Table of Contents

What Is the GST and Why Does It Matter?

The Goods and Services Tax (GST) is a tax most Canadians pay when buying products or services. To help with the cost of living, especially for those with modest incomes, the federal government gives back some of that money through GST credit payments.

These payments are tax-free and help individuals and families better manage everyday expenses. The Canada Revenue Agency (CRA) handles this process and issues GST credits every quarter.

Canada GST Payment Dates for 2024 and 2025

If you’re eligible, your GST payments will land in your account on these dates:

| Year | Payment Quarter | GST Payment Date |

| 2024 | Q1 | January 5, 2024 |

| 2024 | Q2 | April 5, 2024 |

| 2024 | Q3 | July 5, 2024 |

| 2024 | Q4 | October 4, 2024 |

| 2025 | Q1 | January 3, 2025 |

| 2025 | Q2 | April 4, 2025 |

| 2025 | Q3 | July 4, 2025 |

| 2025 | Q4 | October 3, 2025 |

These are the official Canada GST payment dates as listed by the CRA. If you’re searching for gst payment dates 2025, now you’ve got them. Mark your calendar so you don’t miss a thing.

Are you confident your business tax filings are fully optimized and compliant?

Who Is Eligible for GST Payments?

To qualify for GST credits, you need to:

- Be a resident of Canada for income tax purposes

- Be at least 19 years old, or

- Live with your child, or

- Have a spouse or common-law partner

When you file your taxes, the CRA checks your income and automatically calculates your eligibility for the GST credit. There’s no need to apply separately unless you’re a new resident of Canada.

How to Pay GST If You Owe It

Not everyone receives GST payments—some people or businesses must pay GST instead.

Here’s how to do that:

- Log in to your CRA My Business Account

- Select “Make a Payment”

- Choose GST/HST as the account type

- Pick a payment option: online banking, debit, or pre-authorized debit

- Review and submit

Paying on time keeps you in good standing and avoids interest. Keep track of your gst payment date if you file as a business.

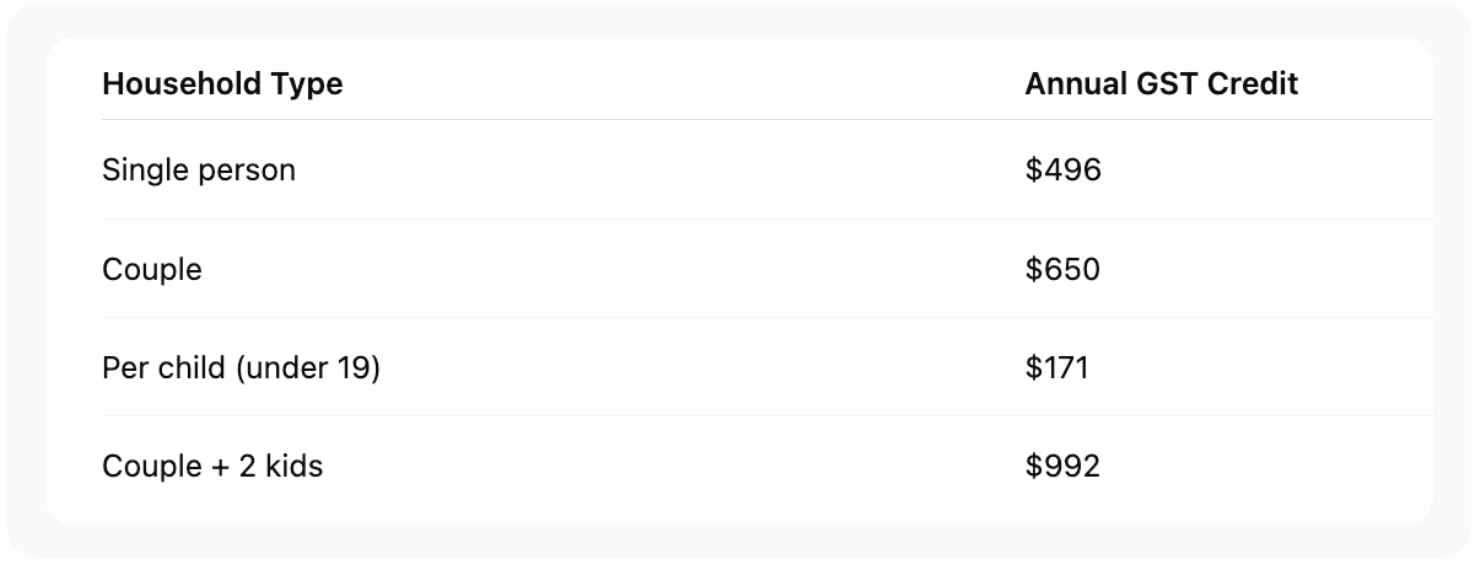

How GST Credit Amounts Are Calculated

The CRA looks at a few key things:

- Your net family income

- Whether you’re single, married, or in a common-law relationship

- How many children under 19 live with you

Here’s what you might receive:

- $496 for a single person

- $650 for a married/common-law couple

- $171 for each child under 19

If you’ve wondered about your Canada GST payment 2025 date amount, it depends on your tax return from the year before.

How to Apply for the GST Credit

Good news: most Canadians don’t need to apply. Just file a tax return, even if your income is zero.

However, if you’re new to the country, you’ll need to apply for the GST using CRA Form RC151. That kicks off the process for future payments.

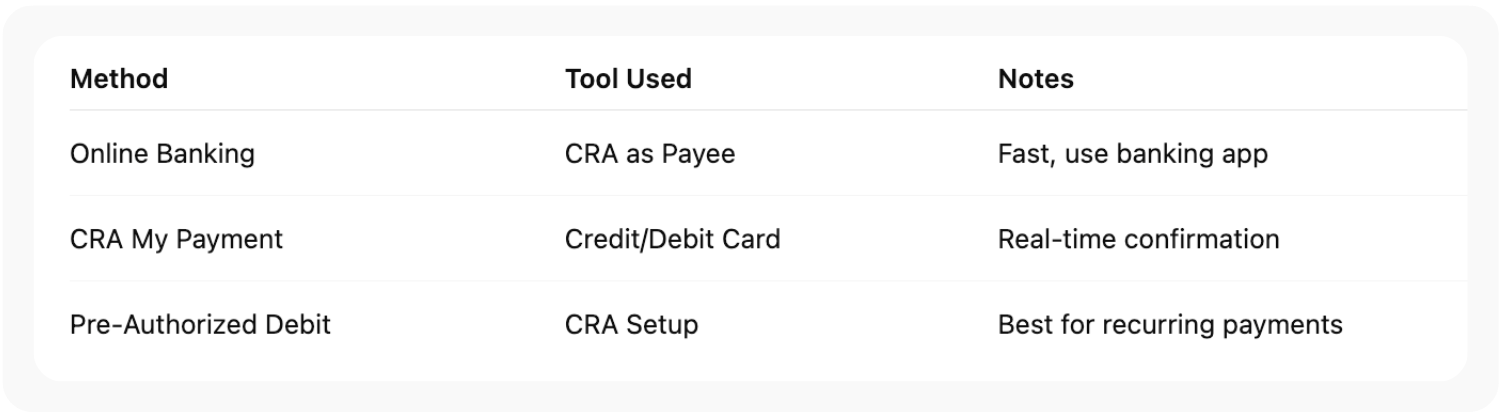

Online Payment GST Options

For those who owe money rather than receive it, online payment GST methods are easy and fast:

Pick the method that fits your routine best. Paying online helps you avoid missing your gst payment dates.

For Modest Incomes and Families: Extra Support

The GST credit is part of a broader system of child and family benefits aimed at helping those with modest incomes. If you qualify for one, chances are you’ll qualify for more—like the Canada Child Benefit (CCB) or Child Disability Benefit.

If you live with your child or are supporting your family, these credits add up. Just file your taxes and the CRA will calculate everything for you.

GST in Real Life: What to Do and Avoid

Mistakes to watch for:

- ❌ Not filing a return because you earned no income

- ❌ Forgetting to update your address or bank info

- ❌ Overlooking how a change in marital status affects benefits

What to do instead:

- ✅ File early

- ✅ Double-check your direct deposit settings

- ✅ Keep tabs on your Canada GST payment dates

Final Thoughts

Whether you’re receiving payments or sending them in, being aware of your GST payment dates, using the right payment option, and filing your return on time makes a huge difference.

Understanding your Canada GST payment dates for 2024 and 2025 isn’t just about getting money—it’s about staying in control of your financial year.

Got questions? Your CRA portal is your best friend. And if you’re still unsure, consult a tax expert or use CRA’s online tools to help you navigate.

FAQs

What are the GST payment dates in 2024 and 2025?

The CRA issues payments in January, April, July, and October each year. For 2025: Jan 3, Apr 4, Jul 4, and Oct 3.

Who qualifies for GST payments?

You must be a Canadian resident for tax purposes and meet age or family requirements. Filing a tax return is essential.

What is the “Canada GST payment 2025 date amount”?

That depends on your 2024 income. The CRA reviews your return and determines your GST credit.

How can I make a GST payment online?

Use CRA My Payment, online banking, or set up pre-authorized debit.

Do I need to apply every year for the GST credit?

No. Just file a tax return, and the CRA automatically assesses your eligibility for the GST credit.

Disclaimer: This blog is for general informational purposes only and does not constitute tax, legal, or financial advice. While we’ve made every effort to ensure the accuracy of the GST payment dates, eligibility guidelines, and online payment methods discussed, these details may change based on updates from the Canada Revenue Agency (CRA) or federal government policy. We recommend consulting a qualified tax professional or contacting the CRA directly for guidance specific to your circumstances. Always file your taxes on time and review the latest CRA resources for up-to-date information.