Filing taxes can sometimes be confusing, but when it comes time to receive a tax refund, it’s usually one part of the process that many people look forward to. A tax refund generally means you paid more taxes than you owed, and the government is refunding the amount you overpaid. This could result because your employer over-withheld tax from your pay, you received tax credits from your Federal or State tax return, you had tax deductions that lowered your taxable income, or perhaps you prepaid part of your taxes.

In Canada, the tax refund in Canada process is done through the Canada Revenue Agency (CRA), and in other regions like New Jersey and Virginia, there are individualized tax refund procedures. Understanding how tax refunds work, expected timelines of requesting and receiving a refund, how to request your refund, and how to prevent delays are all integral to receiving money owed to you.

In this guide, we will cover a wide array of tax refund topics so that you can feel confident claiming your tax refunds correctly.

Table of Contents

What Is a Tax Refund?

Before we go further into details about getting a tax refund, let’s be clear on the definition of what a tax refund is and how it happens.

Tax Refund Defined

A tax refund is a return of money you paid to the tax authorities that is more than what you owe for the year. This can happen when your employer withholds more income tax than is necessary or you qualify for tax credits and deductions.

For example:

If your employer deducts $4,000 in taxes from your pay throughout the year, but your actual tax bill is only $3,500, the extra $500 will be refunded to you.

Why Do People Receive Tax Refunds?

There are several reasons why individuals receive tax refunds. Often, individuals receive tax refunds because they had over-withholding, where their employers deducted more taxes from their paycheck than was necessary. Other potential reasons include refundable tax credits, which are additional funds the government provide to you even if you did not owe any tax. Yet still, there are other subtle tax deductions and advance tax prepayments that lead to a refund.

Sometimes, people intentionally have overpayments as a way to mitigate any unexpected underpayment penalties. These individuals know they will be issued the overpaid amount later and as a lump sum.

Are you confident your business tax filings are fully optimized and compliant?

How Tax Refunds Work in Canada

In Canada, this is managed by the Canada Revenue Agency (CRA). Understanding how your system operates will make it much easier to process a taxation refund in Canada rather than having an unnecessary hassle when claiming one.

CRA Tax Refund Process

When you submit your yearly income tax return, the CRA examines the tax you owe against the tax you have already paid, either by withholdings during the year or by installments. If you have overpaid the tax you owe, you will be refunded the difference.

Note:

The CRA also checks for credits or deductions you may have claimed that you might be eligible for. Once CRA has verified your final amount owed, they release your refund either by direct deposit or by mailing a cheque.

How to Claim a Tax Refund in Canada

To receive a refund, you must first submit your tax return. You can file online using a CRA-certified tax software or file a paper return by mailing it in. CRA recommends using CRA My Account to file your taxes, track your refund, and update your banking details.

Once you have filed your return, you should monitor your CRA My Account to know when your return is processed, and when your refund is scheduled.

When Will I Get My Tax Refund in Canada?

The time it takes to receive a refund depends on how you filed and the payment method you used. For electronic filings with direct deposits, this is as little as 8 business days. For paper returns with cheques processed by mail, this may take a few weeks.

During peak season, you may also experience delays from processing refunds, therefore filing early is usually advantageous.

Common Reasons for Delayed Tax Refunds

Even with a correctly filed return, it can be delayed. Knowing the common reasons can help you avoid them.

Incomplete Tax Filings

Missing or incorrect information is the most common reason for financial delays. If you forget certain forms, have mistakes in your amounts of income, or include wrong bank information, the CRA will contact you for clarification before releasing your money.

Audit or Manual Review

In some cases, CRA has selected a return for further review. This may or may not mean you have done something wrong, but it would happen randomly. Your financial situation would remain in limbo until it was decided and/or completed.

Unpaid Obligations and Offsets

If you have unpaid obligations with the government, such as student loans, unpaid taxes, or child support, it could be reduced and withheld because of this process. This rule is not limited to the CRA, but also for things such as NJ taxation refund or VA taxation refund.

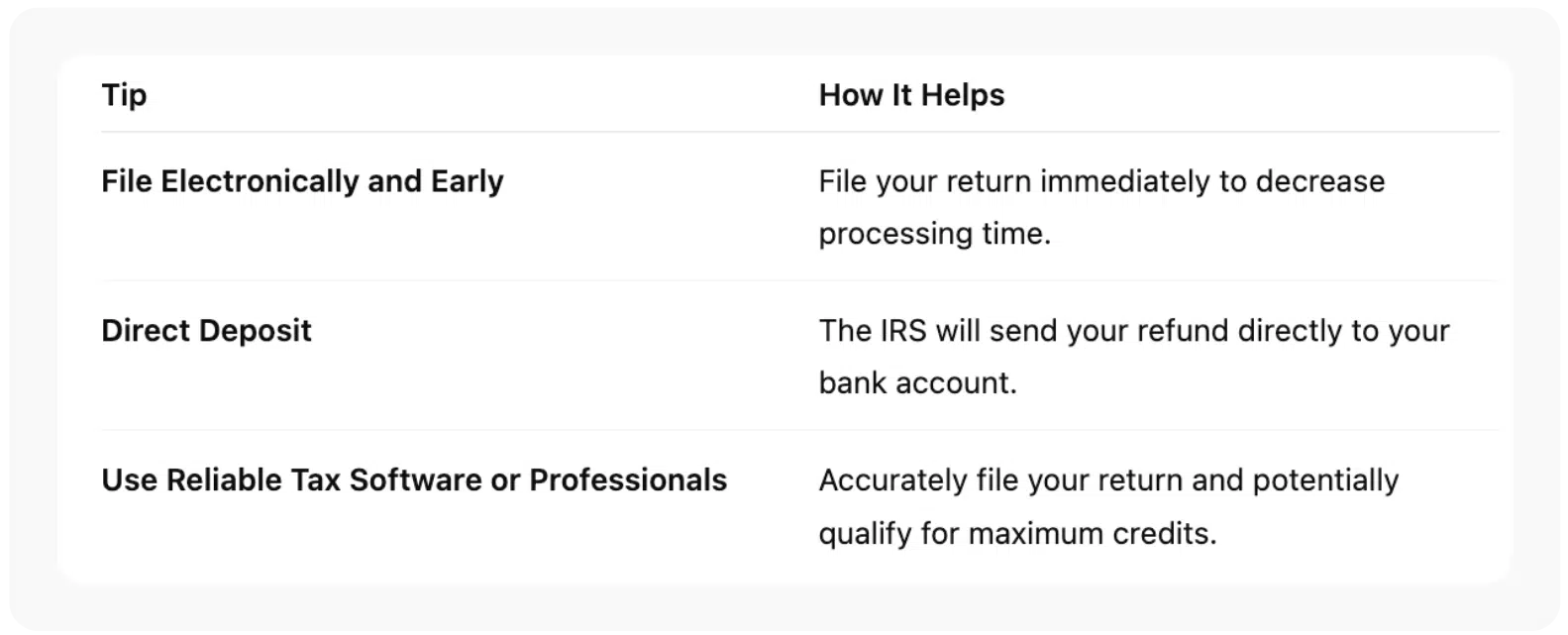

Tips to Get Your Tax Refund Faster

When it comes to tax refunds, waiting to receive your money doesn’t need to be a drawn-out process. By following a few proven tips, you can speed up the length of time it takes to receive your refund. Below are some of the most effective tips to receive your tax refund quickly.

Stay Informed and Get the Refund You Deserve

A tax refund is simply getting back your own money when you have overpaid taxes. A tax refund in Canada, an NJ tax refund, or a VA tax refund is no different. What matters most in getting it promptly is filing it correctly, completely and on time. Using direct deposit, filing it early, and making sure all the information is entered correctly can save you weeks. That said, routinely checking on the status of your tax refund is still important and if the tax authority (CRA) has contacted you for additional details, responding promptly to their request is critical to avoid additional delay and ensure you get the correct amount.

If you are looking for a tax professional to receive the largest refund and stay compliant with CRA requirements, check out Orbit Accountants! We have been providing full-service tax preparation and compliance services for individuals and businesses for years to assist in receiving tax refunds faster and avoiding costly mistakes. Our professional tax preparers guarantee your tax return is completely accurate, submitted on time, and most importantly ,allows you to sleep well at night knowing a professional has performed your taxes. Contact us today for an in-depth look at our expert services!

Frequently Asked Questions

What should I do if it’s past the expected timeframe for the refund and I still have not received my refund yet?

First, visit CRA My Account (or the tax authority’s refund tracker in your province or state) to check the status of your refund. If it is past the expected processing time, contact the tax office or authority to find out if anything has gone wrong with your return.

Can I receive a refund if I did not earn enough income to owe taxes?

Yes. It is possible to receive a refund if you qualify for refundable tax credits. Refundable tax credits are tax credits that will provide financial support to individuals who earn a lower income, even if you did not owe income tax.

How can I tell if my refund was offset and for how much?

In most cases, you will receive a notice from the tax authority explaining the reason the offset occurred, and how much of your refund was taken through the offset. In most instances when referring to offsets, you are referring to unpaid debts for items like student loans, government overpayments, or child support.

Are tax refunds the same thing as tax credits?

No. A tax refund is simply money given back to you if you overpaid your taxes at some point in the tax year. A credit is a reduction in the amount of tax you owe.

Do self-employed people get tax refunds, too?

Yes. If you are self-employed, you overpaid your taxes through instalments or other deductions. You could also receive a refund. The same filing guidelines apply, but you might need to fill in additional forms for business income.

Disclaimer: This article is provided by Orbit Accountants for general information only and does not constitute tax, legal, or accounting advice. Tax rules and refund timelines may change based on CRA updates. Always consult Orbit Accountants or a qualified professional for advice specific to your situation.