviewing payroll deductions. Over- or under-withholding can trigger reassessments.

- Ignoring GST/HST filings. Your accountant income in Canada may depend on accurate sales-tax reporting.

- Assuming software catches everything. Automation helps but isn’t perfect—manual checks matter.

By steering clear of these pitfalls, you protect your finances and reputation.

Frequently Asked Questions

1. What’s the easiest way to get ready for tax season?

Start early. Gather your income and expense records monthly instead of waiting until March or April. Use folders or apps to track receipts year-round.

2. Can I file my own taxes or should I hire an accountant?

You can file personal taxes using CRA-approved tax software, but a business accountant ensures accuracy and identifies deductions you might miss.

3. What happens if I file late?

Late filings can attract penalties and interest, starting at 5 % of the balance owing plus 1 % per month. If you expect a refund, you won’t be fined—but you’ll delay getting your money back.

4. What if I have both employment and small-business income?

Your tax expert will combine both under your personal return. Keep your business records separate to make it easier to file a tax return and prove your deductible expenses.

5. Should my spouse or common-law partner file at the same time?

Yes. Coordinating with your spouse or common-law partner helps maximize credits and deductions, like the Canada Workers Benefit or spousal transfer amounts.

Final Thoughts

Preparing for tax season in Canada doesn’t need to be stressful. With organized books, a clear timeline, and the help of a trusted business accountant, you can file with confidence—and maybe even smile when you hit “submit.”

If you’re unsure about your numbers or need guidance on how to prepare for tax season, reach out to a qualified accountant income Canada professional who can simplify the process and help you plan ahead for the next year.

Legal Disclaimer: This article is provided for general information only and does not constitute accounting, tax, or legal advice. Tax laws and filing deadlines may change and vary by province. Always consult a qualified tax professional or reach out to Orbit before making decisions related to your personal or business taxes. Reading this content does not create a client relationship with Orbit Accountants.