Sending money abroad shouldn’t feel like a maze. Yet, for many Canadian businesses, every cross-border payment seems to lose a little more than expected. Between foreign transaction fees, unpredictable exchange rate spreads, and hidden deductions from international banks, your supplier’s invoice total rarely matches the final outgoing amount.

At Orbit Accountants, we see this every week while managing accounts payable (AP) and accounts receivable (AR) for clients across Canada. This guide explains how to minimize those hidden costs—and how smarter international banking can make your payments faster, clearer, and cheaper.

Table of Contents

What Are Hidden Bank Fees in International FX Transfers?

When a Canadian business sends money overseas, multiple banks touch that payment before it reaches your supplier. Each step can trigger fees: some visible, others hidden inside the exchange rate markup.

These often include:

- Wire transfer fees charged per transaction.

- Foreign transaction fees (usually 2–3%) on debit card or travel credit card payments.

- Currency conversion spreads—the difference between the true mid-market rate and what your bank offers.

- Receiving charges deducted by foreign banks in Canada or abroad.

These aren’t always shown in your online banking dashboard. But they can cost hundreds per transfer—especially for recurring cross-border supplier payments.

Are you currently managing your bookkeeping in-house?

Understanding Canada’s Foreign Transaction Fees

Every Canada foreign transaction fee reflects how banks recover processing costs, fraud risk, and currency conversion. For example:

- When you use a Canadian credit card to pay a U.S. supplier, your bank first converts USD to CAD using its internal exchange rate.

- It then adds a foreign transaction fee—often around 2.5%.

- If you pay via wire transfer, you might pay an additional $15–$50, plus the exchange rate spread.

Some banks advertise “no monthly fee” accounts but make up for it through wider foreign currency spreads or lower transfer rates. Always compare both fees and rates before choosing a provider.

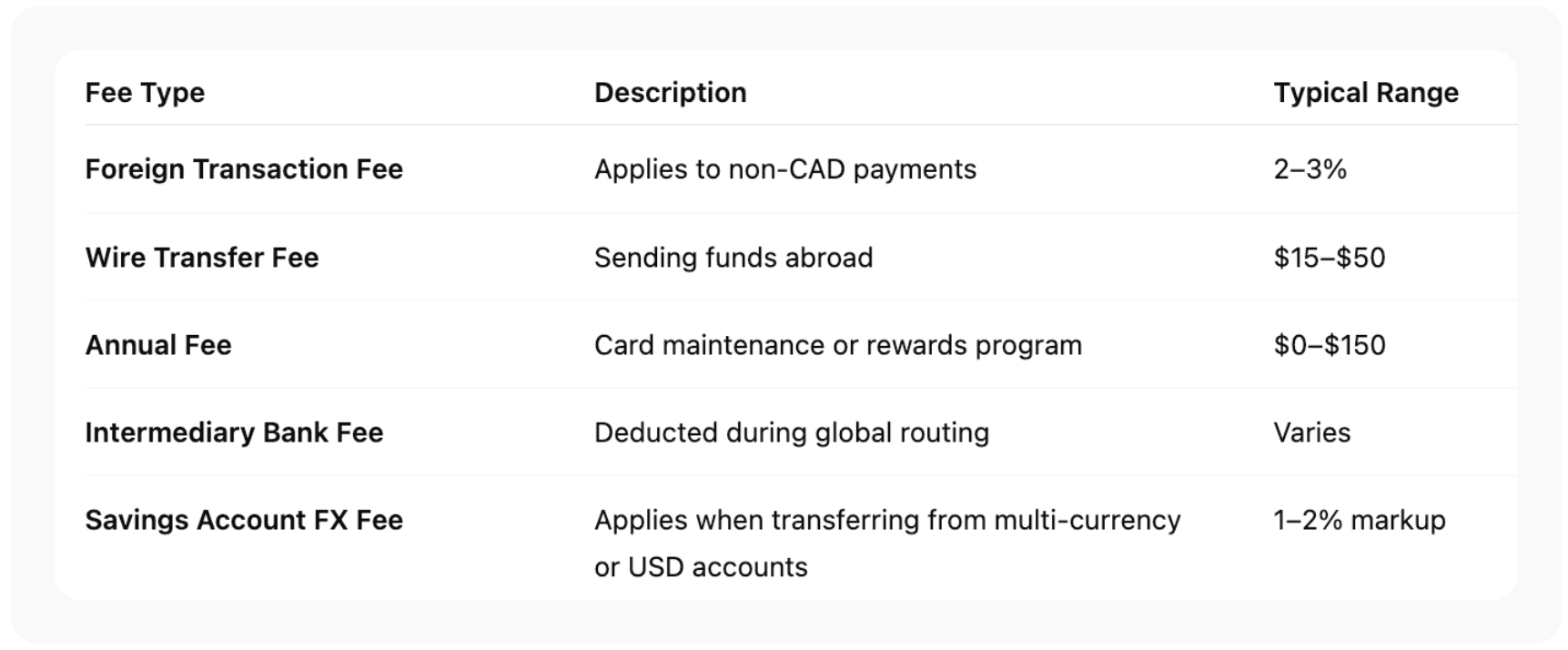

Common FX Costs in Canadian Banks

Even top Canadian banks like TD, RBC, CIBC, Scotiabank, and BMO charge differently based on transaction type:

These hidden charges make it hard to reconcile transactions in your accounting system—especially if your supplier receives less than invoiced due to intermediary deductions.

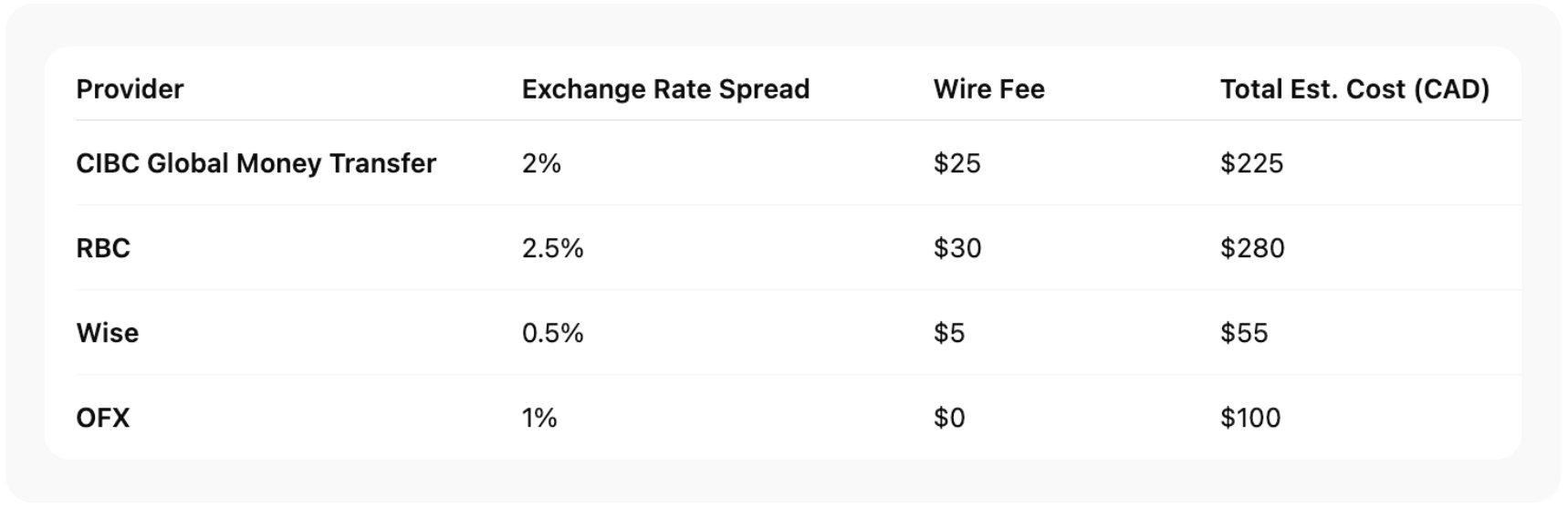

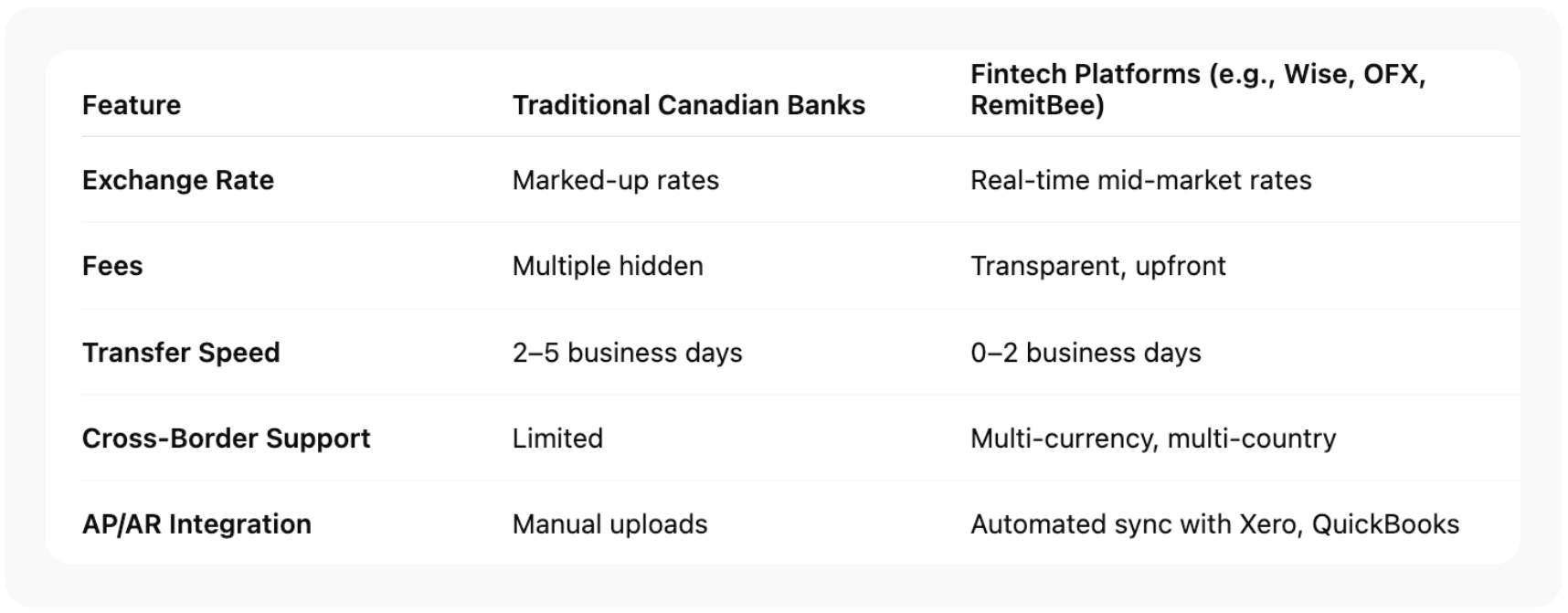

Comparing Traditional vs. Fintech Global Transfers

Modern financial services companies eliminate many middlemen, letting you keep better control over your net worth and predictable cash flow.

Smart Ways to Reduce Cross-Border Fees

- Use Multi-Currency or USD Accounts

Open a savings account or business checking account that lets you hold foreign currencies. This avoids repetitive conversions. - Compare Exchange Rate Margins

Use the Bank of Canada’s rate lookup or fintech apps to benchmark against your provider’s rate. - Negotiate Your Terms and Conditions

High-volume companies can often request reduced wire transfer or cross-border fees. - Automate FX in Accounts Payable Systems

Tools integrated with international banking platforms minimize human errors and show live conversion rates. - Choose FX-Friendly Credit Cards

Look for travel credit cards or debit cards that don’t charge foreign transaction fees or limit monthly fee hikes.

How Orbit Accountants Simplifies Global Payments

Orbit Accountants helps Canadian businesses navigate cross-border finance confidently. Our experts:

- Automate AP/AR reconciliation for multi-currency accounts.

- Audit wire transfers and identify recurring hidden costs.

- Recommend better international banking setups through tools like CIBC Global Money Transfer, Wise, and Xero.

- Provide fractional CFO insights to track FX exposure and its effect on profit margins and cash flow.

Whether you’re managing U.S. suppliers or receiving EU invoices, Orbit ensures every dollar lands exactly where it should.

Frequently Asked Questions

Is there a Canada currency fee on checking accounts?

Yes. Some banks charge a Canada currency fee when foreign currencies are withdrawn or deposited through a CAD checking account.

What is a foreign transaction fee in Canada?

A foreign transaction fee in Canada is usually a 2–3% markup added to purchases or transfers processed in foreign currencies.

How can I avoid paying a Canada foreign transaction fee?

Use a multi-currency or USD account, or cards that don’t charge foreign transaction fees. Some international banks in Canada also offer accounts with reduced spreads.

Does Rocket Money work in Canada?

Rocket Money offers limited features for Canadian users since it primarily syncs with U.S. financial institutions.

Which are the main international banks in Canada?

Canada hosts several international banks, including HSBC, Citi, and BNP Paribas, along with domestic banks offering international divisions.

Are foreign banks in Canada better for business FX transfers?

Some foreign banks in Canada offer lower FX margins for business clients, but always compare total costs and transfer speeds.

How can I reduce wire transfer costs?

Batch payments, use fintech platforms, or set up multi-currency savings accounts to reduce repetitive conversions.

Do international banks charge annual or monthly fees for FX accounts?

Yes, some international banking packages may include a small annual fee or monthly fee, often offset by lower interest rates and faster transfers.

Legal Disclaimer: This content is provided for general information only and should not be considered financial or legal advice. Bank fee structures, FX spreads, and international banking terms may change without notice. Always confirm terms with your provider or a qualified financial professional before making any transfer decisions.