Table of Contents

Introduction: Why Internal Controls Matter

For nonprofit organizations in Canada, the mission always comes first. Yet even the most passionate mission can be derailed if financial safeguards are missing. Internal controls are more than just accounting jargon—they’re the day-to-day checks and balances that reduce the risk of fraud, errors, and misuse of donor funds.

Without strong internal controls, a small nonprofit can quickly face financial loss, reputational damage, and even regulatory issues with the Canada Revenue Agency (CRA). Donors, board members, and communities expect transparency, making it critical to design systems that protect every dollar.

Are you currently managing your bookkeeping in-house?

What Are Internal Controls in Nonprofits?

Internal controls are the policies and procedures that ensure financial transactions are accurate, authorized, and properly recorded in the general ledger.

They serve three main purposes:

- Accuracy: Making sure financial statements reflect reality.

- Accountability: Confirming that the right people are approving, spending, and recording money.

- Prevention: Detecting or discouraging fraud before it happens.

Think of them as the nonprofit’s financial immune system: invisible, but essential to long-term health.

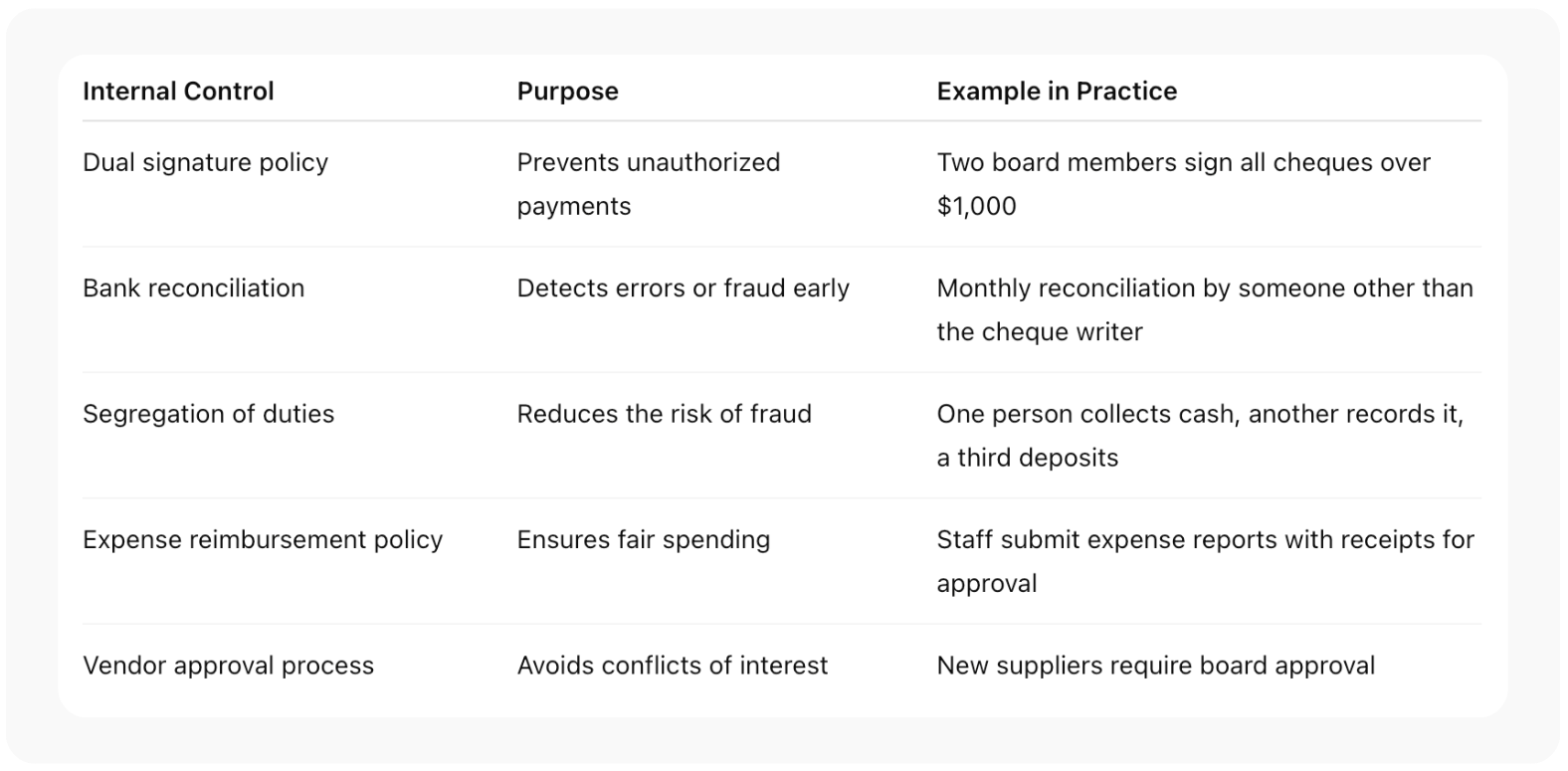

Internal Controls Examples Every Nonprofit Should Know

Canadian nonprofits can adopt many practical measures. Here are some common internal controls examples:

The Role of Segregation of Duties in Small Nonprofits

Segregation of duties is often the toughest control for a small nonprofit. Limited staff makes it tempting for one person to handle everything—collecting donations, depositing funds, and updating the accounting system. But this creates a high risk of fraud and error.

Practical tip: Even in a very small nonprofit, the board of directors can help. A volunteer treasurer or committee member can review bank statements or sign off on reconciliations. This simple separation of duties adds a powerful layer of oversight.

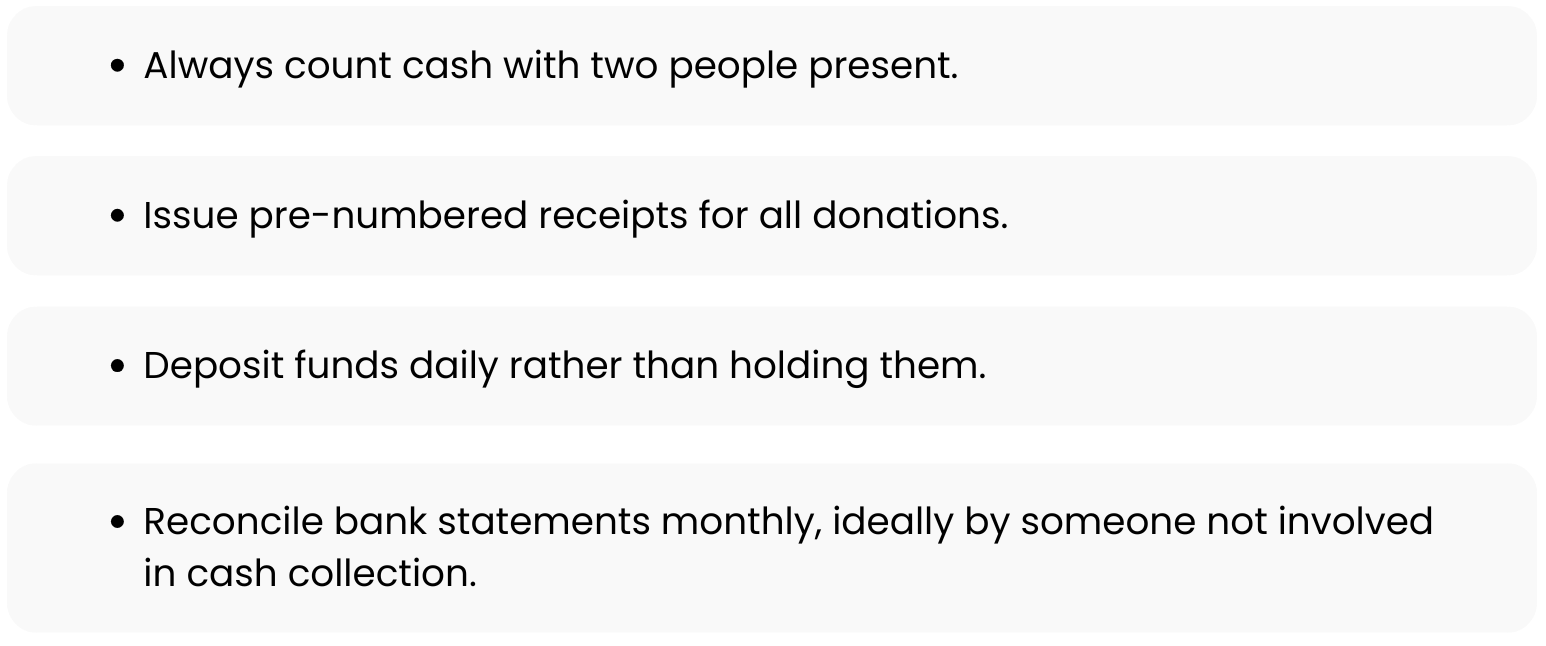

Cash Handling Controls and Bank Reconciliation Practices

Cash handling controls are crucial for nonprofits that rely on fundraising events, membership fees, or donations at community drives.

Best practices include:

Expense Reimbursement and Credit Card Controls

Employee or volunteer reimbursements and nonprofit credit cards are common areas for mistakes or misuse. A clear expense reimbursement policy should require:

- Original receipts attached to an expense report.

- Supervisor or board approval before repayment.

- Reasonable expense categories (e.g., travel, supplies, event costs).

For credit cards, internal controls should include:

- Setting low limits per card.

- Restricting card use to specific staff.

- Requiring monthly review of statements by the treasurer or finance committee.

Vendor Approval Processes and Fraud Prevention Safeguards

Nonprofits often work with many vendors—printers, caterers, contractors. A weak vendor approval process can open the door to conflicts of interest or inflated invoices.

Fraud prevention measures include:

- Getting at least two quotes for major purchases.

- Maintaining an approved vendor list.

- Having the board of directors review and approve new vendors.

This reduces the risk of fraud and ensures transparency with donor funds.

How the Board of Directors Strengthens Accountability

The board plays a critical role in nonprofit fraud prevention and oversight. Key responsibilities include:

- Reviewing monthly financial statements.

- Approving budgets and monitoring variances.

- Ensuring that Sarbanes-Oxley Act principles, while U.S. in origin, inspire Canadian best practices around transparency and whistleblower protections.

When the board takes financial oversight seriously, staff and volunteers follow suit.

Creating an Internal Control Checklist for Nonprofits

A practical way to strengthen controls is by using an internal control checklist. Items might include:

- Are cash receipts promptly recorded and deposited?

- Are bank reconciliations reviewed by someone independent?

- Does the organization have a dual signature policy?

- Is there a written expense reimbursement policy?

- Are approval processes documented and followed?

This checklist becomes a living tool, updated as the nonprofit grows.

Implementing Internal Controls with Accounting Software

Modern accounting software makes many control activities easier. Cloud-based tools allow multiple users, built-in approval processes, and clear audit trails. Features like role-based permissions support the separation of duties.

For example, one user might enter expenses, while another approves payments. Integration with bank statements also speeds up reconciliations and reduces the risk of error and fraud.

Common Risks: Error, Fraud, and Reputation Damage

Without adequate internal controls, nonprofits face:

- Errors: Misclassified transactions leading to inaccurate financial statements.

- Fraud: Misuse of funds by staff or volunteers.

- Reputation damage: Donors lose trust if finances appear mismanaged.

A strong control environment reduces the risk of fraud and reassures funders that their contributions are in safe hands.

Long-Term Benefits of Strong Internal Controls

While controls may feel burdensome at first, the long-term benefits far outweigh the effort:

- Higher donor confidence.

- Stronger grant applications (funders often ask about controls).

- Clearer financial reporting for better decision-making.

- Peace of mind for the board and leadership team.

Internal controls are an investment in the nonprofit’s sustainability and impact.

Conclusion: Protecting Your Nonprofit’s Future

For Canadian nonprofits, internal controls aren’t optional—they’re essential. Whether it’s implementing segregation of duties, adopting a dual signature policy, or setting up credit card controls, each step builds trust and resilience.

With a clear internal control checklist, sound policies, and board involvement, nonprofits of any size can safeguard their resources and focus on what really matters: serving their community.

Frequently Asked Questions

What are nonprofit internal controls?

They are policies and procedures that ensure financial transactions are authorized, accurate, and properly recorded, protecting against fraud and error.

Why is segregation of duties important for small nonprofits?

It reduces the risk of fraud by ensuring no single person controls an entire financial transaction from start to finish.

What is a dual signature policy?

It requires two authorized signers on cheques or electronic payments above a set threshold, preventing unauthorized disbursements.

How do bank reconciliations help nonprofits?

They compare internal records with bank statements to catch errors or suspicious activity early.

What should an expense reimbursement policy include?

Requirements for receipts, approval processes, and reasonable expense categories to ensure fair and transparent spending.

How can credit card controls prevent misuse?

By setting low limits, restricting cards to certain staff, and requiring monthly statement reviews.

What is the role of the board of directors in fraud prevention?

Boards review financial statements, approve budgets, and oversee internal controls, adding a layer of accountability.

What are some internal control examples for cash handling?

Two-person cash counts, pre-numbered receipts, and daily deposits.

How does accounting software support internal controls?

It offers role-based permissions, audit trails, and automated bank reconciliations that strengthen oversight.

What happens if a nonprofit lacks strong controls?

It faces greater risk of error, fraud, regulatory issues, and damage to its reputation with donors.

⚖️ Disclaimer: This blog is for informational purposes only and does not constitute legal, accounting, or financial advice. Nonprofit organizations should consult qualified professionals when designing or reviewing internal control systems. The examples and checklists provided are general in nature and may not cover all risks specific to your organization.